4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 66.8115

The EUR/USD currency pair on the penultimate trading day of the week continued to move Wednesday, that is, an upward movement. However, all these movements occur within the side channel 1.17-1.19, which we have already discussed in previous articles. By and large, now there is a classic situation "some can't, others don't want to". The bears now simply do not have the strength, desire and reason to sell the pair. The US dollar looks extremely shaky, as does the US economy, which lost a record 33% in the second quarter. Much more than any country in the European Union and the EU as a whole. Thus, for simple economic reasons, the US dollar does not look attractive from the point of view of investment. Moreover, the American economy does not look attractive either. As we said, it lost 33% in the second quarter, but how quickly it will recover is unknown. Naturally, the President of the country, Donald Trump, has already declared a "Golden age", which the country will enter very soon, hinting at his own re-election in order for this "Golden age" to come. However, Trump has been misled more than 20,000 times during his 4 years in office. To make unfounded, unsubstantiated, absurd statements to the President of the United States - business as usual, boring Monday. Thus, there is simply no trust in his words. But there is confidence in the words of Anthony Fauci, who says that the "coronavirus" epidemic has become uncontrolled. There is confidence in Jerome Powell, who says that the economic recovery will be long and very difficult, and also notes that much will depend on the results of the fight against the "coronavirus". And there is trust in Joe Biden, who has not yet been caught in a lie or made absurd statements. And, as you know, Joe Biden believes that after Donald Trump, America will have to be restored. In principle, this is true. Because it was under Trump that the US entered the most severe crisis since the Great Depression. Trump offers his voters, roughly speaking, to give him a second chance and allow him to restore everything that collapsed under him. Why would the Americans do that? After all, for example, the EU economy, which experienced the same crisis, went through the same pandemic, lost only 12% in the second quarter, and the virus itself was localized. Yes, there are new outbreaks in some European countries, such as in France or Spain. However, in the United States, even the first wave has not yet ended, and the number of daily recorded cases of diseases is off the scale even now, when the epidemic is on the wane. Thus, American voters can ask Trump, who is just famous for his work with the economy, why the EU lost 12% of GDP, and America – 33%? Almost three times as much? Based on these considerations, we continue to believe that the topic of "coronavirus" and the topic of elections are now the two main topics for America and the US currency.

Meanwhile, no sooner did we write in yesterday's article that Joe Biden made a great "horse move" by appointing Kamala Harris as his Vice-President, than the British newspaper The Guardian wrote about it. In her opinion, this choice of Biden will help him get a lot of new votes in the election. Journalists of the British tabloid believe that at the time of the mass social movement "Black Lives Matter" it is the arrival of a black politician to power that can help ease the tension that has arisen between people of different nationalities and skin color. Now women can vote for Biden, black Americans who previously did not want to vote for him. Trump, who was accused more recently of racism, who during his reign several times publicly insulted women (speaker of the House of Representatives Nancy Pelosi, journalists who asked him uncomfortable questions), is clearly not popular among the beautiful half of the population, as well as among the black population. This is the situation obtained 2.5 months before the election in the United States.

As for traders of the EUR/USD pair, they are waiting. They are waiting for the situation to clear up, waiting for new major players to enter the currency market, waiting for a change in the mood of major traders, waiting for new high-profile news and events. As we found out during the previous weeks, ordinary reports like inflation or even GDP are not enough for traders to take the pair out of the formed side channel of 1.17-1.19. Thus, tomorrow's publication of Eurozone GDP for the second quarter, which may result in a fall of 15% in annual terms and 12.1% in quarterly terms, is unlikely to help the European currency in principle, and even more so to get the pair out of the flat. Several relatively important reports will also be published in America, but they are unlikely to help traders leave the side channel. Retail sales in the United States in July may grow by 1.9%, and industrial production - by 3%. We believe that a strong reaction from private market participants will follow only if the actual values of these reports differ significantly from the forecast ones.

From a technical point of view, the euro/dollar pair reached the upper area of the side channel. Thus, around the 1.19 level, we expect the price to turn down and fall further. Yes, after overcoming the previous two local highs (1.1911), the upward movement may continue with renewed vigor, but we recommend that traders buy the euro very carefully in this case, since buying a currency near its two-year peaks is quite a dangerous occupation. The main thing is not to forget about security and set stop-loss. We remind you that in addition to the fact that the European economy lost much less during the crisis than the American one, the euro currency no longer has any trumps. Recall that the ECB rates remain negative for a long time and even after the Fed lowered its rates, they still remain more "dovish" in Europe. Moreover, traders have been engaged in the past three months in exactly the same way that they worked out the strong fall in the US economy and the relentless COVID-2019 pandemic. The currency cannot constantly grow on the same factors, otherwise the British pound would already be near price parity with the dollar due to Brexit.

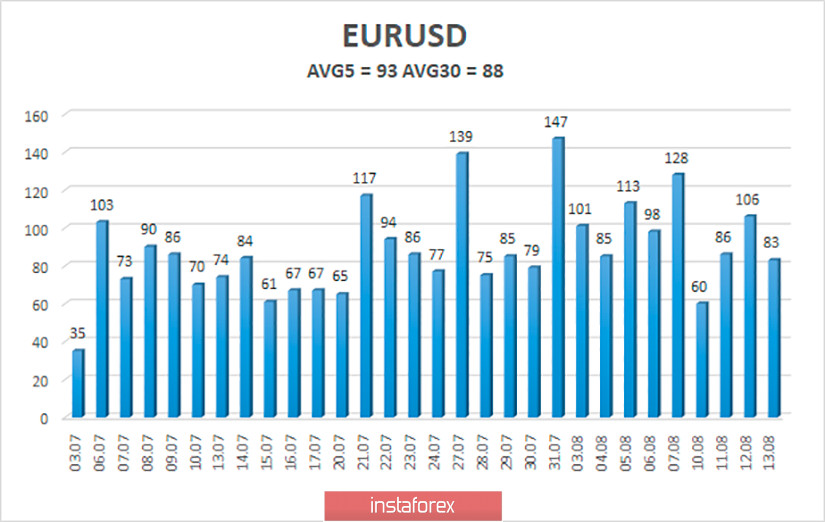

The volatility of the euro/dollar currency pair as of August 14 is 93 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1723 and 1.1909. The reversal of the Heiken Ashi indicator downwards signals a turn of the downward movement within the side channel of 1.1719 – 1.1911.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

Trading recommendations:

The EUR/USD pair continues to trade near the sideways moving average, which indicates a flat. Thus, at this time, it is recommended to either trade between the borders of the side channel based on the signals of the Heiken Ashi indicator, or wait for the end of the flat and the resumption of the trend movement.