The US dollar continued the correction on Monday that started last Friday, which is really long overdue on the wave of its significant technical oversold, which was largely supported by the growth in demand for risky assets during the period of corporate reporting of companies.

On Monday, a different picture was already noted on the currency market. Demand for shares of companies in Asia, Europe and the United States strengthened on the wave of positive economic data, but the dollar continued to correct, strengthening against all major currencies. It can be recalled that the reason for the surge in demand for risk was the data of business activity indices in China, the eurozone, Britain and the United States. Everywhere, the indicators either exceeded the expected values, or I will send a little worse than the forecasts, but still higher than the previous June values.

For example, the ISM manufacturing business activity index (PMI) in America jumped to 54.2 points from 52.6 points, the ISM manufacturing employment index came out worse than expected, rising to 44.3 points from 42.1 points against the forecast of growth to 44.3 points.

One would think that the dollar's strengthening is connected precisely with the positive statistics, however, this is unlikely. Fundamentally, the dollar remains at a huge disadvantage against major currencies. We have repeatedly listed these reasons, which have not disappeared anywhere and may even become even more negative. American parliamentarians began to discuss D. Trump's new initiatives, which are expected to include new measures to support the American and business in a total amount of about $ 1 trillion. Assessing the current strengthening of the dollar, we believe that this phenomenon is temporary and is connected only with the technical oversold of the dollar and with the desire of the investors who have made a profit to fix it. We are confident that after a short correction, the weakening of the US currency will continue.

Today, the RBA meeting was held, at which it was decided to leave interest rates at the same level. The key interest rate was kept at 0.25%. Investors expected a comment from the Australian regulator on the situation in the country's economy, as well as its exposure to external and internal factors, which, from a positive point of view, can be attributed to the growth after the coronavirus infection in the Chinese economy, and to the negative state of the pandemic in Australia.

Against the background of the final decision of the regulator, the Australian dollar received support, but this is most likely due to the general positive sentiment on the markets in Asia after the confident growth of stock markets in Europe and the United States the day before.

In general, we believe that the correction will not last long and the weakening of the dollar will continue.

Forecast of the day:

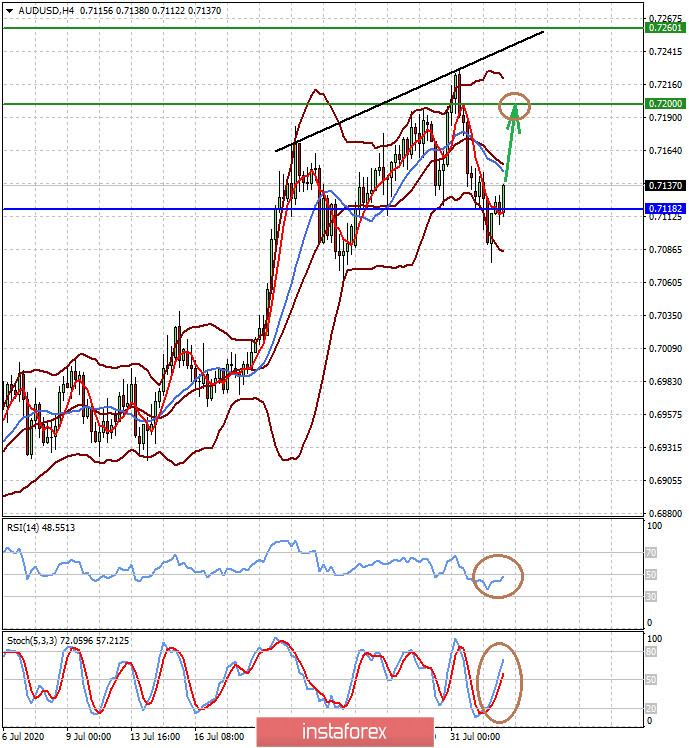

The AUD/USD pair held above the level of 0.7115, supported by the RBA's decision to keep interest rates unchanged and positive sentiment in the markets in the Asia-Pacific region. The pair may test the level of 0.7200 today.

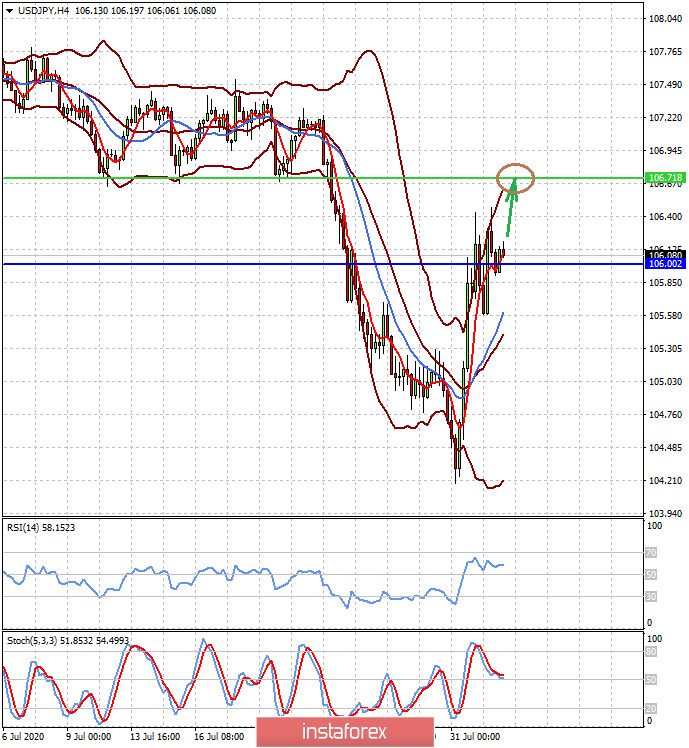

The USD/JPY pair is trading above the level of 106.00. It is supported by the demand for risky assets. Maintaining positive mood in the market will push the pair to further rise to the level of 106.70.