Bears may push gold below the psychological level of $1,800. This level coincides with the SM 21 and the 200 EMA on 4-hour charts.

The price of gold fell sharply on Thursday due to US Treasury yields. On Friday with the release of non-farm payroll data NFP kept it consolidated around 1,786. The yield on US Treasuries US Treasury 10-year benchmark rose almost by 8% all last week.

This week inflation data for the United States will be released on Wednesday, a reading close to 7% will allow yields on US Treasuries to rise. It could trigger a stronger fall in gold. On the contrary, a reading below that predicted by analysts could favor gold consolidating above 1,800.

Early in the European session, the US dollar index (#USDX) is recovering from Friday's collapse. It is trading above 95.70 (5/8). If the trend continues, it could put pressure on gold and it approaches the support level of 2/8 Murray at 1,781.

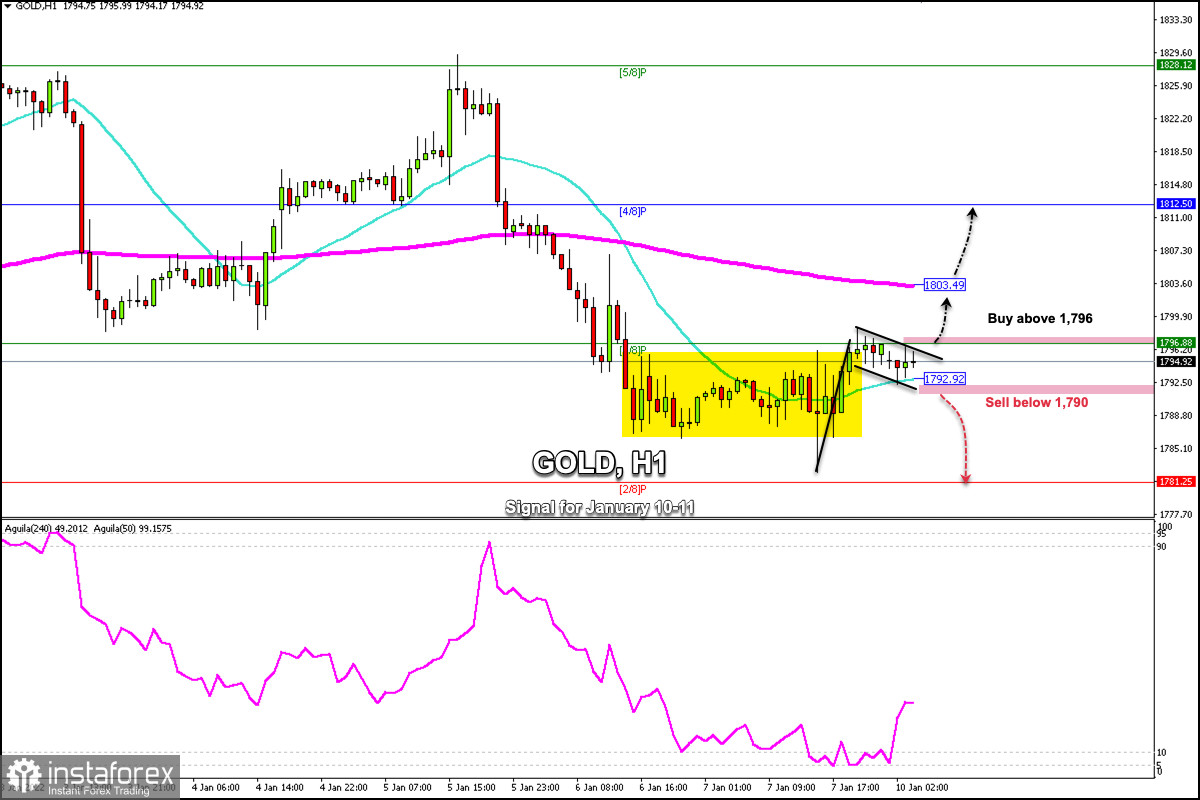

The 1-hour chart shows that gold has formed a bullish pennant pattern. A sharp break above 1,796 could accelerate the upward movement towards the 200 EMA located at 1,803 and if it breaks this level to 1,812 (4/8).

On the contrary, if in the next few hours it consolidates below 1,790 and below the SMA 21, we could expect the downtrend to continue towards the support level of 1,781. If this level is broken, it could fall to 1,765.

Support and Resistance Levels for January 10 - 11, 2022

Resistance (3) 1,819

Resistance (2) 1,808

Resistance (1) 1,802

----------------------------

Support (1) 1,786

Support (2) 1,781

Support (3) 1,770

***********************************************************

Scenario

Timeframe 1-hours

Recommendation: buy above

Entry Point 1,796

Take Profit 1,803 (200 EMA), 1,812 (4/8)

Stop Loss 1,789

Murray Levels 1,796 (3/8), 1,812 (4/8) 1,828 (5/8)

***********************************************************

Alternative scenario

Recommendation: Sell below

Entry Point 1,790

Take Profit 1,781 (2/8), 1,765 (1/8)

Stop Loss 1,796

Murray Levels 1,781 (2/8) 1,765 (1/8)

*********************************************************