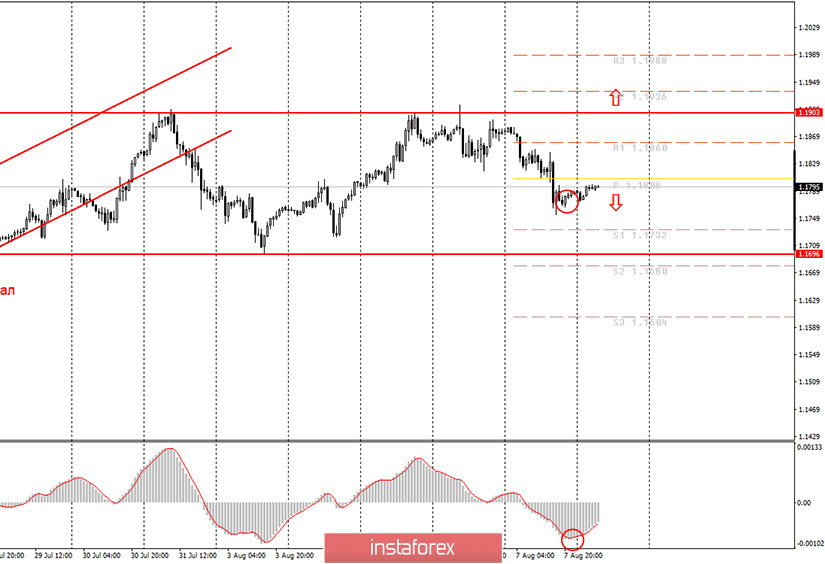

Hourly chart of the EUR/USD pair.

The EUR/USD currency pair started a weak upward correction on Monday night trading. The MACD indicator turned up, however, the price also began to rise, so we managed to avoid "indicator discharge" (the indicator property, in which the price and the indicator move in opposite directions, happens when the price moves in one direction for a strong and long time). So, from a technical point of view, everything is beautiful. Now, traders should wait for the completion of this correction and it will be possible to resume trading on the downside at least until the level of 1.1696, which is the previous local minimum, is worked out. And only if this level is overcome, then it will be possible to assume the formation of a new downward trend. Until then, the pair's quotes may return to the level of 1.1903 at any moment.

On Monday, August 10, the European Union and America are not scheduled for any important macroeconomic publications. Thus, most likely, nothing will affect the tone of trading today. If this is the case, then traders can easily adjust the pair to certain levels and after a smooth turn down, resume the downward movement. We believe that this is the most likely option for today. Of course, the market can receive unplanned news. For example, an important and high-profile speech by Donald Trump, news about negotiations between Republicans and Democrats regarding the provision of a new package of financial assistance to the US economy, or data on "coronavirus" diseases in the US. Each of these topics can potentially change the mood of traders, which can lead to an increase in the movement or a reversal of the price. We remind you that the market is very sensitive to the topic of the COVID-2019 epidemic in the United States, and it does so with good reason. Since the epidemic slows down the recovery of the American economy after the "lockdown". And the American economy has already suffered almost the most in the world, losing 33% of GDP in the second quarter. And now we don't know what the data for the third quarter will be. As we have already said, the pandemic in America is "uncontrolled in its spread". Thus, many factors suggest that it is time for the dollar to become more expensive. But at the same time, almost at any moment, traders can refuse this option due to the weak fundamental background from America, and then the dollar will start to fall again.

On August 10, the following scenarios are possible:

1) Purchases of the pair are still not relevant, since the price left the ascending channel and could not overcome the level of 1.1903. There are no technical structures, such as trend lines or channels or other models that support the upward trend at the moment. Thus, we believe that it is not appropriate to trade for an increase at this time.

2) Sales of the currency pair are still more promising now. At the moment, the pair is being corrected, as indicated by the MACD indicator (the signal for correction is circled in red). Therefore, we now suggest waiting for the completion of this correction and a signal from the same MACD to sales. Then we recommend that you re-open sell orders with targets of 1.1732 and 1.1696. In principle, given the current average volatility of the pair (an indicator of the average number of points from the minimum to the maximum of the day), traders can reach the first goal today. However, the stronger the upward correction, the less time and effort will be left to work out the level of 1.1732 on August 10.

What's on the chart:

Price levels of support and resistance – levels that are targets when opening purchases or sales. You can place Take Profit levels near them.

Red lines – channels or trend lines that display the current trend and indicate which direction it is preferable to trade now.

Up/down arrows – indicate when you reach or overcome which obstacles you should trade up or down.

MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp reversal of the price against the previous movement.

Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.