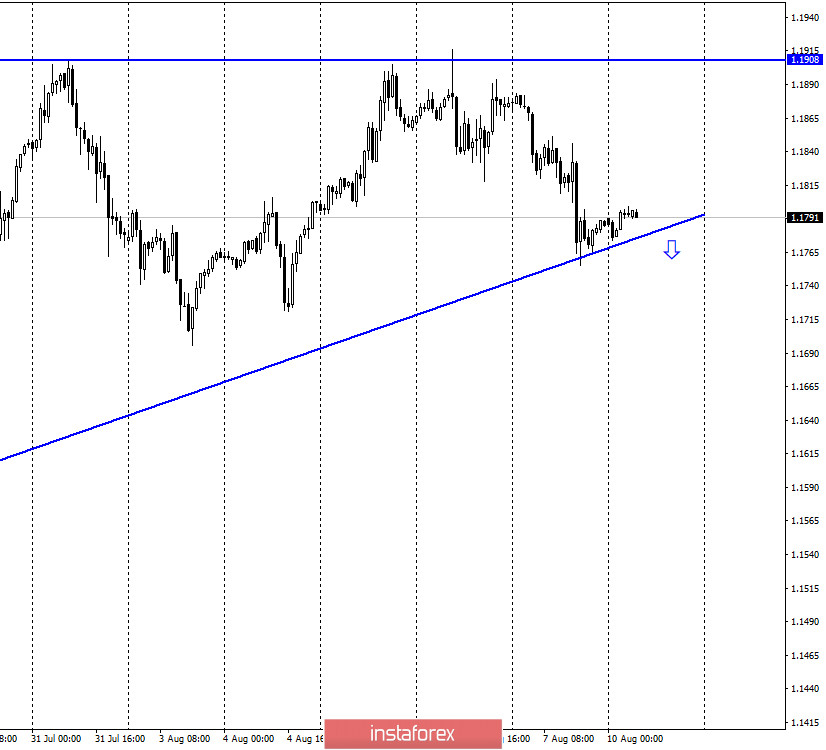

EUR/USD – 1H.

Hello, traders! On August 7, the EUR/USD pair performed a fall to the upward trend line, for the first time in a very long time. And despite the fact that the "bullish" mood of traders remains due to the same trend line, I believe that in the near future there may be a closing of quotes under it, which will allow us to count on a fall in the pair's quotes. On Friday, the US currency was supported by US reports. For the first time in a long period of time (several months), really positive data came from America. The number of new Nonfarm Payrolls jobs was almost 1.7 million, and the unemployment rate fell to 10.2%. Traders expected to see worse indicators. Thus, the American statistics turned out to be a pleasant surprise for them. However, in the coming weeks, everything may return to normal, as the situation with the coronavirus in the United States is not improving, although the country has stopped updating daily anti-records for the number of cases of diseases. Nevertheless, economic indicators may continue to grow for some time, but then there will inevitably be a downturn and a slowdown in economic recovery. Thus, the US dollar got time to go down as far as it can. Because the problems of the dollar in 2020 are clearly not over yet.

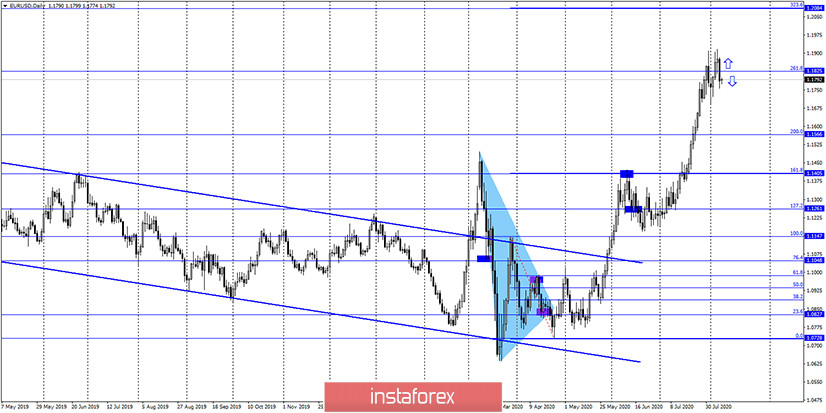

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a new reversal in favor of the US dollar, after the formation of another bearish divergence in the MACD indicator, and almost completed a fall to the corrective level of 127.2% (1.1729). However, the new bullish divergence of the CCI indicator allowed the pair to stop falling and perform a reversal in favor of the European currency. Thus, the growth process can continue today. However, closing the pair's exchange rate under the Fibo level of 127.2% will work in favor of the dollar and continue to fall in the direction of the corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the EUR/USD pair closed under the corrective level of 261.8% (1.1825). Thus, the process of falling can be continued in the direction of the corrective level of 200.0% (1.1566). The two lower charts also cast doubt on further growth, but there are certain obstacles to continuing the decline.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation over the "narrowing triangle", which now allows us to count on further growth of the euro currency, which can be very strong and long-term.

Overview of fundamentals:

On August 7, there were no economic reports in the European Union, and in America – three at once, and all of them are quite important. Unemployment, Nonfarm Payrolls and average wages, all three reports were higher than traders' expectations, so naturally the US currency showed growth on Friday.

News calendar for the United States and the European Union:

On August 10, the calendars of the European Union and America are empty. Thus, the influence of the information background will be absent today.

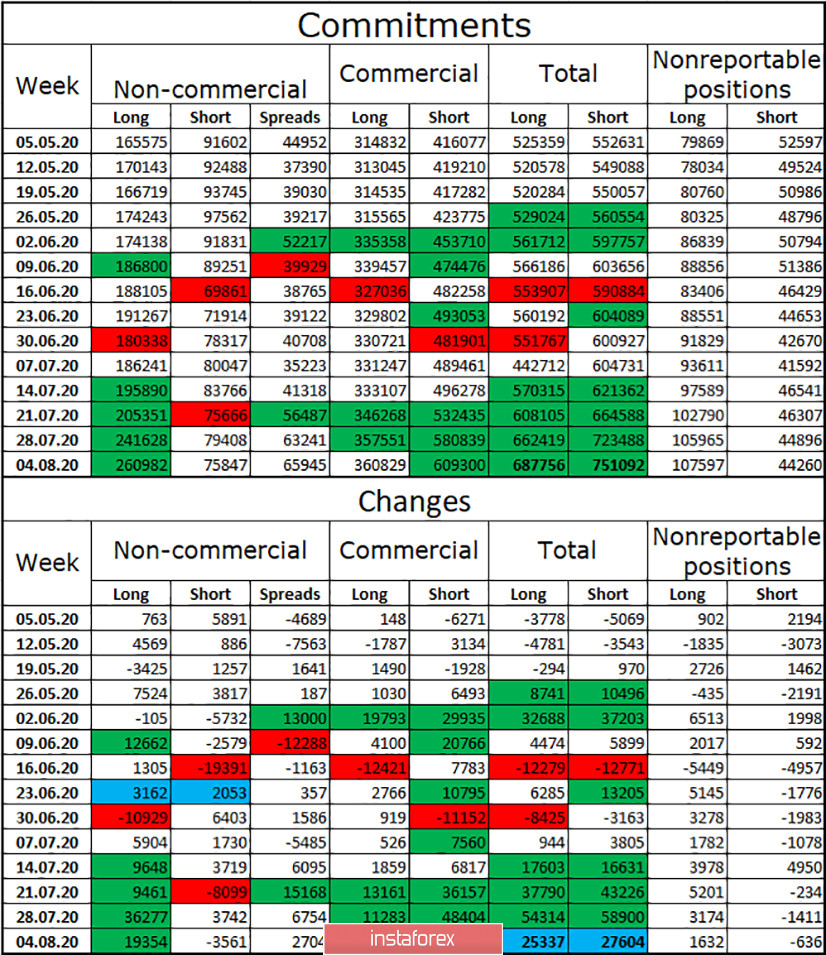

COT (Commitments of Traders) report:

The latest COT report was very predictable. Given the fact that the euro currency continues to grow in general, as indicated, for example, by the trend line on the hourly chart, and so far the dollar is only capable of small corrections, it is obvious that large traders continued to increase long-contracts. During the reporting week, their number increased by 19 thousand. At the same time, the "Non-commercial" group also got rid of short-contracts, thus showing that their mood is becoming even more "bullish". Thus, the advantage of the euro over the dollar remains large, and the advantage of longs over shorts in the hands of speculators remains great. Based on this, it follows that the COT report does not yet give any signals about the possible completion of the growth of the euro currency.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend cautious purchases of the currency pair with a target of 1.2024, if a close above the level of 1.1908 is made. I recommend selling the pair with the target level of 1.1496 if the close is made under the level of 1.1729 or under the upward trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.