Sometimes, it happens that the market is moving in the direction opposite to expectations. This is exactly what is going on now. The S&P 500 had been on track to historic highs before the publication of the ADP National Employment Report. The ADP payroll processor released downbeat data on the private sector employment. It seemed to crush resistance of the EUR/USD bears. Nevertheless, the US Labor Department posted better-than-expected data on initial unemployment claims. On Friday, the US nonfarm payrolls revealed similar data on employment in the public and private sectors like in the ADP report. This assured EUR bulls to take profit. Now they are thinking about a downward correction.

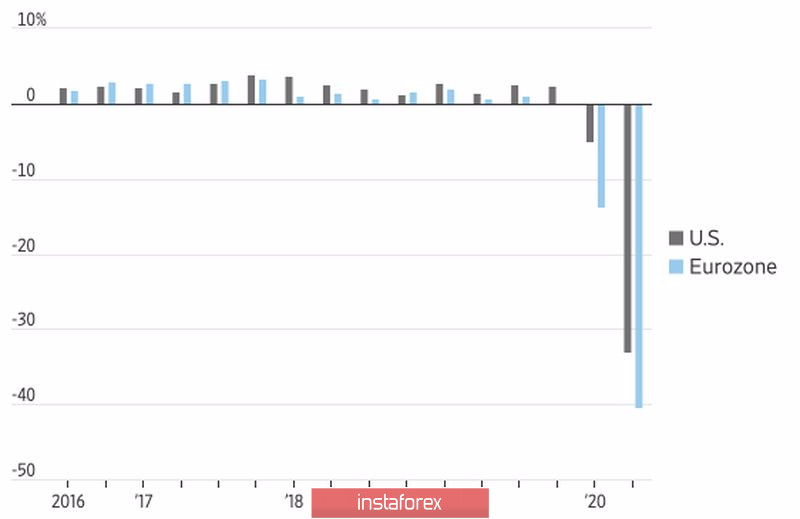

The milestone event for EUR is the EU-backed recovery fund which provides a long-term support to the single European currency. In addition, EUR found support from the move of central banks towards diversification of their gold and forex reserves as well as investors' revision of their portfolios in favor of the euro-denominated assets. Another argument for investors in favor of EUR is different prospects of the EU and US economies. On the one hand, the eurozone plunged into a deeper recession in Q2 than the US. On the other hand, the better coronavirus picture, more efficient social programs on the labor market, and coordinated efforts of the EU leaders suggest a more rapid GDP recovery to the pre-crisis level than in the US.

US and eurozone GDP

No wonder EUR is shining now with prospects for sustaining strength in the long term. Nevertheless, it would be a good idea to take notice of two important points. First, US stock indexes have been advancing higher than European ones. Why? The US stock market owes its steady rally to unexpectedly strong financial reports from large US companies for Q2. Second, the assumption about a growing EUR share in central banks' gold and forex reserves has not been confirmed yet. Apparently, central banks will rush pumping up their reserves with EUR in case Washington decides to resume its trade war with China.

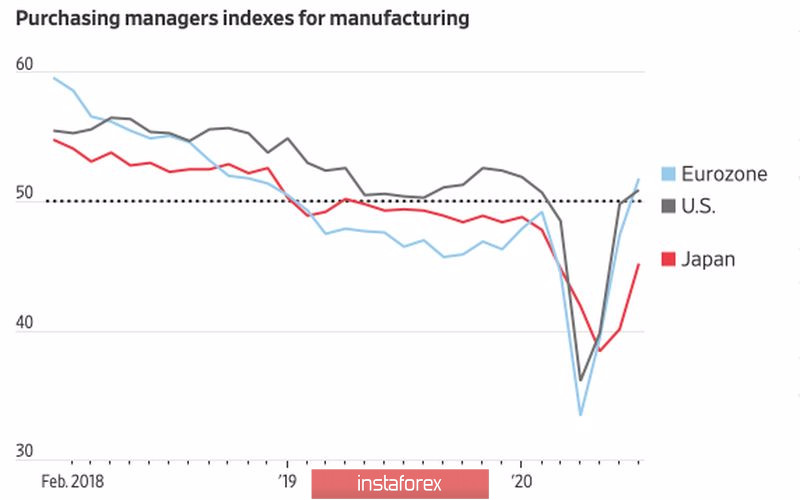

It makes sense to stay sober amid the EUR stunning rally. Indeed, the second COVID-19 wave in Spain and lower virus rates in the US assure some EUR/USD bulls to take profit. Remarkably, the US economy released unexpectedly upbeat metrics which come as a surprise. This prompts investors to make a conclusion that the downturn in the US economy is not as dismal as believed. For instance, the US outpaces the eurozone and Japan in terms of business activity.

Manufacturing PMI

Meanwhile, some EUR fans are willing to exit long positions for several reasons such as uncertainty around the new stimulus package in the US, escalating jitters in the US – China relations, and the presidential elections. Hardly anyone doubts that the White House and Congress will eventually come to the common denominator and pass the bill until the first week of August. So, the second stimulus package will be good news for the US dollar. The meeting between Washington and Beijing is scheduled for August 15. The parties are due to discuss to what extent they have fulfilled their commitments under the first phase trade deal made in January. Citing well-informed sources, Bloomberg reported that China intends to revise the trade deal due to the pandemic. However, if something goes wrong for Donald Trump, the trade war is likely to spark off again.

Back to the chart. The overall trend of EUR/USD is quite steady but the time is ripe for a downward correction. It would be a nice idea to enter the market with long deals on retracements to 1.1755, 1.169, and 1.1635.

EUR/USD, daily chart