Good day, dear colleagues!

As a result of mixed trading on August 3-7, the British pound fell into the company of those major currencies that declined against the US dollar. As previously expected, the main influence on the closing of the last five-day trading period was data on the labor market of the United States of America. Let me remind you that the three most important indicators (the change in employment in non-agricultural sectors of the American economy, the unemployment rate and wage growth in July) exceeded the expectations of economists and were better than consensus forecasts. You can find out more about this by reading today's article on the euro/dollar.

As for the GBP/USD currency pair, the most important reports from the UK this week will be preliminary GDP data for the second quarter, as well as reports on the British labor market. In addition, many more statistics from the US will be published, but this will be mentioned in more detail on the day of the release of macroeconomic data that can affect the price dynamics of the pound/dollar currency pair. No statistical reports will be received from the United Kingdom today, and the United States will provide data on the level of vacancies and labor turnover at 15:00 (London time).

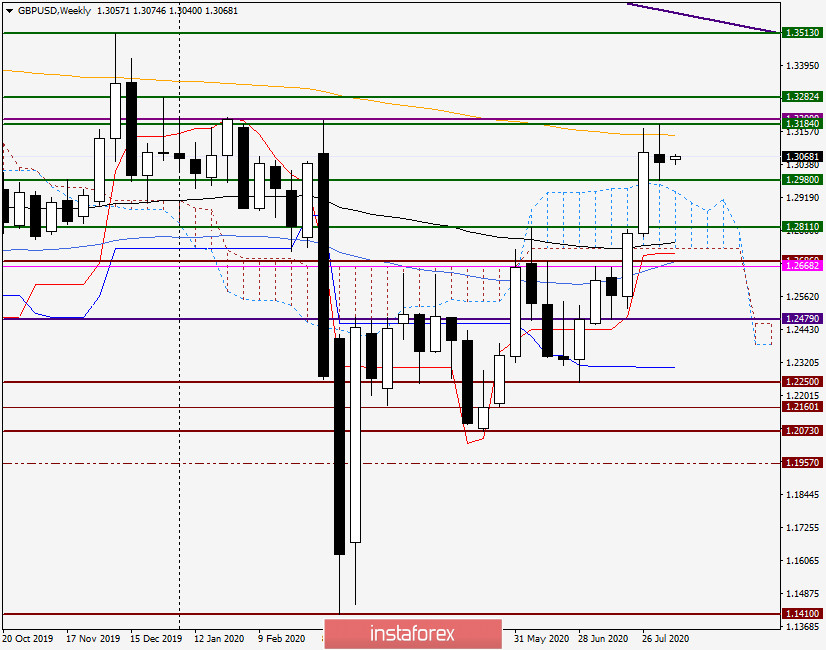

Weekly

As already noted at the beginning of the article, the pound fell in price against the US currency, however, the loss of the "British" was only 0.14%. However, in this case, a much more important factor is the formed weekly candle, which can be considered a "Rickshaw" reversal model. The probability of working out this model of candle analysis increases the presence of a small bearish body, and where exactly this candle appeared. And it appeared after unsuccessful attempts by bulls to break through the 200 exponential moving average (orange) and a strong resistance zone of 1.3170-1.3200, which was repeatedly mentioned in previous reviews of this currency pair. In addition, it must be recognized that the US dollar is quite strongly oversold across a wide range of the market, which implies a high probability of adjustment of the US currency.

However, as usual, we will consider both variants of the GBP/USD price movement that can be implemented this week. The bullish scenario assumes the mandatory absorption of the reversal model of the "Rickshaw" candle analysis, with the closing of trading above 200 EMA and the latest highs at 1.3184. If this week ends above the important and strong level of 1.3200, the bullish sentiment for GBP/USD will further strengthen. In turn, bears on the pair need to update the previous lows at 1.2980 and try to close the trading week within the cloud of the Ichimoku indicator, the upper border of which passes at 1.2940.

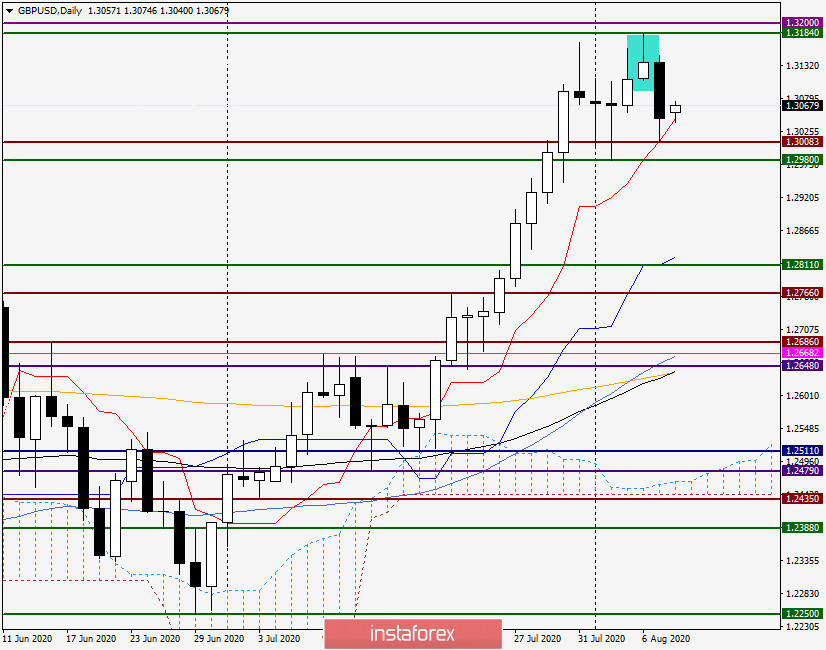

Daily

But on the daily chart, the candle for August 6 signaled the weakness of the bulls in the pound and the inability of players to increase to continue the rise of the exchange rate. In particular, this was indicated by the long upper shadow of the circled candle, which is larger than the bullish body itself. And indeed, the next day the quote turned in the southern direction.

Strong and extremely important support is located in the price zone of 1.3010-1.2980, a true breakout of which can collapse the rate to the area of 1.2830-1.2800. However, the current support is provided by the Tenkan line, from which there are attempts to resume growth.

Conclusion and trading recommendations for GBP/USD:

Given the latest bearish reversal candle on the weekly chart and the likely fall in UK GDP in the second quarter of about 20% due to COVID-19, as well as the overdue correction of the exchange rate, the main trading idea for the pair looks like its sales after rising to the price zone of 1.3090-1.3110. If GBP/USD can gain a foothold above 1.3110, I expect the upward trend to continue towards 1.3180, where it is worth observing the appearance of bearish candle signals, and if there are any, open short positions for the pound.

At the same time, today I do not rule out effective purchases, but with small goals of about 30-40 points, after the pound fell to a strong support area of 1.3050-1.3010. However, even with this positioning, it is better to enlist the support of confirming signals of Japanese candles on the four-hour and (or) hourly charts. Given the lack of important statistics, today's trading will be influenced by technical factors and market sentiment related to risk appetite. But tomorrow at 07:00 London time, data on the UK labor market will be published, which will undoubtedly have a strong impact on the price dynamics of the pound.

Good luck!