Hello, dear colleagues!

At yesterday's trading, the main currency pair of the Forex market again showed an unwillingness to move in the south direction and trade under the significant level of 1.1700. Market participants continue to be wary of the US currency, as the outbreak of the COVID-19 pandemic in the US has not yet been extinguished, and the debate in the US Congress on taking the next measures to counter the coronavirus continues. There has been some progress in the negotiations, however, there are still issues on which the Democrats and Republicans are not yet able to find common ground. If the negotiations finally reach an impasse, US President Donald Trump has the authority to sign the economic assistance bill himself. At least, this possibility was announced by the White House administration.

Against this background, investors fear that COVID-19 will cause even more damage to the world's leading economy and its recovery will be slower than in the Eurozone. In this regard, it can be assumed that the monetary policy of the US Federal Reserve System (FRS) will be more lenient than that of their counterparts from the European Central Bank (ECB). Let me remind you that in some EU countries there are also COVID-19 outbreaks, however, they are local in nature and are not comparable in scale to what is happening in America.

However, over the past 24 hours, the number of people infected with a new type of coronavirus infection in the United States has declined to 50 thousand people. Nevertheless, the US continues to hold an unenviable lead in the daily number of covid infections. Also, Brazil and India continue to be in the top three in terms of the daily number of infected people. In total, the number of people infected with coronavirus continues to grow and is approaching 19 million people.

If we go back to yesterday's statistics, it came out better than expected for both the Eurozone and the US, but, in my opinion, it did not have a decisive impact on the price dynamics of EUR/USD. After all, the main events of this week are still ahead, and market participants are looking forward to reports on the US labor market. It is likely that Friday's Nonfarm Payrolls will clarify the picture regarding the temporary prospects for the recovery of the US economy, as well as indicate the further attitude of investors to the US currency and, consequently, its direction.

Today, several interesting macroeconomic reports will be published for the euro/dollar currency pair, which may affect the price dynamics of the instrument. At 10:00 London time, the Eurozone will publish retail sales data for June. Later at 13:30 (London time), a report on the trade balance will be received from the US, and at 15:00 (London time), the index of business activity in the service sector from the Institute for supply management (ISM) will be published. Perhaps this is all, so it's time to move on to the consideration of price charts.

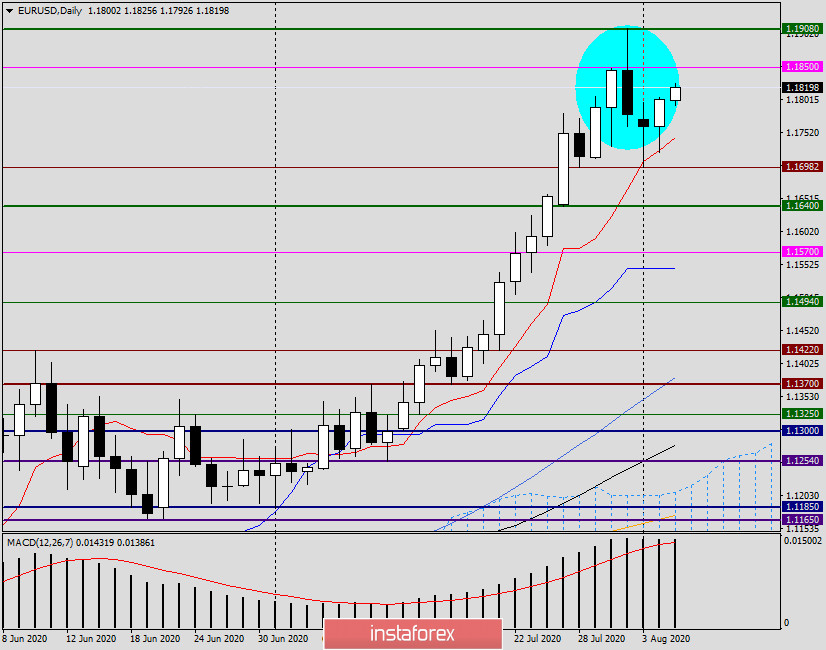

Daily

Immediately, I would like to note that yesterday's trading recommendations regarding purchases of the euro/dollar after a decline in the price zone of 1.1730-1.1705 were confirmed. Initially, the valid pair fell to 1.1721, after which it began to recover actively. The result of this recovery was the formation of a bullish candle with a closing price of 1.1801, which is very characteristic. Even if only by one point, the euro bulls managed to finish yesterday's session above the most important technical level of 1.1800.

What's next? And then I expect the growth of the quote, and I will explain why. First, yesterday's lows were higher than the previous ones, and after a long lower shadow, a bullish (white) candle body appeared. This is a very significant and important point. Secondly, it is necessary to note the support provided to the price by the Tenkan line of the Ichimoku indicator, as well as the fact of breaking the bearish divergence of the MACD indicator.

I venture to assume that the correction of the exchange rate and the attempts of players to work out the circled model of candle analysis "bearish absorption" have come to an end, and now the pair has every chance to resume the rise. Do not forget about Friday's data on the US labor market, which, no doubt, will have the most serious impact on the results of weekly trading.

At the moment, the main trading recommendation for EUR/USD is to buy after the pair falls into the price zone of 1.1780-1.1755. If near the current prices for H4 and (or) H1 will appear reversal bearish candles with a closing price below 1.1800, you can short sell to the selected prices, then consider the probability of a reversal and the possibility of opening long positions.

Good luck with trading!