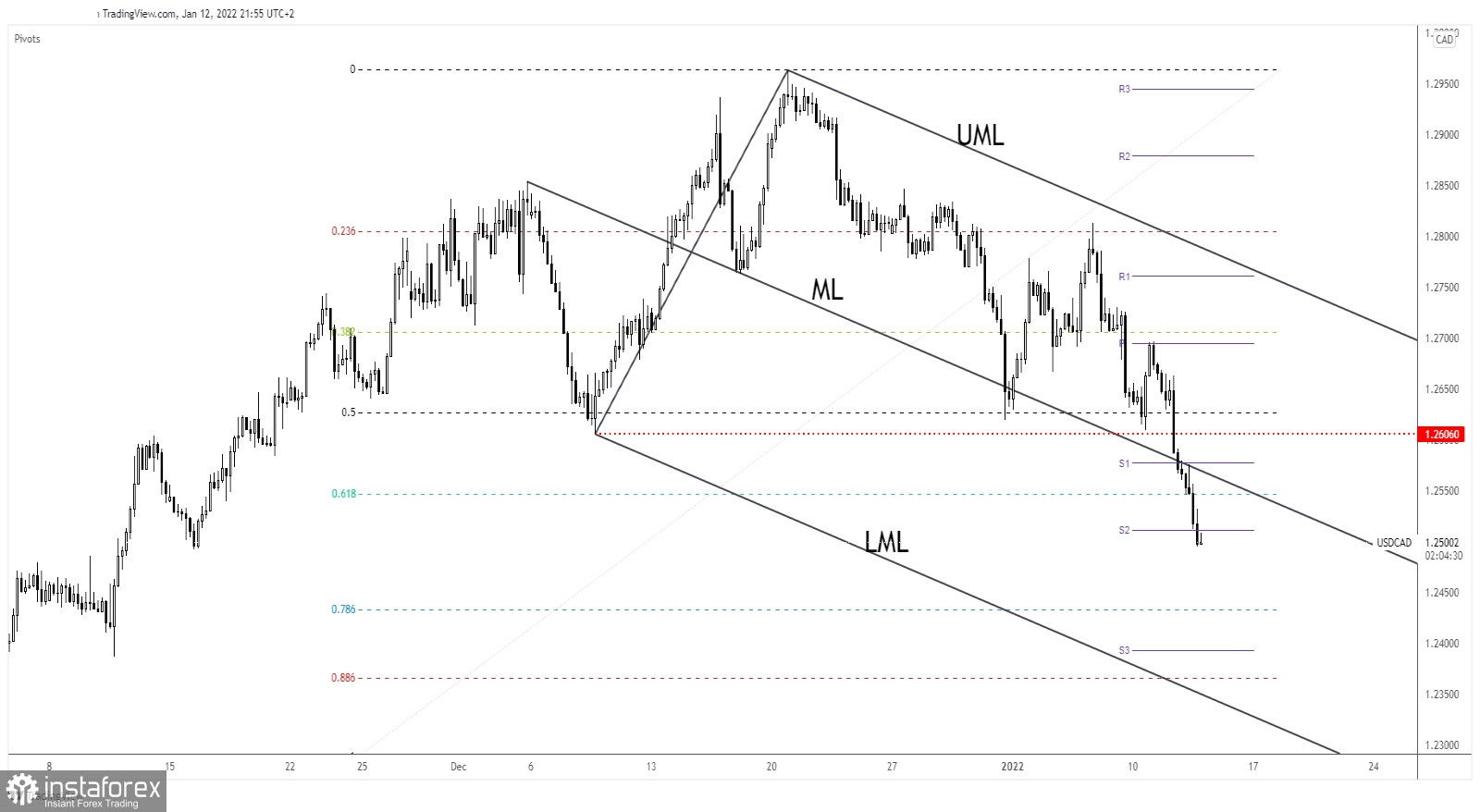

The USD/CAD pair plunged as the Dollar Index has registered a strong sell-off. The currency pair activated a major reversal pattern, a Head & Shoulders formation, so more declines are possible. In the short term, the pressure is high as the DXY failed to make new highs or to stay higher.

The price extended its sell-off after the US inflation data publication. The CPI rose by 0.5% versus 0.4% expected, while the Core CPI registered a 0.6% growth versus 0.5% estimates. Higher than expected inflation reported by the US in December is not good for the currency. The inflationary pressure is bad for the economy.

USD/CAD larger correction

The breakdown below the 1.2606 and through the Descending Pitchfork's median line (ML) activated a major Head & Shoulders pattern. The price retested the broken median line (ML) before taking out also the 61.8% retracement level.

At the time of writing, it was traded at 1.2507 level right below the weekly S2 (1.2512) broken downside obstacle. As long as it's trapped below the Descending Pitchfork's median line (ML), the price could approach and reach fresh new lows.

USD/CAD forecast

The major Head & Shoulder pattern indicates a larger downside movement. A temporary rebound could help the sellers to catch new short opportunities. After its amazing sell-off, a temporary bounce back is favored. The bias remains bearish as long as it stays under the median line (ML). The Descending Pitchfork's lower median line (LML) is seen as a major downside target.