The yield of 10-year treasures declined to 0.505% on Wednesday, which is the lowest since March, and gold futures exceeded the level of $ 2,000 per ounce, and, obviously, the growth will not stop there. These two markers indicate that the short recovery from the March-April dip is nearing completion. Investors fear the development of a full-fledged economic crisis, which cannot be attributed to "the consequences of the coronavirus pandemic."

The head of the Federal Reserve Bank of Minneapolis, Neel Kashkari, announced that the economy would benefit if the US was "hard-locked" for 4-6 weeks. This happened after the publication of official data on GDP for the 2nd quarter, according to which the US economy lost 32.9% of GDP. It is clear that re-blocking will lead to a severe crisis worse than the depression of 1929/33, and there is a desperate attempt to write off the causes of the depression to the coronavirus.

The demand for defensive assets is growing, and therefore, the period of dollar weakness is ending.

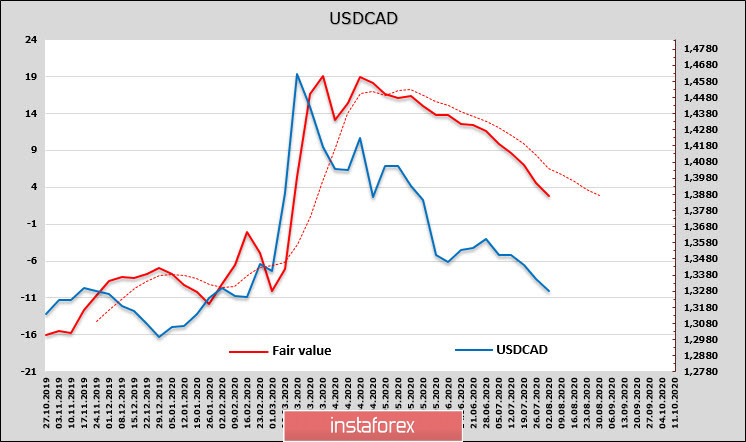

USD/CAD

According to Friday's CFTC report, the Canadian dollar is the only commodity group currency that major players did not sell, but, on the contrary, bought - the net short position declined by another 307 million and stopped at -0.93 billion.

As a result, the target price continues to decline. While AUD or NZD is showing a reversal, the Canadian currency has every chance of strengthening, which happened on Tuesday, when the strong resistance zone 1.3330/40 was broken. The estimated price is higher than the spot price, but it has a clear tendency to decline, that is, the downward direction dominates at the moment.

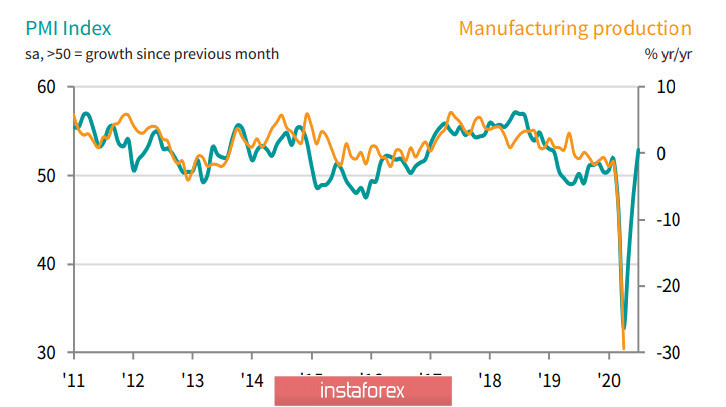

The main focus this week will be on the Canadian labor market report on Friday, August 7, which will be published simultaneously with the US report. So far, the estimates are quite contradictory - if a result was predicted close to June (+953 thousand) on Friday, then as of Wednesday morning, the forecast was reduced to +400 thousand. Such a change in the forecast looks unusual, if not strange, since the PMI report in the manufacturing sector showed an increase in July to 52.9p, the result exceeded forecasts and indicates the beginning of a recovery. Moreover, this is the maximum for 18 months, that is, one should expect both a steady growth in industrial production and a recovery in the labor market.

The Canadian dollar lagged behind other currencies in the commodity group for some time, because, as we noted earlier, the Canadian economy is strongly integrated with the US economy, and weak demand in the US automatically led to a negative reaction on the loonie. The situation is likely changing at the moment – we are waiting for a reversal in the dollar and strong data on non-farms, which will simultaneously support the canadian, since Canada's own macroeconomic indicators look quite convincing.

For USD/CAD, a downward impulse is expected to develop. The nearest target is the support zone 1.3180/3200, further dynamics will be clear after the publication of non-farms on Friday.

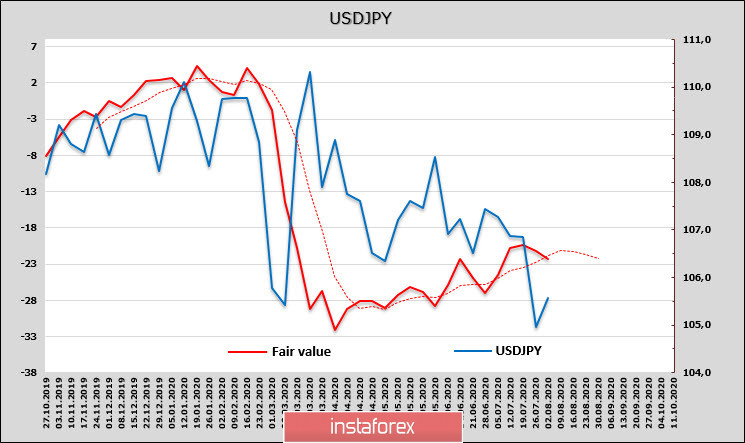

USD/JPY

The net long position grew by 1.131 billion and reached 3.391 billion, which, of course, is significantly less than the advantage of the euro over the dollar, but it also gives the bulls of yen some confidence. At the same time, the estimated fair price still has no direction, which means that there is no fundamental reason for the yen to exit the range.

Japanese media are increasingly reporting that the idea of lowering the consumption tax in order to support falling demand has emerged in the bowels of the ruling LDP party. If this idea is supported, a political crisis may suddenly develop along with the hopes of accelerating economic growth, as the likelihood of the dissolution of Parliament and the need for early elections will increase dramatically.

In any case, the situation for the yen looks extremely uncertain. The monetary authorities of Japan have exhausted all legitimate methods to stimulate the economy and are ready to take radical steps, the consequences of which no one can yet calculate.

The USD/JPY pair has formed a bottom of 104.12, corresponding to the lower border of the descending channel, related to the previous low of 105.95 from May 6, and a return to the middle of the channel in the 106.10/30 zone looks reasonable. To do this, it is necessary to overcome the resistance of 105.95. If it is not passed, then the chances for a further decline in USD/JPY will increase.