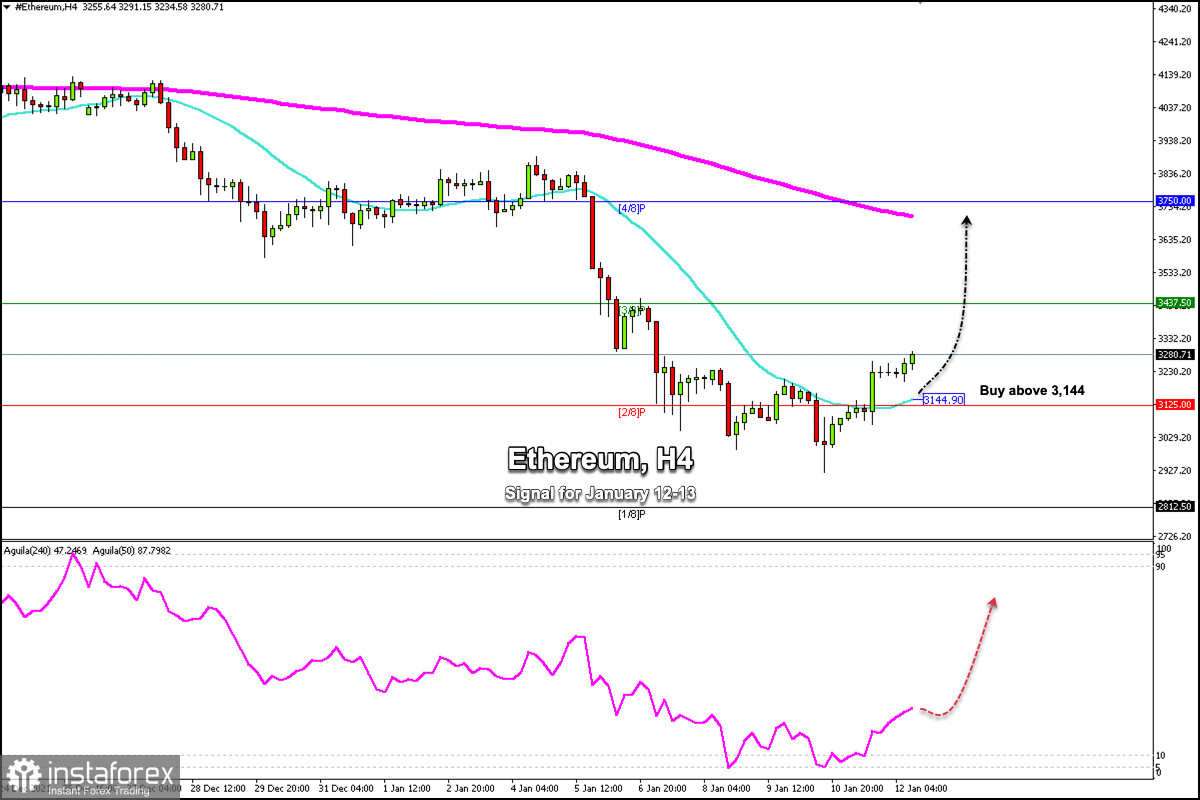

On January 10, Ether reached the low of 2,920 at the same price levels of September 30, 2021. From this level, it is recovering and is now located above 2/8 Murray and above the SMA of 21 located at 3,144.

Given that Ether is now giving a positive signal, as long as it remains above the 2/8 Murray located at 3,125, we could expect a recovery of ETH / USD towards the zone of the 200 EMA located at 3,690 and up to 4/8 of Murray in 3,750.

Market participants can expect an increase in the volume of purchases. This could give momentum and the price could consolidate above the 200 EMA and thus rise to the psychological level of 4,000 that coincides with 5/8 Murray (4,062.50).

The eagle indicator has left the oversold zone after breaking the 5-point level. Now it is giving a positive signal for Ether. The price is likely to reach the key level of 3,750 in the next few days.

Our trading plan for the next few hours is to buy above 2/8 Murray around 3,125 with targets at 3,437 (3/8) and 3,750 (4/8).

If Ether falls back below the key level of 21 SMA, we should be careful and expect a technical bounce around the psychological level of 3,000. A technical bounce around this support level between 2,920 - 3,000 could be an opportunity to buy back Ether.

Support and Resistance Levels for January 12 - 13, 2022

Resistance (3) 3,521

Resistance (2) 3,437

Resistance (1) 3,307

----------------------------

Support (1) 3,125

Support (2) 2,964

Support (3) 2,819

***********************************************************

Scenario

Timeframe H4

Recommendation: buy above

Entry Point 3,144

Take Profit 3,437 (3/8), 3,700 (200 EMA)

Stop Loss 3,050

Murray Levels 3,125 (2/8) 3,437 (3/8) 3,750 (4/8)

***********************************************************