The higher-than-forecast pace of recovery in manufacturing activity in Europe and the US supports the positive at the beginning of the week. The final PMI in the Euro zone reached 51.8, improving the preliminary data, this is the first expansion in a year and a half, and the US ISM rose to 54.2p, the highest value since March 2019. First of all, it should be noted the growth of new orders to 61.5% and the index production to 62.1%, while the employment index is only 44.3%, that is, firms report an increase in production activity and at the same time continue to cut staff.

At the same time, it is clearly too early to fall into euphoria. Negotiations on a new package of incentives are ongoing, the parties call the course of discussions "productive", although there are no concrete results so far. So, if Congress does not approve the new initiatives, the White House will take some unilateral steps, as such a measure is called the possible suspension of the payroll tax, which will have a temporary effect, but will deal a strong blow to budget revenues in the long term.

At the moment, the markets are waiting, there is no reason for strong movements.

NZD/USD

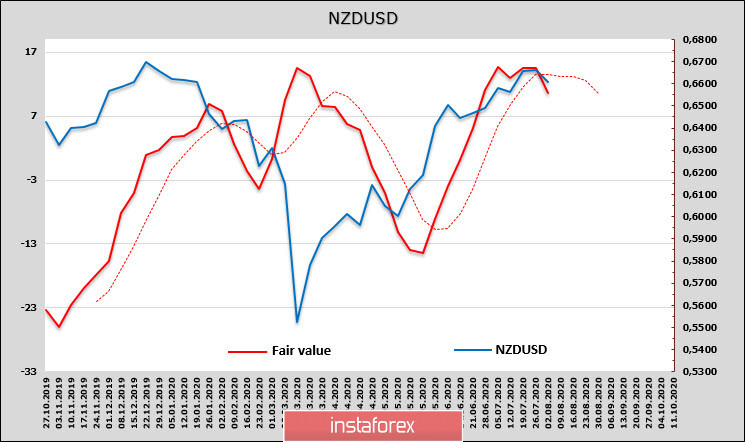

The NZD cannot reach the resistance level of 0.6750 in any way, and, apparently, the chances that it will be able to do so in the current momentum are decreasing – the euphoria that covered the markets after the removal of quarantine measures is over.

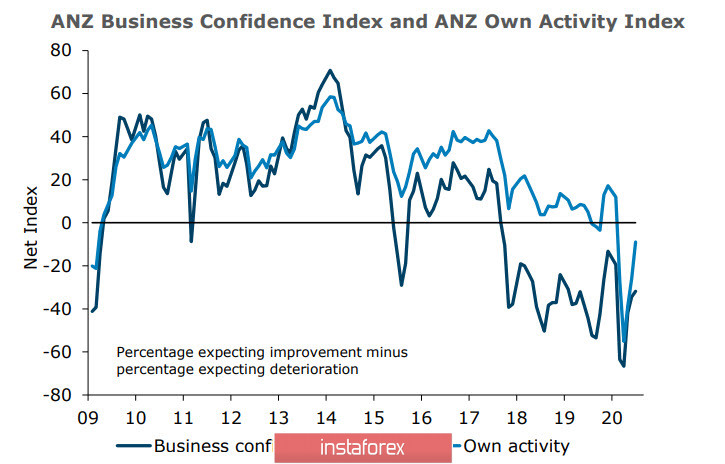

Consumer confidence index from ANZ - Roy Morgan in July slightly declined from 104.5p to 104.3p, the index of business optimism of the Reserve Bank of New Zealand also went slightly lower from 29.8p to 31.8p, the forecast worsened from -6.8% to -8.9%.

ANZ Bank believes that the main blow of the recession will be in the 4th quarter, and downside risks may lead to additional monetary policy instruments including a negative rate next year.

The CFTC report turned out to be negative for the New Zealand currency, the net bullish position changed to bearish again, which, in turn, contributed to a downward reversal of the estimated fair price.

On Wednesday, August 5, there will be data on the labor market for the 2nd quarter, and on August 6, the RBNZ will publish statistics on inflation expectations in the 3rd quarter. Negative expectations - even a possible rise in inflation will be unstable, macroeconomic indicators warn that the economic slowdown cannot be linked solely with the virus, since the reasons for a deeper recession were ripe long before the pandemic.

The nearest support is 0.6580/90, then 0.6490 and 0.6380. Despite the fact that, technically, the impulse has not yet formed a reversal pattern, according to the behavior of financial markets, we can conclude that large players are starting to cautiously take profit, which increases the chances of a corrective decline.

AUD/USD

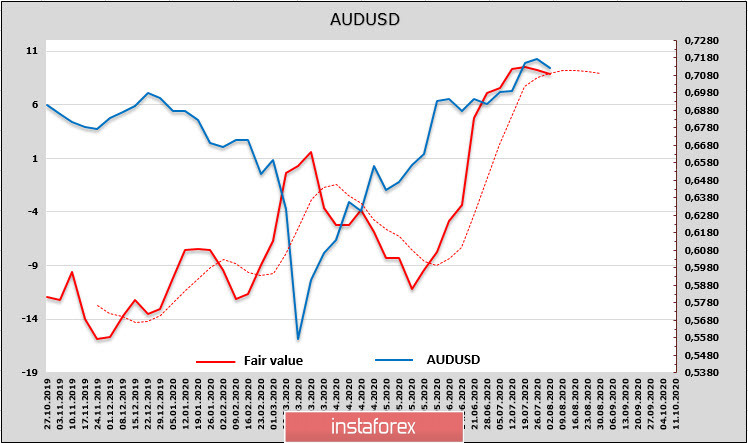

The CFTC report for the Australian was also bearish, a net short position was formed in the still small amount of 359 million, but the trend towards a reversal is also obvious.

The latest macroeconomic reports, with rare exceptions, are in the "red" zone - in June, the number of building permits unexpectedly declined, there was a slowdown again in lending to the private sector instead of the expected growth, and the growth of vacancies in the labor market is too slow.

Following its meeting this morning, the RBA kept monetary policy unchanged, as predicted, the bank shied away from improving its forecasts, noting that the Australian economy is experiencing its biggest recession since the 1930s, and the recovery will be uneven and uneven. On August 7, RBNZ will present several scenarios for the further development of the situation and more clearly identify the risks. In the meantime, we need to proceed from the fact that the bullish momentum is losing strength, there are high chances that the local maximum has already been formed at the level of 0.7227 and a corrective pullback is approaching. A decline to the support of 0.7020/40 is likely, then either going into the side range or continuing the decline.