To open long positions on EURUSD, you need:

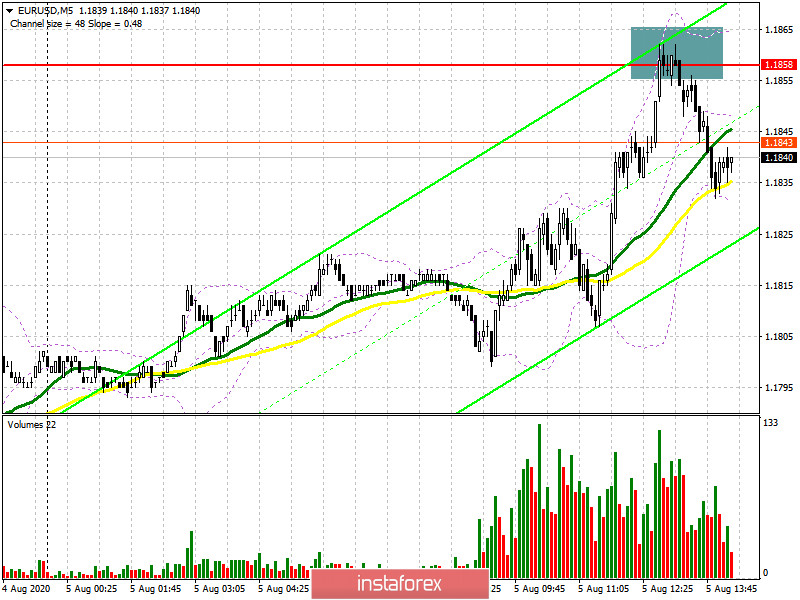

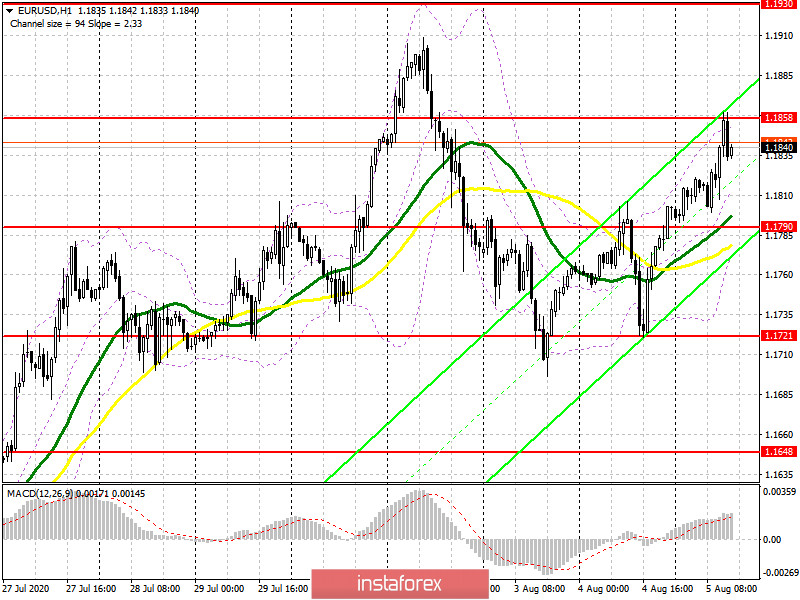

In the first half of the day, it was not possible to wait for the formation of a buy signal in the support area of 1.1790, as after a short pause, the bulls continued to push the pair up using data on the services sector and the composite index for the Eurozone countries. On the one hand, the reports were quite good, but on the other hand, there is a slight decrease in the growth rate in the summer period. Apparently, this limited the upward potential of the euro in the first half of the day in the resistance area of 1.1858, where a sell signal is now being formed. If you look at the 5-minute chart, you will see how the bears achieved a false breakout, which created a good point for entering the market in short positions. However, so far this has not led to a larger sale. It is possible that after a small proto-trading under this level in the afternoon, the bulls will continue to push the euro to weekly highs. You can open long positions only after a breakout and fixing above the resistance of 1.1858 in order to reach the level of 1.1930, where I recommend fixing the profits. The area of 1.1987 will be a more distant target. If the pressure on EUR/USD returns in the US session, it is best not to rush to open long positions, but wait for the update of the support of 1.1790, where the moving averages have already pulled up or buy the euro immediately on the rebound from the larger minimum of 1.1721.

To open short positions on EURUSD, you need:

The bears failed to do anything in the first half of the day, even falling short of the support of 1.1790, which indicates a clearly bullish momentum in the pair, which was formed yesterday. Sellers of the euro still need to return to the level of 1.1790, as only a consolidation below this range will increase pressure on the pair and lead to an update of yesterday's low in the area of 1.1721, where I recommend fixing the profits. The longer-term goal remains the area of 1.1648, the test of which will indicate the resumption of the bearish trend. It is necessary to pay tribute, while sellers cope with their secondary task of protecting the resistance of 1.1858, but how long they will be able to hold there remains a mystery. Most likely, this area will be broken up in the American session. Therefore, those who sold from this level in the first half of the day need to act very carefully and exit the market at the slightest hint of a breakout of 1.1858. If this happens, it is better not to rush with new short positions, but wait for the update of the new maximum of 1.1930 in the expectation of a correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily moving averages, which indicates the resumption of the bull market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the upper limit of the indicator around 1.1858 will lead to a new wave of euro growth. Breaking the lower border of the indicator in the area of 1.1780 will increase pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.