Hello, dear colleagues!

On the first day of trading this week, the US dollar strengthened against all major competitors, with the exception of the Canadian dollar. However, the strengthening of the US currency was ambiguous and of different scales. We will talk about this in more detail in the technical part of the review, but for now a little bit about yesterday and today's macroeconomic statistics.

As it became known yesterday, industrial production in the Eurozone increased more than analysts expected: the forecast is 51.1, and in fact 51.8. Let me remind you that the value of the business activity index in the manufacturing sector above fifty is a positive factor. However, this result is not particularly surprising. After the lifting of restrictions and the resumption of work of almost all enterprises, the growth of industrial production, not only in the Eurozone, but also in Germany, is quite expected and even natural.

In turn, business activity in the United States and construction spending in this country, published yesterday, were worse than experts' expectations. I think that this is not particularly surprising, since COVID-19 continues to run rampant in the United States. More than 4.5 million people are infected in the country, with the daily increase in cases hovering around 70 thousand. As of last night, the death toll in the United States from COVID-19 totals more than 155,000. Very sad and depressing statistics. The authorities of the United States have not been able to curb the insidious pandemic for quite a long time. Of course, in such a situation, the White House administration and US President Donald Trump are under fire, especially from Democrats.

Let me remind you once again that the 45th President of the United States has never supported the introduction of strict restrictive measures to localize the spread of coronavirus. Trump was more concerned about the state of the American economy, which he laid the foundation for his re-election to a second presidential term, and here he clearly miscalculated. There is little doubt that he will be remembered in the election for the number of deaths from COVID-19 and his frivolous attitude to the pandemic. If you also consider the riots that broke out in the United States after the murder of an African-American by police, the chances of Donald Trump being re-elected, in my personal opinion, are minimal.

However, this is a completely different story, and we will return to the consideration of the euro/dollar currency pair. Looking at today's economic calendar, we see that it is not rich in macroeconomic events. The Eurozone will publish its producer price index at 10:00 (London time). In turn, the United States will submit reports on production orders at 15:00 (London time).

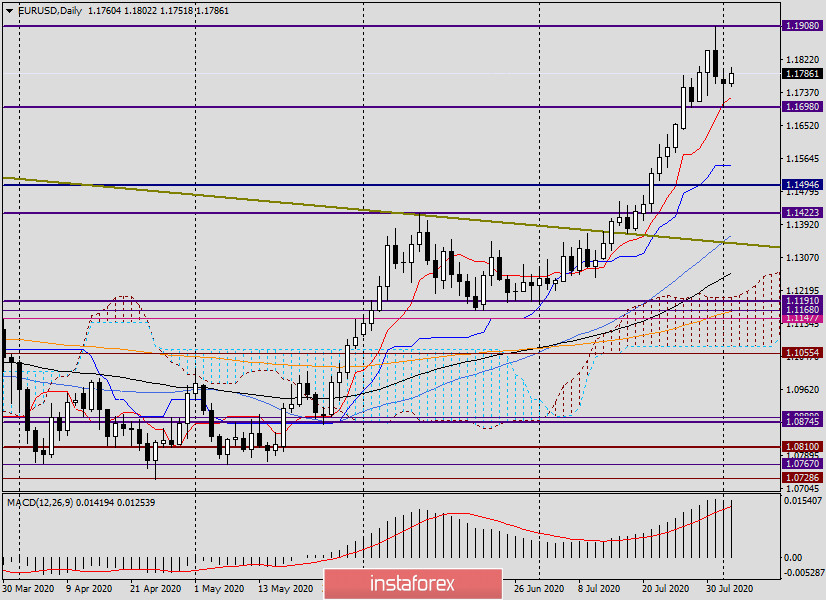

Daily

As expected in yesterday's review of the main currency pair of the Forex market, Friday's "bearish absorption" candle did not go unnoticed by market participants, and it began to be played back. However, the decline was stopped at 1.1698, after which the exchange rate began to actively recover, and trading on August 3 ended at 1.1760.

Today, at the moment of writing, the pair is growing and trading near 1.1793, demonstrating the intention to return above the important technical level of 1.1800. It is worth noting that yesterday the price was strongly supported by the Tenkan line (red) of the Ichimoku indicator, as well as another significant technical level of 1.1700. If the upward potential is maintained, there is a high probability of a rise to 1.1845/50, and if this barrier is overcome, the pair can retest the strong and significant level of 1.1900, where the subsequent direction of the quote will be decided. The bearish scenario provides for the price going under the Tenkan line (1.1724), updating yesterday's lows at 1.1698 and ending trading under this level. Judging by the long lower shadow of yesterday's candle, market participants do not intend to trade below 1.1700, which most likely implies a return of eur/usd to the upward dynamics.

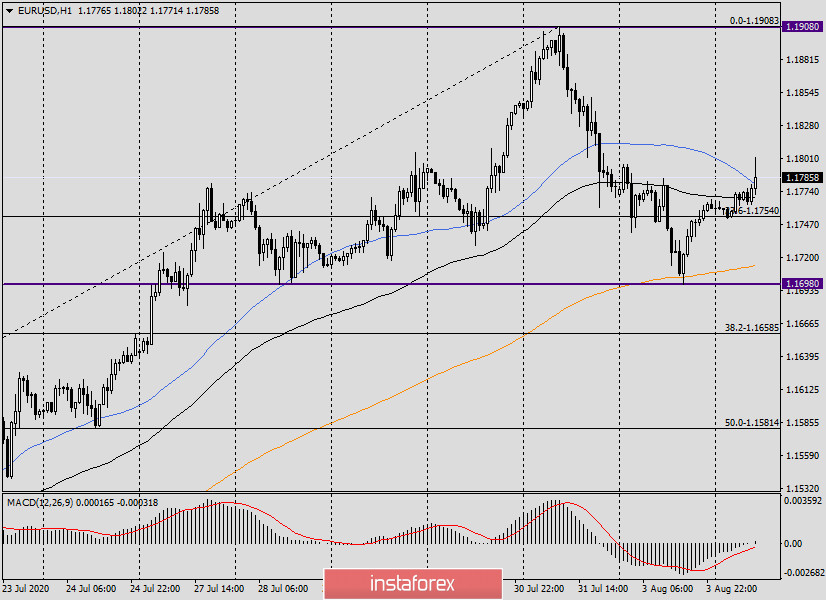

H1

On the hourly chart, there is a confident return above 89 exponential and 50 simple moving averages. If the pair is fixed above 50 MA (blue) and 1.1800 with three candles in a row, you can plan to buy the single currency on the pullback to the price zone of 1.1800-1.1780. However, we can not completely rule out attempts by the bears to resume yesterday's pressure. If this happens, then you should look for lower prices for opening long positions in the area of 1.1750-1.1700.

Given the strength and importance of the price zone of 1.1850-1.1900, the appearance of reversal patterns of candle analysis can be interpreted as a signal to open sales. In both cases, before opening trades, you should pay attention to the candlestick signals that appear on the four-hour and hourly charts. For today, the nearest target of buyers looks like the price area of 1.1850-1.1900. It is better to fix sales in the price zone of 1.1750-1.1700.

Good luck with trading!