Crypto Industry News:

A proposal titled "Multidimensional EIP-1559" was featured in a blog post in which Buterin noted that different resources in the Ethereum Virtual Machine (EVM) had different gas consumption requirements.

Today's scheme, in which all resources are combined into one multi-dimensional resource (gas), cannot cope with these differences.

The problem is that directing all resources to one resource leads to "very suboptimal gas costs" when these limits are mismatched.

Buterin presented his rather complicated change proposals with a lot of technical mathematics, and in short, the proposal contained two potential solutions using "multidimensional" prices.

The first option would be to calculate the cost of gas for resources such as data transmission and storage by dividing the base charge for each resource unit by the total base charge. The base charge is the fixed network charge per block included in the Ethereum Improvement Proposal (EIP) 1559 algorithm.

The second, more complex, option specifies a base charge for using resources, but includes limits for each resource. There would also be 'priority charges' which are set as a percentage and calculated by multiplying the percentage by the basic charge.

Vitalik also argued that the disadvantage of the multi-dimensional pricing structure is that "block builders would not be able to accept deals in the order of high to low gas charges." They would have to balance the dimensions and solve additional math problems.

Time will tell if the proposal will be accepted, as at the moment the priority is the next major update. The Ethereum network is currently preparing for a "connection" that will dock the Ethereum blockchain in the Beacon chain and successfully terminate the work-checking algorithm. Work on the Kintsugi test network is already underway and full implementation is expected in the first quarter of this year.

Technical Market Outlook

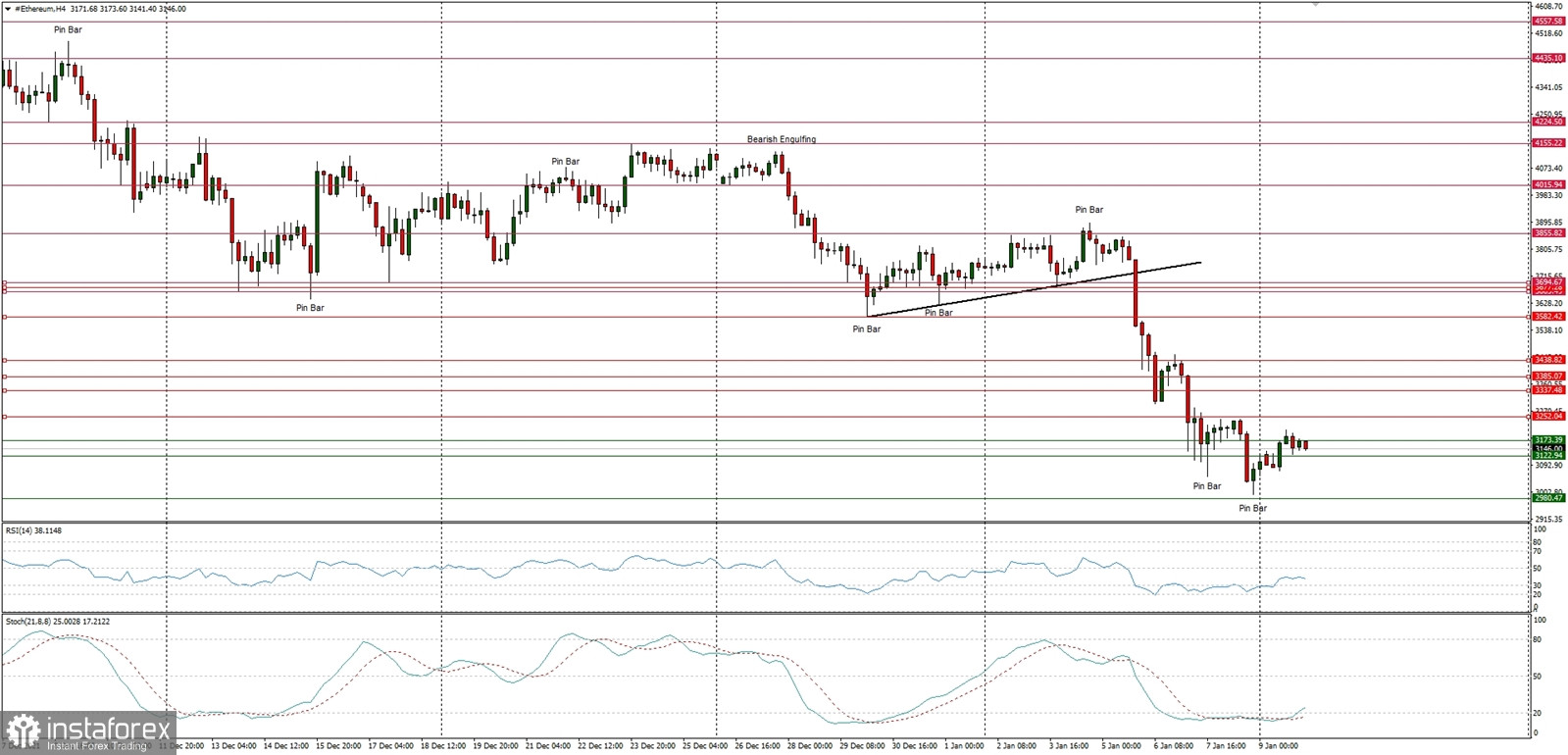

The ETH/USD pair has been seen testing the key long-term technical support located at the level of $3,000. The intraday technical resistance is seen at the level of $3,252, but the key short-term technical resistance is located at the level of $3,582, so the bulls have a quite a long road to make in order to resume the up move. The complex and time consuming corrective cycle in form of ABCxABCxABC pattern has not been completed yet, nevertheless larger time frame trend remains up and only a clear and sustained breakout below the swing low at $2,644 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $4,512

WR2 - $4,187

WR1 - $3,620

Weekly Pivot - $3,304

WS1 - $2,721

WS2 - $2,382

WS3 - $1,782

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.