Today, policymakers of the Bank of England unanimously decided to retain the interest rate at a record low, thus providing support for the pound sterling, which continued strengthening against the US dollar. However, if we take a closer look at the results of the meeting, it becomes clear that the regulator is unlikely to give help to the UK economy in the future, which is also a clear bearish signal. Therefore, major market players continue increasing the number of their short positions for a reason every time the pound is growing. Reports from the futures market tell us about this in detail. Thus, the COT report indicated that during the reporting week, short non-commercial positions increased to 64,738, while long non-commercial positions, on the contrary, declined to 39,392. As a result, the negative value of the non-commercial net position increased and amounted to -25 409 versus -15 080. This fact shows that the pound sterling is likely to fall sharply after the greenback recovers its positions.

The pound strengthened mainly because the Bank of England refused to cut interest rates below zero meanwhile chances were quite high. In addition, traders took well the revised forecasts of UK GDP contraction.

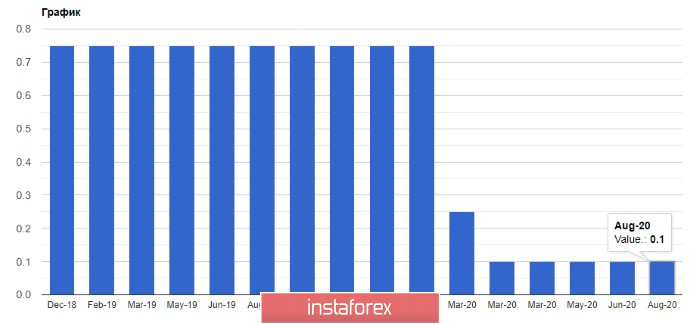

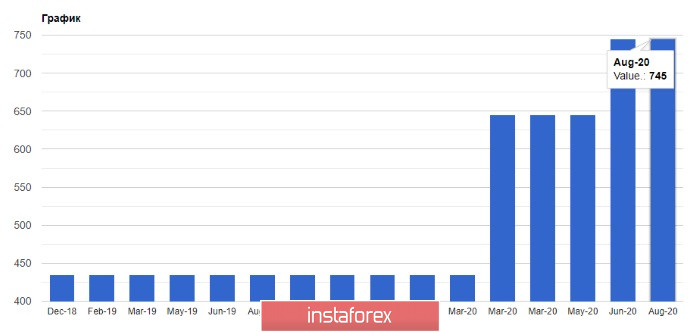

The nine-member Monetary Policy Committee voted to hold the interest rate at 0.10%. Nobody of the members voted to increase the interest rate. Also, the bank retained the size of the asset purchase programme at GBP 745 billion. However, it seems like the introduction of new stimulus measures will be necessary. Most likely, this autumn, the regulator will implement a new stimulus package aimed at protecting the UK economy from the consequences of the coronavirus pandemic and Brexit. New measures may be announced as early as October this year. If that happens, the pound has little chance to continue growing.

As for the forecasts, the Bank of England expects the unemployment rate to rise to around 7.5% by the end of the year, while GDP is projected to recover by the end of 2021. According to the Bank of England estimates, UK GDP contracted by 21% in the second quarter. Overall, the economy is forecast to contract by 9.5% in 2020, significantly below May estimate of a 14% reduction. This is a positive signal for the pound. The regulator noted that, despite the revision of forecasts, the balance of risks is shifted to the negative zone. Therefore, inflation will remain below the target level of close to 2% and will return to it no earlier than in a few years.

Thus, long positions in the pound increased after it was announced that negative interest rates were currently less effective. However, it is better to be careful, as in his interview, the Governor of the Bank of England noted that negative interest rates remained the instrument for adjusting the monetary policy, but now they did not seem appropriate. The governor did not exclude the possibility of their use in the future if the state of the economy changes dramatically. The most favorable moment for negative interest rates, according to the head of the Bank of England, is precisely the time of economic recovery, and not during a crisis. Bailey also believes that although the UK economy is recovering, it is doing it quite unevenly. Apart from that, he also welcomed local lockdown measures, which were the right step for the economy.

As for the technical analysis, the GBPUSD pair continued to grow and broke through monthly highs. Then, the upward movement stopped, which could result in a serious problem, since the bulls only managed to fight off the first wave of the pound correction, which was formed at the beginning weeks, while the second correction looms on the horizon. If the trading instrument returns to today's lows in the 1.3100, it will be an alarming signal for buyers.

EUR/USD

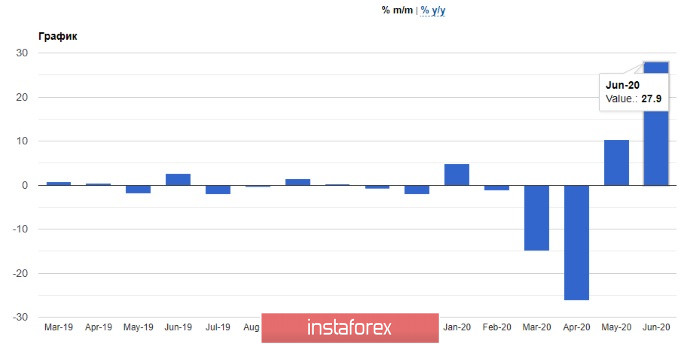

The euro increased slightly after the release of a strong data on the growth of orders in the manufacturing sector in Germany, which leaves hope for a V-shaped economic recovery. However, traders were quick to take profits in the absence of support from major market players. An increase in external and domestic demand, as well as in orders will have a positive impact on the pace of economic recovery in Germany in the post-crisis period.

Currently, domestic activity accounts for 90% of the pre-crisis volumes. Now, factory orders have returned to 90% of the pre-crisis levels. According to the Destatis report, orders advanced 27.9% on a monthly basis, faster than the 10.4% increase seen in May. Economists had forecast a 10.1% rise for June. Compared to June last year, factory orders declined 11.3% in June. Domestic orders advanced 35.3% and foreign orders climbed 22% from the previous month.

The price failed to break out at the resistance level of 1.1905. Also, it is important to make sure that the situation in the American labor market has not yet completely deteriorated due to the recent increase in the number of coronavirus cases. If the pressure on risky assets resumes by the end of the week, we can expect the EUR/USD to return to 1.1810 - to the middle of the channel - and then to update its lower border in the 1.1720 area. The short term direction will be determined by the level the price will be able to reach.