To be honest, yesterday was very revealing in many ways. So, we clearly saw that the market is clearly aimed at a correction and a serious strengthening of the dollar. After all, even good European statistics, the maximum that could do is only temporarily suspend the strengthening of this very dollar. In addition, investors clearly do not intend to massively buy dollars in the face of high risks and weak American statistics. Well, the funniest thing is that we were clearly shown which data matter and which does not.

So, the week began exactly where the previous one ended - with the strengthening of the dollar, although slow and inconspicuous, but still strengthening. However, this process suddenly stopped. The reason for this behavior was the final data on the index of business activity in the manufacturing sector of the euro area, which turned out to be significantly better than the preliminary estimate. If this very estimate showed an increase in the index from 47.4 to 51.1, then the final data pleased with the growth to 51.8. And here it is important not only that the index rose stronger than expected, but also that it exceeded the 50.0 point mark, which separates stagnation from growth. That is, European industry sees growth prospects and looks to the future with confidence. Naturally, this is an extremely positive factor. However, it wasn't enough for the single European currency to start growing. All these charms could only stop its decline.

Manufacturing PMI (Europe):

A little later, similar data were published for the UK, and they turned out to be worse than forecasted this time. If the preliminary estimate showed an increase in the index of business activity in the manufacturing sector from 50.1 to 53.6, then in fact, it grew only to 53.3. And here, of course, we can say that it is precisely because of this that the dollar began to strengthen again. However, such a statement would be wrong. First, this very rise in the dollar began almost an hour after the publication of data on the UK. Second, with all due respect to the United Kingdom, the size of the UK economy is so small compared to the euro area or the United States, that British statistics are far less important than European or American statistics. And the business activity index in the manufacturing sector still significantly rose.

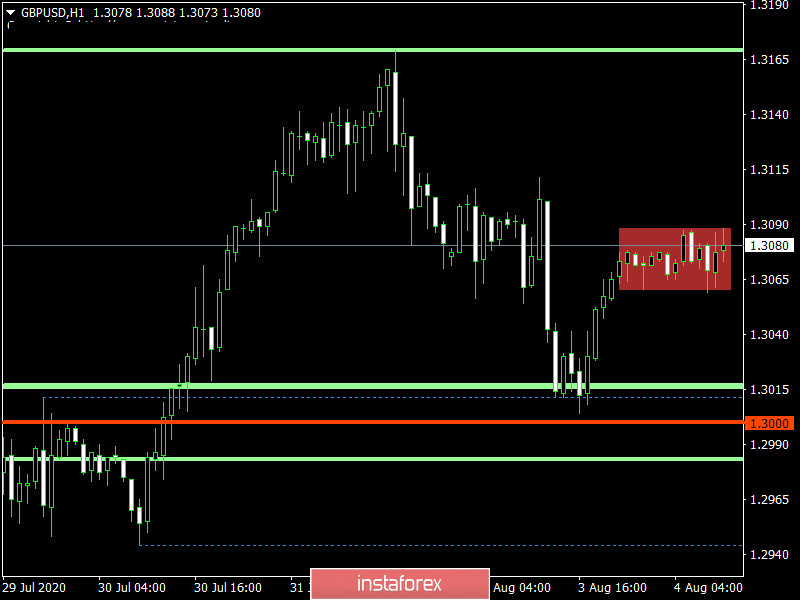

Manufacturing PMI (UK):

So, the growth of the dollar, which began some time after the publication of data on the UK, was largely due to the expectations of US statistics, which is somewhat disappointing. A preliminary estimate of the PMI in the manufacturing sector showed an increase from 49.8 to 51.3. Well, in fact, it turned out that the index rose to 50.9, it is somewhat worse than forecasts while the growth dynamics is noticeably lower than in Europe. This was the reason that the quotes quickly returned to the values at which they were at the time of the publication of data on the euro area. But perhaps most notably, the market reaction showed the importance of the ISM PMI. You can see how quite often all the media speaks for the most part about this indicator, which is purely American. After all, if the Markit index is published for all countries of the world, then ISM is only for the United States. So, just the index of business activity in the manufacturing sector from ISM rose from 52.6 to 54.2. Moreover, it turned out to be better than forecasts, which showed growth only to 53.6. And if this indicator was the most important, then the dollar should have continued to strengthen but that did not happen. If the indicator from ISM is, if not the most significant, but at least equivalent to the Markit index, then the dollar should have just stopped and stood still. But judging by the market reaction, investors have simply ignored this indicator.

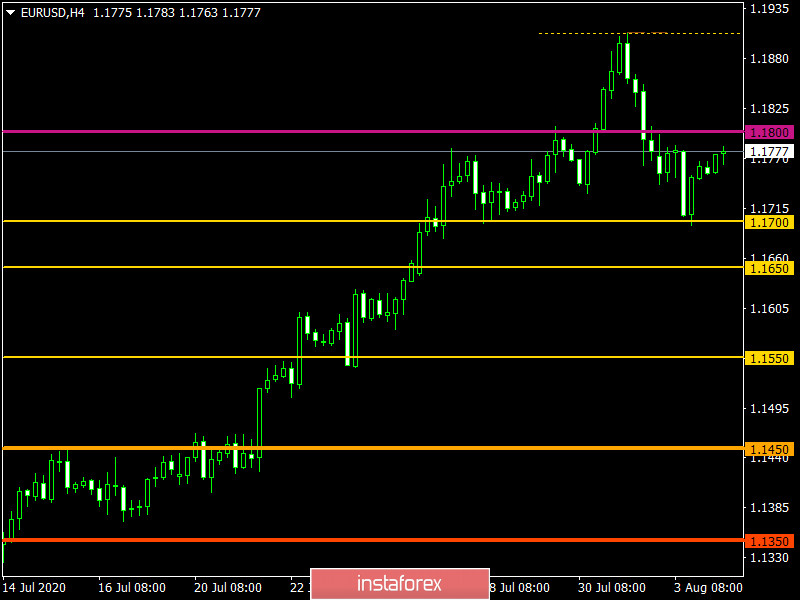

Manufacturing PMI (United States):

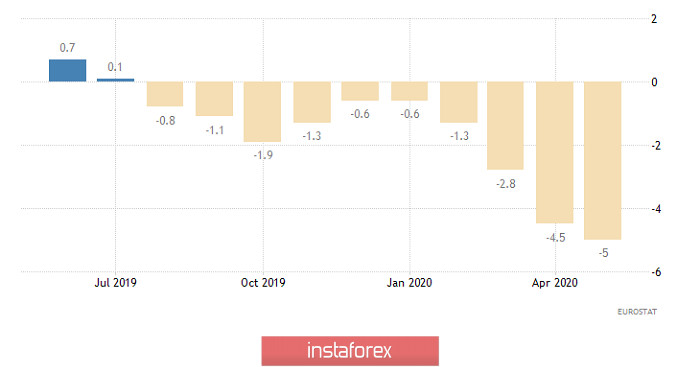

So, the market is clearly trying to correct itself, but so far it has failed. And apparently, it will not succeed at least today. The fact is that the only thing that is published today is producer prices in Europe, which are a leading indicator for inflation. So, if it was predicted last week that the rate of decline in producer prices would remain unchanged, now it is assumed that they will slow down from -5.0% to -4.0%. And here it is important not so much that the scale of the slowdown in the rate of decline is quite significant, but the very fact of this very slowdown. After all, inflation in Europe is practically zero, and if producer prices start to rise, as evidenced by a slowdown in the decline, then inflation is unlikely to decline. Rather, on the contrary, it will grow. And from the point of view of investors, this is an extremely positive factor. So, it is very likely that we will see further weakening of the dollar that will only overheat the market more. And this is distraught with a strong fall in the future.

Producer Price Index (Europe):

The euro/dollar pair, following the corrective move, managed to find a point of variable support in the area of 1.1700, where a slowdown occurred and, as a result, the price rebounded in the opposite direction. It can be assumed that the quotes are approaching the level of 1.1800, where, depending on the price fixing points relative to the set coordinate, the subsequent breakout move or rebound will be clear.

The pound/dollar currency pair, in the stage of a pullback, returned to the area of the level of 1.3000, where a rebound occurred on a systematic basis, followed by stagnation at 1.3065/1.3090. Moving along a narrow amplitude will not last long, and thus, work on the breakdown of the established boundaries is the best tactic in terms of local operations.