The US dollar was under pressure again on Tuesday, albeit not so strong against major currencies. This was due to the high demand for risky assets, which draws significant cash flows from defensive assets. And in our opinion, this is because of the news about certification or the practical start of industrial production of a vaccine against coronavirus infection in Russia. President V. Putin officially announced this on Tuesday.

In addition, of course, the latest news from the United States that the morbidity and mortality curve in America has begun to decline has played a positive role, which, together with the start of production of drugs for COVID-19, will become a strong incentive for the resumption of dollar sales. It can be recalled that not only the improvement in market mood, but also the massive stimulus measures taken earlier from the US Treasury and the Federal reserve make the dollar's supply in the financial system significant and, as a result, reduce its price, turning it into a funding currency.

On Tuesday, data on manufacturing inflation in the United States was published, which unexpectedly rose above the forecast of 0.3% to 0.6% in July, while the indicator declined by 0.2% a month earlier. In annual terms, manufacturing inflation was still in the negative zone, although it slightly grew to -0.4% from -0.8%.

Also yesterday, the figures of the index of economic sentiment and conditions from the ZEW in Germany were released. The sentiment in August rose to 71.5 points from 59.3 points a month earlier, which supported the euro rate, despite the growing negative trend in economic conditions. Here, the indicator dropped in August to -81.3 points from 80.9 points, although it was expected to increase to -68.8 points.

The data from the UK labor market were also not bad, which showed an increase in the number of new jobs to 94,400 in July against a negative increase of 28,100 in June. These data also supported the sterling rate, which has been moving in the wake of the single European currency.

Today, the day will be filled with a large volume of statistics from New Zealand, where the RBNZ meeting on monetary policy will also take place, while Great Britain will publish preliminary GDP values for the 2nd quarter and industrial production and trade balance figures. But all the attention of investors will still be focused on the publication of the values of consumer inflation in the United States. We would like to remind that the monthly value is expected to remain at the level of 0.2% and the annual decline to 1.1% from 1.2%.

It can be assumed that if the data does not turn out to be higher than expected, it will be a negative factor for the dollar rate.

Forecast of the day:

The EUR/USD pair continues to consolidate in the wake of rising yields on US government bonds that support the dollar. Uncertainty about whether there will be new stimuli in the United States on Tuesday put pressure on demand for risky assets and, accordingly, for the pair. We believe that the pair will remain in the range of 1.1700-1.1900 for now and may even grow to its upper border, but if it breaks out of the range, then it is likely to decline to 1.1600.

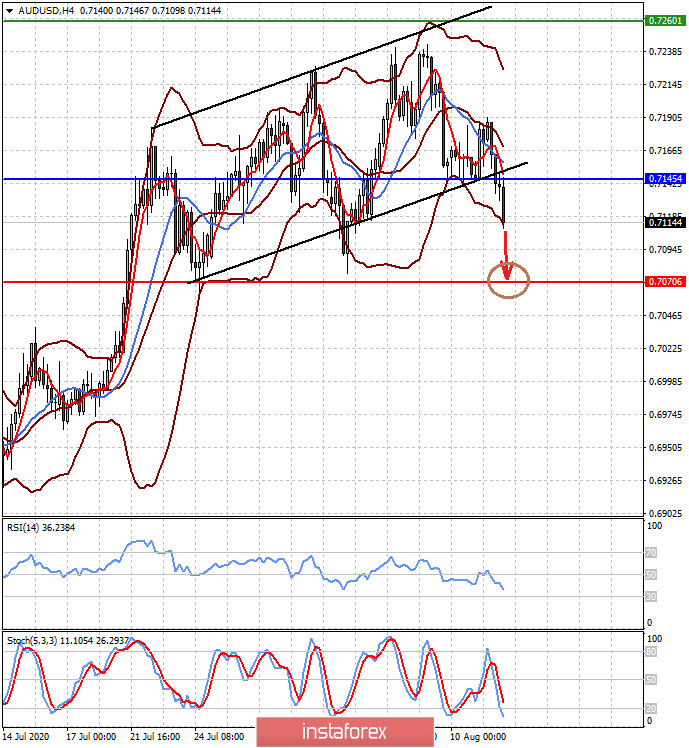

The AUD/USD pair has broken out of a short-term upward trend amid rising tensions between US and China, as well as falling risk appetite in the markets, and it looks like it will test the level of 0.7070 today if this mood continues.