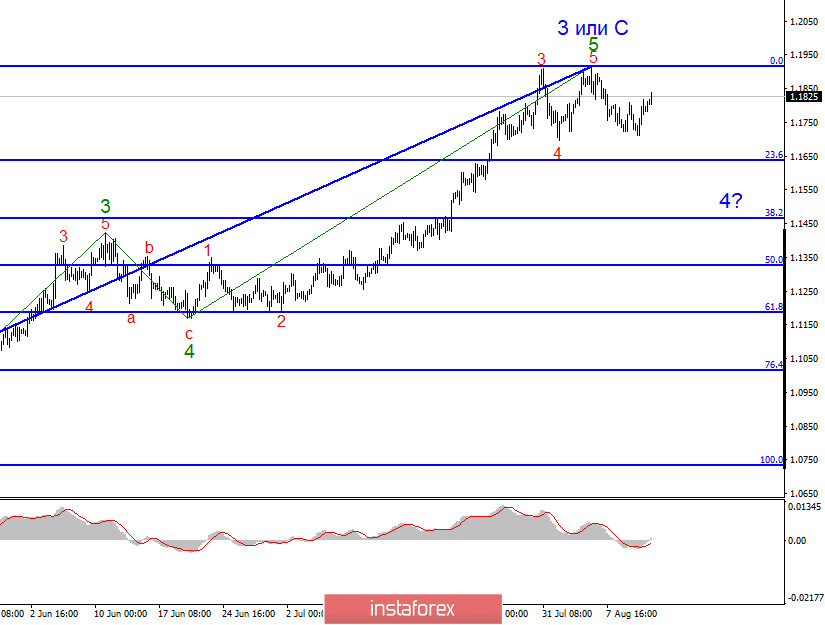

The overall picture of an upward wave series, which started on March 20, looks rather convincing. The first three waves have been already completed. Now it is unclear whether there will be some obstacles for waves 4 and 5 to develop. If yes, 0.0% Fibonacci correction could be broken successfully. It will indicate that the market is ready for more long EUR deals. I'd like to stress that correctional wave 4 is needed before we will see a further uptrend. Meanwhile, correctional wave 4, which is taking shape after August 6, has not been able to pass the lows of wave 4 inside wave 5 inside wave 3 or C. To sum up, I'm anticipating another downward wave.

Looking at the current wave structure in details, it is clear that correction against wave 3 or C is lower than 23.6%. The whole wave 4 should consist of a 3-level structure. If the uptrend period is over, EUR/USD will reverse downwards after the price retraces from the lows of August 12 within a new series of downward waves.

The information background yesterday was full of events. Nevertheless, the market took little notice of some economic data. A report on the eurozone's industrial production turned out to be worse than expected. Curiously, demand for the single European currency was buoyant for the whole day. Later, inflation data from the US surpassed expectations. However, investors were poised to buy the euro even following the upbeat CPI report. Therefore, putting the ongoing wave structure aside, market sentiment on the US dollar remains sour. Lately, the US economy has been stuck in dire straits. The worst trouble is that the US GDP shrank 33% in Q2 2020. On the other hand, experts find out the green shoots of recovery in the US economy. Oddly enough, this does not encourage investors. How come?

Perhaps, the problem is uncertain prospects in the US. The presidential elections will be held in nearly three months. It seems that investors are mostly worried about the political future in the top global economy. With Donald Trump at the helm, the country is stricken by high unemployment, the economic downturn, the trade war with China, and conflicts with some other countries. Besides, Congress has been rattled with feuds between Republicans and Democrats for 4 years straight. To be more exact, Donald Trump has to forge ahead with his ideas confronting the Democrats. One thing is obvious. No one dares to predict the outcome of the elections. In the meantime, investors are cautious about long deals on the US dollar. The coronavirus pandemic adds fuel to the fire as the US President and Congress have failed this challenge with their inefficient measures.

Today on August 13, Germany reported on its consumer inflation. The HICP came out at 0.0% in annual terms in July. In other words, consumer prices in Germany stand flat from July 2019. This zero inflation is no good for the economy. Interestingly, the euro is still enjoying demand in the European session today.

Conclusions and trading tips

Supposedly, EUR/USD has completed the upward wave C inside B. In the meantime, I don't recommend opening new long deals on this currency pair. It would be better to close current deals at least until 0.0% Fibonacci correction is broken successfully. Besides, you could consider short deals on EUR/USD with the following targets: 1.1634 and 1.1465 that is 23.6% and 38.2% Fibonacci correction under MACD signals downwards.