Trading recommendations for the EUR / USD pair on August 5

Analysis of transactions

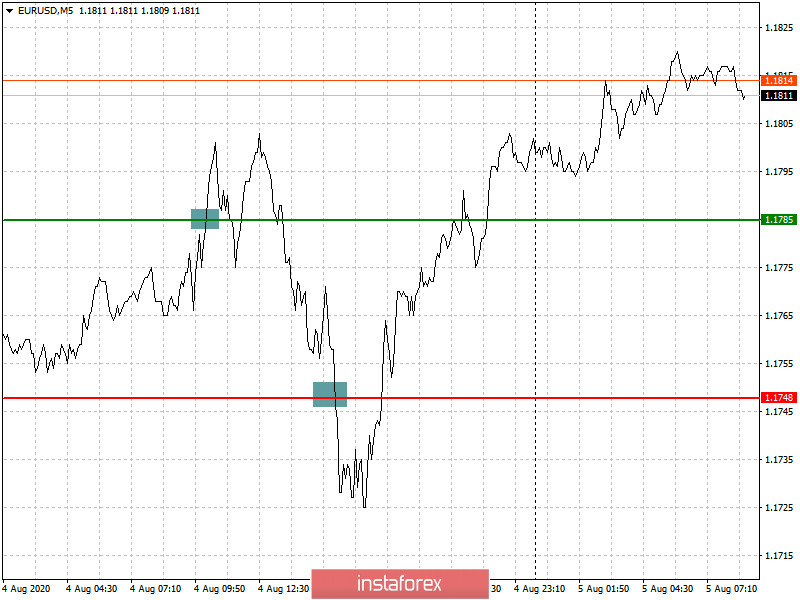

The test of the price level 1.1785 led to a 20-pip rise in the euro, after which it slowed down due to sales and then moved towards the level of 1.1748. The pair passed about 20 points, and then reversed again afterwards.

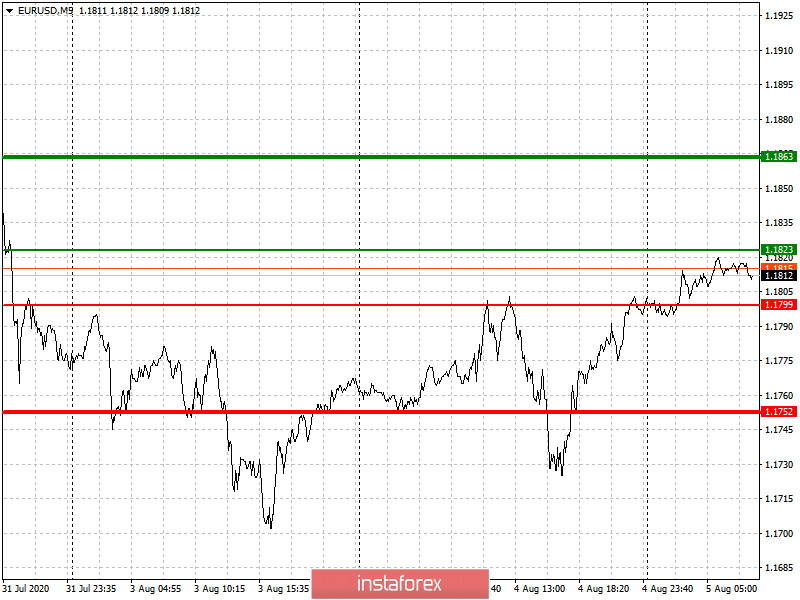

Good data on eurozone PPI helped the euro halt its decline against the US dollar, which weakened again due to poor performance on orders in the US manufacturing sector. Thus, the EUR / USD pair rose in the market in the afternoon.

- Open buy positions when the quote reaches the level of 1.1823 (green line on the chart), aiming for a rise towards the level of 1.1863. Good data on the eurozone services sector will help increase the European currency today, especially if they turn out better than the forecasts. Take profit when the quote reaches a price level of 1.1863.

- Open sell positions after the quote reaches the level of 1.1799 (red line on the chart), aiming for a drop to the level of 1.1752. However, before selling, wait for the report on the eurozone services sector, because negative data, that is, figures worse than economist forecasts, will be a factor for the euro's decline on the market. Take profit at a level of 1.1752.

Trading recommendations for the GBP / USD pair on August 5

Analysis of transactions

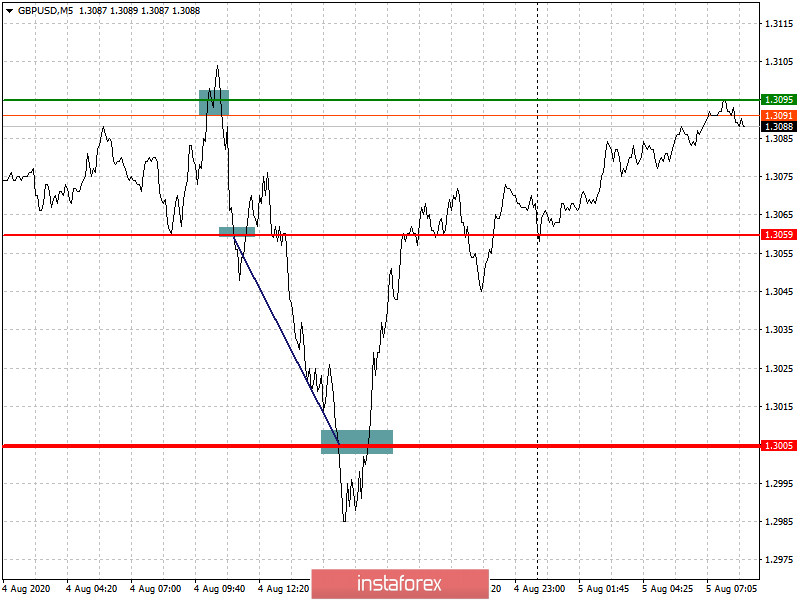

The buy signal for the pound from the level of 1.3095 turned out to be unprofitable, but the sales that were formed after the quote tested the support level of 1.3059 gave over 50 pips of profit, as the pair fell to the target level of 1.3005.

The most important report for today is the data on the UK services sector, which makes up a large part of the economy. Any growth and activity on the indicators will lead to a rise in the pound against the US dollar.

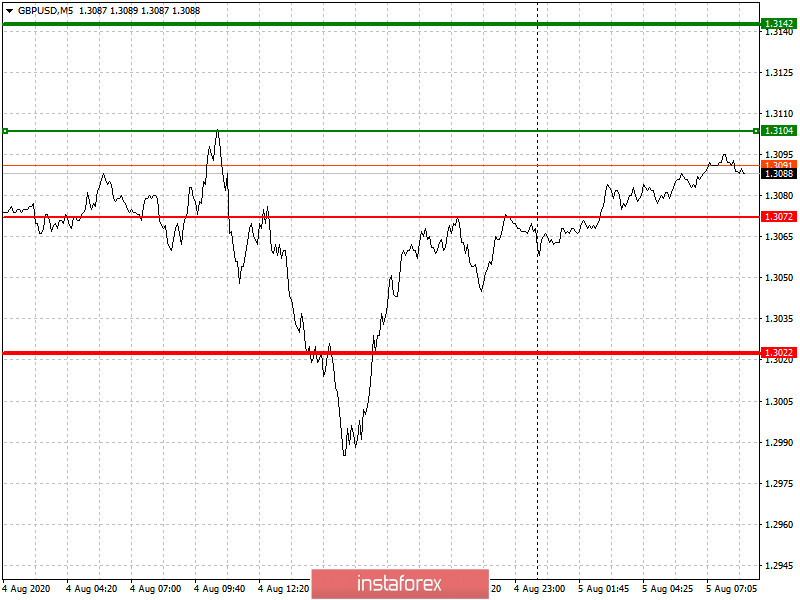

- Open buy transactions when the quote reaches the level of 1.3104 (green line on the chart), targeting a rise to the level of 1.3142 (thicker green line on the chart). Any good data on the UK economy will support the pound to rise in the market. Take profit at a price level of 1.3142.

- Open sell transactions after the quote reaches a price level of 1.3072 (red line on the chart), as a breakout of which will lead to a rapid decline in the daily TF. However, a larger decline in the pound needs a weak performance in the UK services sector, that is, the indicator should be worse than economists' forecasts. The target for the decline will be the price level of 1.3022, where take-profit should be placed.