The USD/CAD pair has found support at 1.2610 level today and now it's traded at 1.2681 level at the time of writing. Technically, the downside movement seems over after the price action printed a bullish engulfing.

Surprisingly or not, the price stays near 1.2697 today's high even if the Dollar Index plunged in the last hours. As you already know, USD/CAD plunged on Friday after the NFP was reported at 199K versus 426K forecasts. On the other hand, the Canadian Unemployment Rate dropped unexpectedly from 6.0% to 5.9%, while the Employment Change was reported at 54.7K compared to 24.5K estimates.

In the short term, USD/CAD could move sideways ahead of the US inflation data. The CPI and the Core CPI will be released on Wednesday. The volatility will be high around these high-impact publications.

USD/CAD Turned To The Upside!

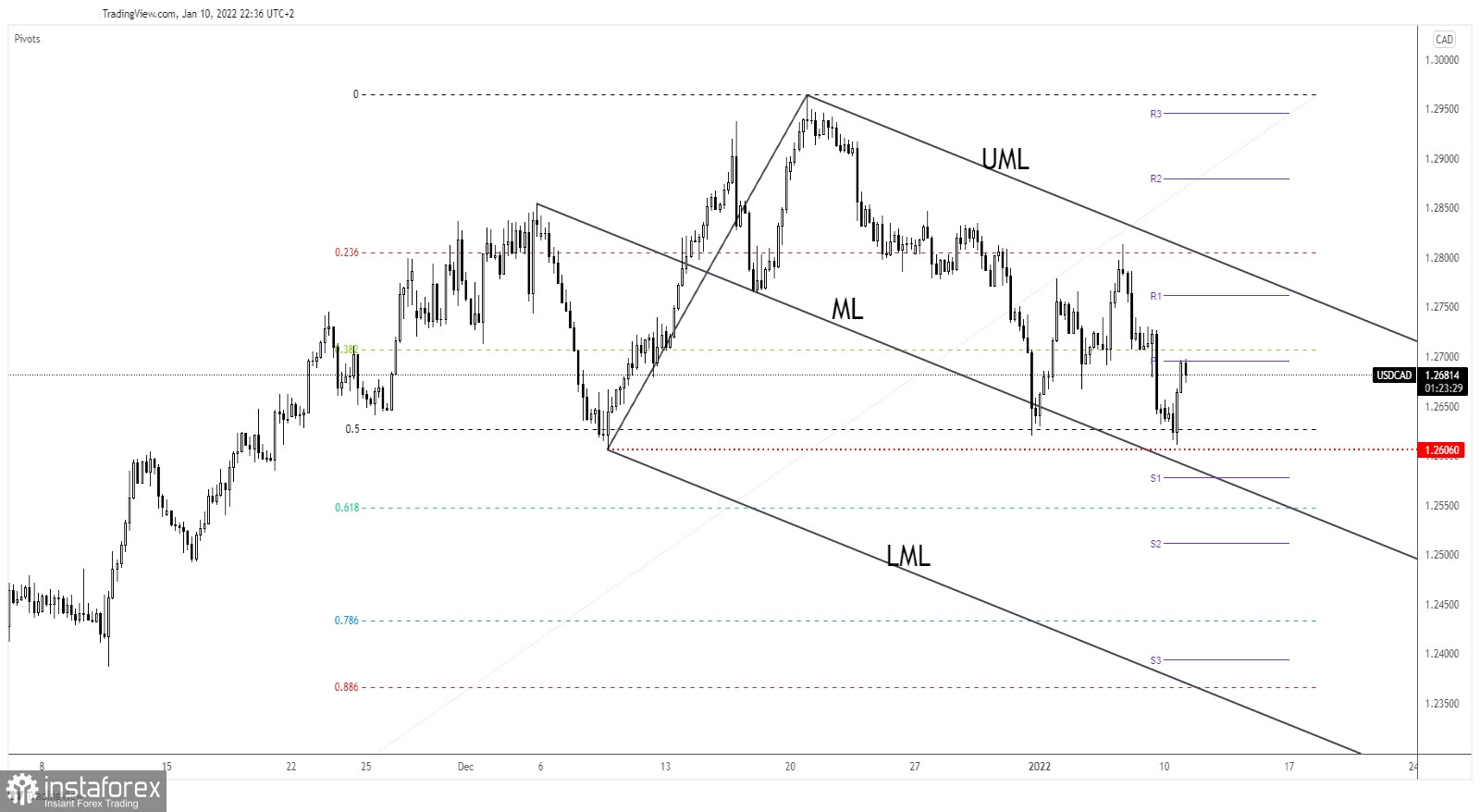

USD/CAD failed to reach the 1.2606 static support and now it has reached the weekly pivot point of 1.2695 which stands as resistance. Also, the pair has failed to reach and retest the descending pitchfork's median line (ML) signaling that the sellers are exhausted.

Technically, it's trapped between the 50% and 23.6% retracement levels. Jumping and closing above the weekly pivot point and above the 1.2700 psychological level may indicate potential growth towards the descending pitchfork's upper median line (UML).

The 1.2626 (50% retracement level) - 1.2606 area represents a strong demand zone. Staying above it, USD/CAD could try to develop a strong upwards movement. Personally, I would like to see strong consolidation above it or a retest, a major bullish pattern before considering going long.

USD/CAD Prediction!

A valid breakdown below 1.2606 could signal a larger corrective phase. On the other hand, a sideways movement followed by a valid breakout above the descending pitchfork's upper median line (UML) may activate an upside continuation.