Good day, dear traders!

At yesterday's trading, the GBP/USD currency pair showed multidirectional price dynamics, but still ended Monday's session with minor losses. We will return to the analysis of price charts later, but for now we will briefly discuss the fundamental background and the unfortunate pandemic of a new type of coronavirus infection.

Yesterday's data from the UK on the PMI manufacturing activity index, which turned out to be weaker than experts expected, and became the main factor of pressure on the British pound. Let me remind you that the forecast was 53.6, but the actual figure was 53.3. Today, no macroeconomic reports from the United Kingdom are planned, and the United States will publish data on production orders for June at 15:00 (London time).

As noted in yesterday's article, the main event for the British currency this week will be the decision of the Bank of England on interest rates, which we will learn about on August 6 at 07:00 London time. In addition, the minutes of the meeting of the British Central Bank will be published, after studying which market participants will see how the votes of members of the monetary policy committee were distributed when making a decision on the key interest rate. As a rule, investors pay special attention to these protocols. It is no secret that the Bank of England may lower its main rate to zero, which does not bode well for the exchange rate of the British pound. But, as they say, we'll wait and see. Regarding the upcoming meeting of the British Central Bank on Thursday, it is expected that the main interest rate will be left at its current level of 0.10%.

As for the COVID-19 pandemic, the number of infected people worldwide is approaching 19 million. At the same time, more than 700 thousand were victims of the coronavirus. If you compare the situation with COVID-19 in the US and the UK, it is certainly much more difficult in the United States. The daily number of infected people in the United States continues to be held in the region of 65-70 thousand, and the authorities are not able to do anything about it, and for quite a long time. Naturally, this situation is not favorable for the world's leading economy, so the US Federal Reserve System (FRS) is likely to hold rates at the current minimum values for quite a long time. At the same time, it is possible that the Federal Reserve will have to lower the refinancing rate again. As for the excessively inflated US budget deficit, it has increased even more due to the adoption of large-scale stimulus measures.

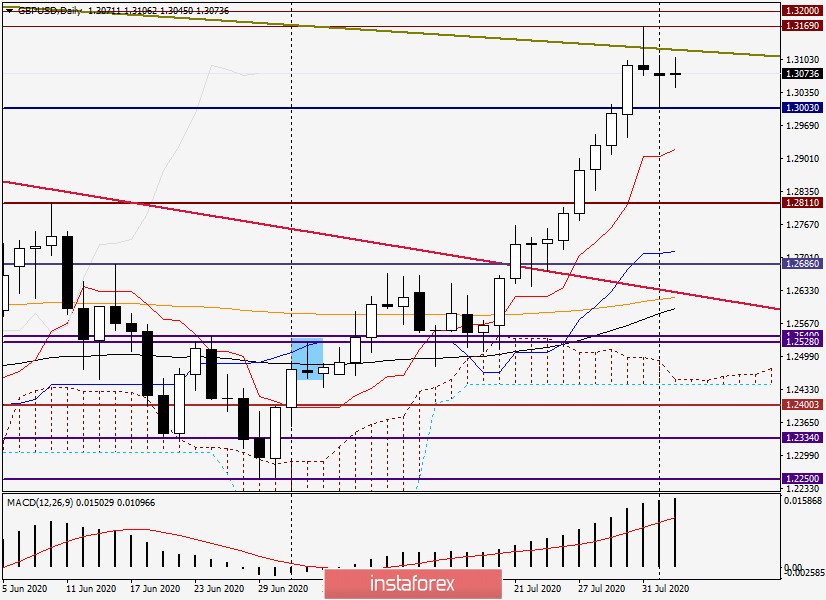

Daily

All of the above in no way contributes to the strengthening of the US dollar, which, despite some adjustments, remains weak, at least at this stage of time.

If we go to the technical analysis of the pound/dollar pair, we see that after falling to 1.3003, the pair quickly recovered its losses and closed Monday's trading at 1.3070. Yesterday's Doji candle with a very long lower shadow indicates the market's reluctance to trade under the psychological level of 1.3000, and once again confirms the current vulnerability of the US currency.

However, at the end of this article, the pound/dollar again moved to a downward trend and is trading near 1.3055. Nevertheless, I believe that the pound/dollar has every chance to continue implementing the upward scenario. Although for final conclusions, it is worth waiting for the decision on interest rates and comments from the Bank of England.

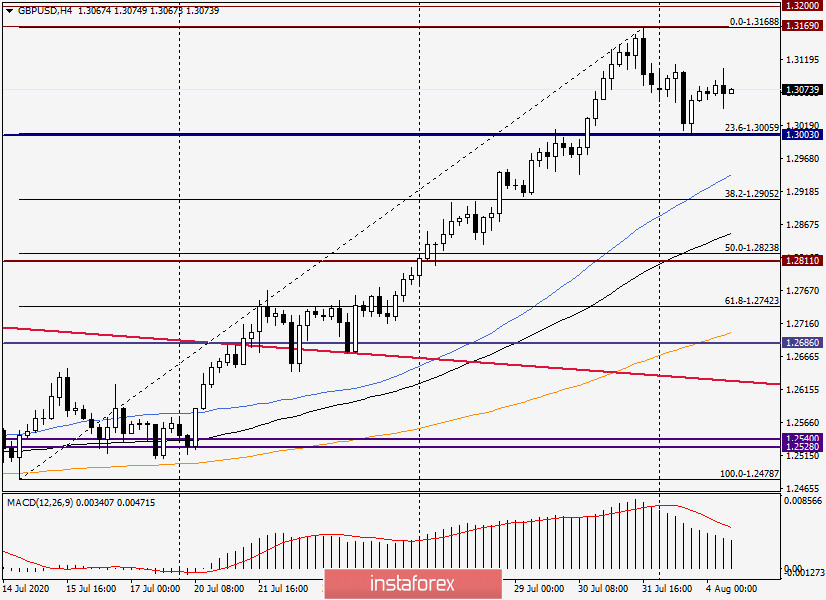

H4

Yesterday's recommendation to buy the pound on a pullback to the psychological level of 1.3000 was correct. As you can see, there is also a level of 23.6 on the Fibonacci grid, stretched to the growth of 1.2479-1.3169. In my opinion, this is where there is a very strong support, the breakdown of which can change the balance of power for this currency pair.

I recommend that you try buying sterling again when it falls into the price zone of 1.3020-1.3005. At the same time, a short-term flight of the price below, in the area of 1.2960-1.2945, from where a sharp rebound of the price up and its return above 1.3000 can take place, is not excluded. I believe that both of the highlighted price zones look very good for opening long positions on the pound/dollar pair. As for possible sales, they will become relevant after the appearance of bearish candles on the four hourly and (or) hourly charts in the area of 1.3080-1.3100.

Good luck!