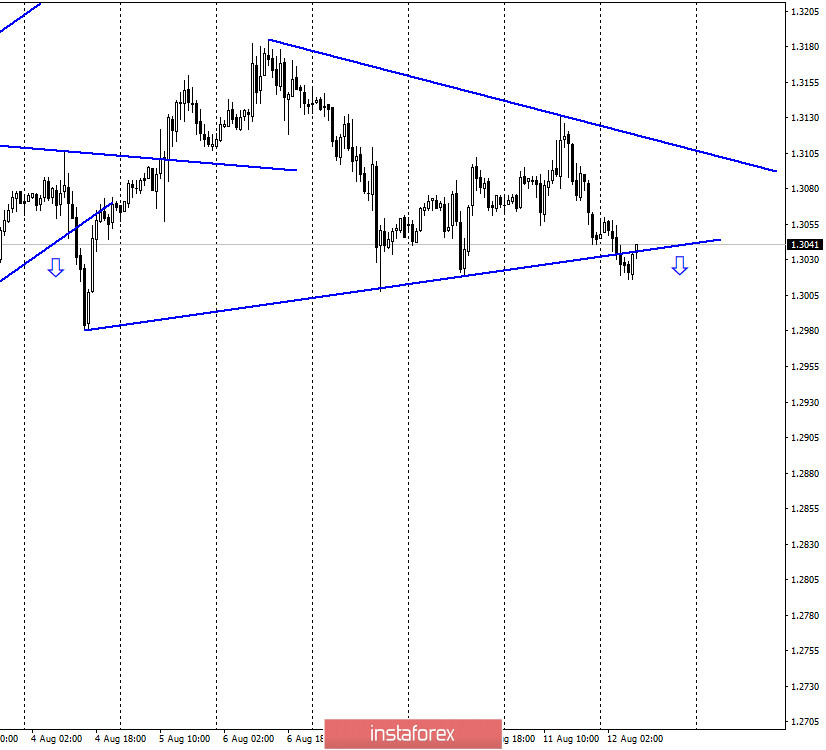

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and anchored under the upward trend line. A new downward trend line is also built in parallel with this line. Both now show the "bearish" mood of traders. Nevertheless, the British pound rose slightly this morning. This is due to slightly less bad GDP data in the second quarter and June than traders expected. According to the Office for National Statistics of the UK, in June, GDP growth was 8.7% (traders expected +8%), and in the second quarter, the fall was 20.4% instead of the expected 20.5%. Industrial production increased by 9.3% in June, instead of the expected 9.2% m/m. Thus, it is not possible to call these reports strong. They are only slightly less bad than traders expected. The Briton received a little support after their publication, however, it is unlikely that it will go far up on this data. So far, everything is going to the point that the period of growth for the British is over. There has been no openly bad news from America in recent days, which gives hope for further growth of this currency. The situation with the coronavirus also seems to be improving in America, and in the world - it is beginning to deteriorate again, thanks to which the dollar can now receive additional support.

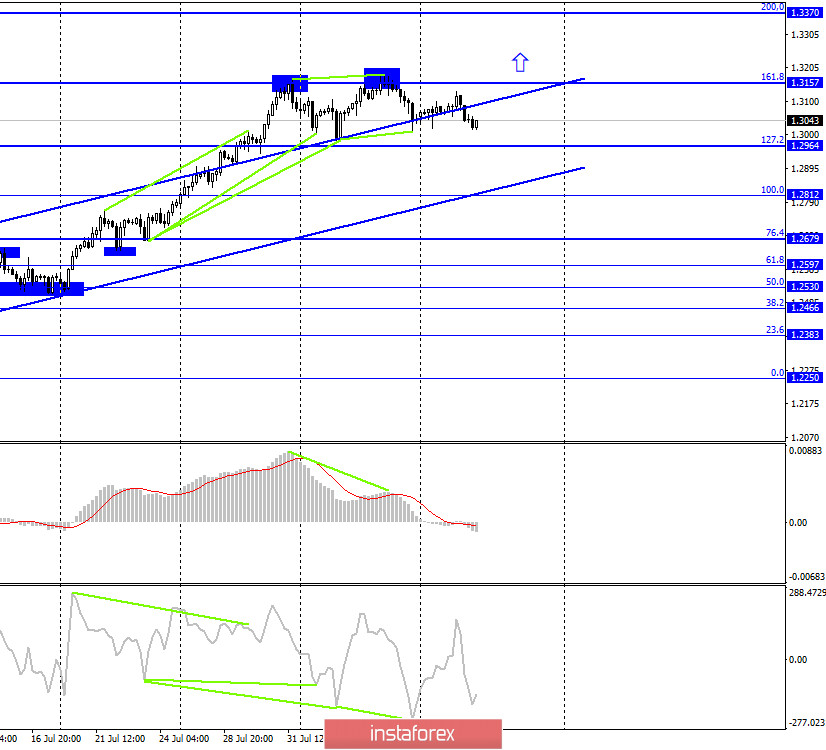

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and resumed the process of falling towards the corrective level of 127.2% (1.2964). Today, this process can be helped by weak economic reports from Britain. Closing the pair's rate at 127.2% will increase the chances of a further fall towards the next corrective level of 100.0% (1.2812). No new emerging divergences are observed in any indicator today.

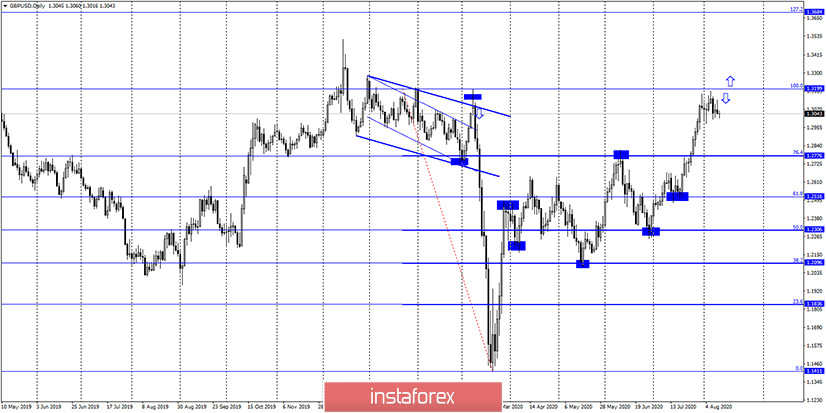

GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.3199), however, the level of 161.8% on the 4-hour chart stopped the pair's growth. Closing the rate above the 100.0% level will work in favor of further growth in the direction of the Fibo level of 127.2% (1.3684).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the lower downward trend line. A pullback from this line may allow the pair to perform a reversal in favor of the US dollar and resume the process of falling towards the approximately 1.1500 level. This is a long-term perspective.

Overview of fundamentals:

There was no economic news in the UK or the US on Tuesday. Thus, the information background did not affect traders.

The economic calendar for the US and the UK:

UK - change in GDP (06:00 GMT).

UK - change in industrial production (06:00 GMT).

US - consumer price index (12:30 GMT).

On August 12, traders can only wait for the report on inflation in America. If it does not turn out to be extremely weak, I would say that the dollar today has an excellent chance of continuing to grow.

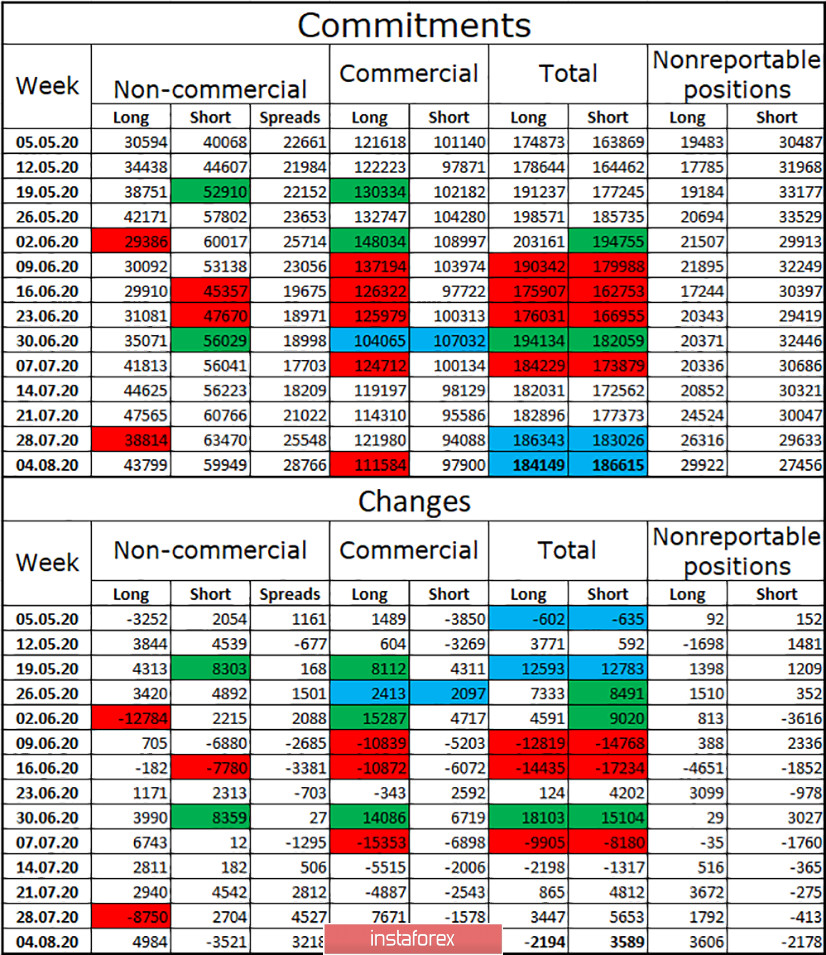

COT (Commitments of Traders) report:

The latest COT report on the pound was again quite unexpected. Let me remind you that in the last two weeks, speculators either got rid of long contracts or opened more short contracts. That is, according to the logic of things, the Briton should have started falling two weeks ago. However, instead, the growth of its quotes continued. A new COT report showed that a group of "Non-commercial" traders has started to re-open long contracts. However, the previous two weeks can't be crossed out just like that. Despite the fact that speculators have again begun to favor the British, I still doubt its prospects. On the other hand, if the information background from America deteriorates, the fall of the dollar may well resume.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2964 and 1.2812, if the close is made under the low divergence on the 4-hour chart and under the new trend line on the hourly chart. I recommend buying the British currency again if the quotes close above the level of 1.3157 with the goals of 1.3200 – 1.3250.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.