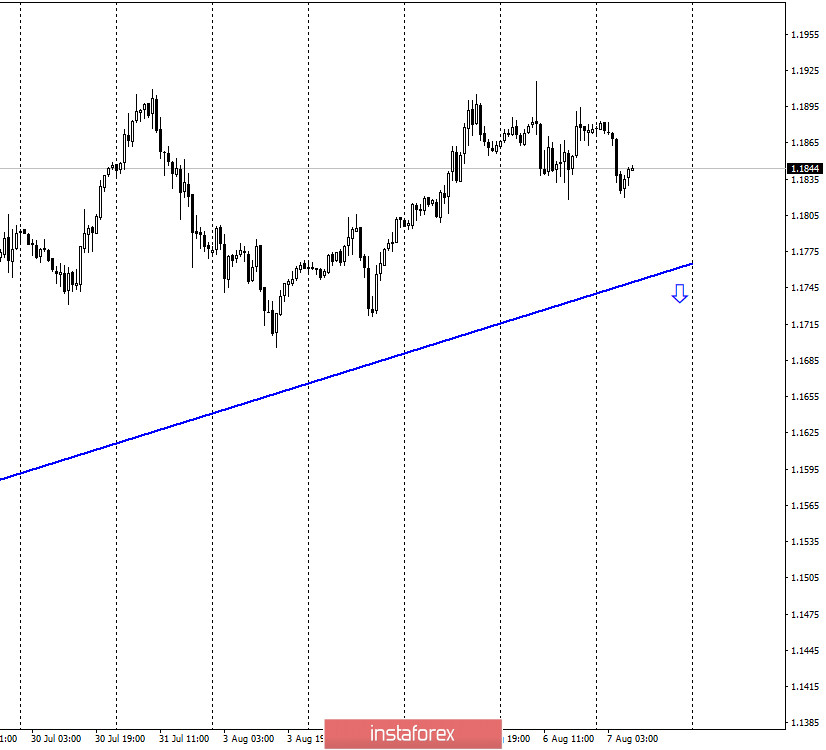

EUR/USD – 1H.

Hello, traders! On August 6, the EUR/USD pair performed a reversal in favor of the US currency and again approached the upward trend line, which continues to maintain the current "bullish" mood of traders. I remind you that the mood will remain "bullish" until the quotes close below the trend line. However, at the same time, traders failed to rise above the previous peaks. Thus, the pair is now limited in both growth and fall. The key event of today is undoubtedly the Nonfarm Payrolls report, which will be released in America this afternoon. Finally, traders will have the opportunity to work out an important economic report, since recently their attention has been more shifted towards the coronavirus, which is why the dollar has constantly fallen in price. Today, the US currency can fall even more, as there are serious concerns that this report will be worse than traders' expectations. It is expected that the number of jobs created in July will be 1 million 600 thousand. However, this week's ADP report, which shows changes in the number of employees in the private sector, has already been released, and it was significantly worse than expected. Thus, it is quite possible that Nonfarm Payrolls will be weaker, showing that the labor market in America is recovering from the pandemic crisis with great difficulty. In this case, the dollar may start falling again on August 7.

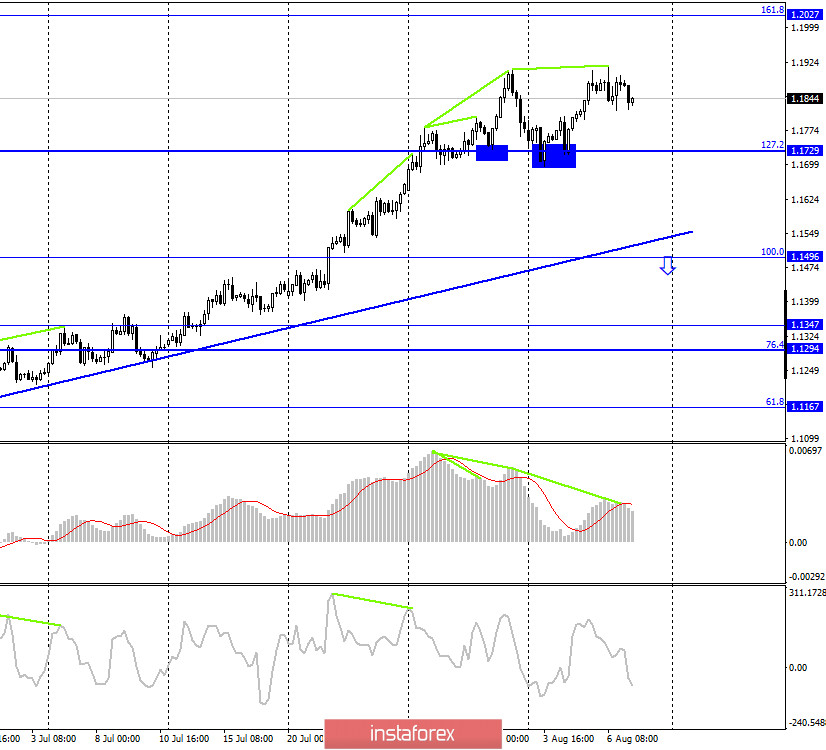

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a new reversal in favor of the US dollar after the formation of another bearish divergence in the MACD indicator. Thus, the pair started a new process of falling towards the corrective level of 127.2% (1.1729). Closing the pair's quotes above the last divergence peak will increase the probability of resuming growth in the direction of the Fibo level of 161.8% (1.2027).

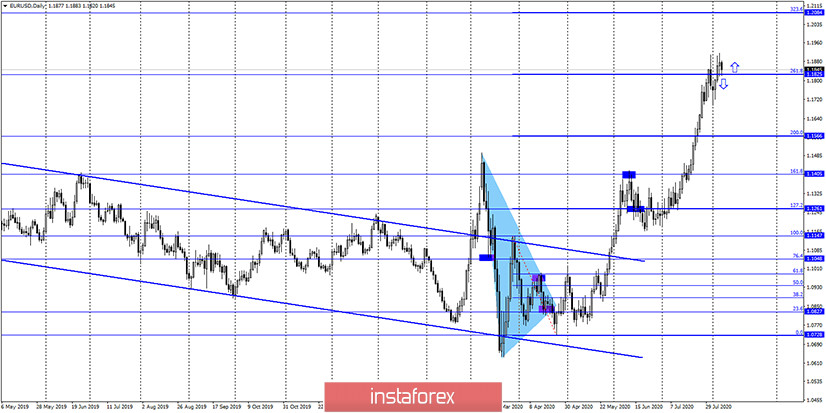

EUR/USD – Daily.

On the daily chart, the EUR/USD pair closed above the corrective level of 261.8% (1.1825). As a result, the growth process can be continued towards the next corrective level of 323.6% (1.2084). However, the two lower charts cast doubt on further growth and require fixing over the divergence and the 1.1908 level.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation over the "narrowing triangle", which now allows us to count on further growth of the euro currency, which can be very strong and long-term.

Overview of fundamentals:

On August 6, there were no economic reports in the European Union, and only one in America. The number of new applications for unemployment benefits was 1,186 million, and repeated - 16,107 million. Both values were better than traders' expectations, which could have supported the dollar, however, it did not.

News calendar for the United States and the European Union:

US - unemployment rate (12:30 GMT).

US - change in the number of people employed in the non-agricultural sector Nonfarm Payrolls (12:30 GMT).

US - change in average hourly earnings (12:30 GMT).

On August 7, the EU calendar is empty again, and several important reports will be received from America at once, which cannot be ignored.

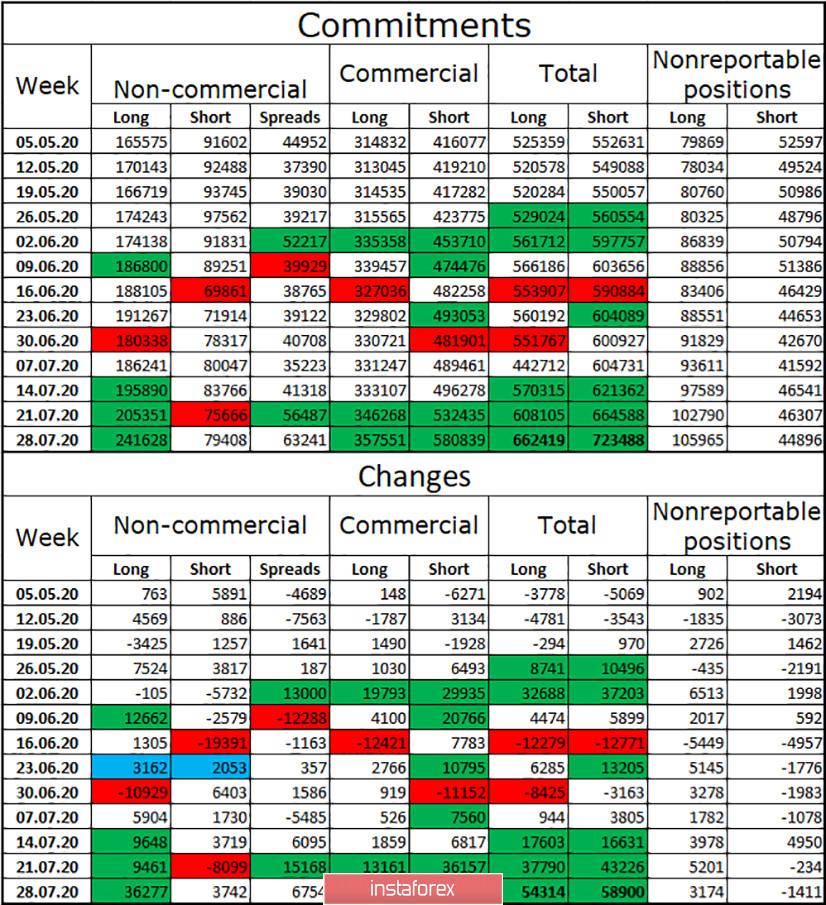

COT (Commitments of Traders) report:

The latest COT report was extremely interesting. The Non-commercial group opened as many as 36277 purchase contracts during the reporting week. This is a very high value. And it was it that formed the upward trend for the reporting period. Thus, this figure alone from the entire report was already enough to make a conclusion about the current mood of major traders in the European currency. The Commercial group also actively opened and closed contracts, however, data for this group is not important. In total, 241 thousand long-contracts and only 79 thousand short-contracts are now placed in the hands of speculators. Thus, the latest COT report does not yet give any reason to assume the end of the upward trend.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend cautious purchases of the currency pair with a target of 1.2024, if a close above the level of 1.1908 is made. I recommend selling the pair with the target level of 1.1496 if the closing is made under the level of 1.1729, as well as under the ascending trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.