Market participants continue to behave inappropriately in many ways, thereby only making things worse. The market is already very overheated, and the dollar is catastrophically oversold. Even good US data can't bring market participants to their senses. We watched the single European currency steadily go up for almost the entire day. It took some time for market participants to realize that something was wrong and that the US data were much better than the forecasts. And from all this it follows that the risks only tend to increase, and when it reaches investors that something is going wrong, the euro's collapse will be catastrophic. Yes, such that it will also contradict common sense.

Speaking directly about US data, they really turned out to be significantly better than forecasts. The number of initial applications for unemployment benefits, which should have been reduced from 1,191,000 to 1,150,000, has decreased to 963,000.The number of initial applications dropped below one million for the first time since March, which can be regarded as an extremely positive factor. In addition, the number of repeated applications for unemployment benefits fell from 16,090,000 to 15,486,000. A decrease to 15,800,000 was expected. So, there is a clear trend towards the recovery of the labor market and also at a faster pace than expected. However, this had little impact on the market. After all, at least some kind of pullback began only a couple of hours after data on applications for unemployment benefits was released. Yes, and it is difficult to call it a pullback, since they were able to win back only half of the euro's daily growth.

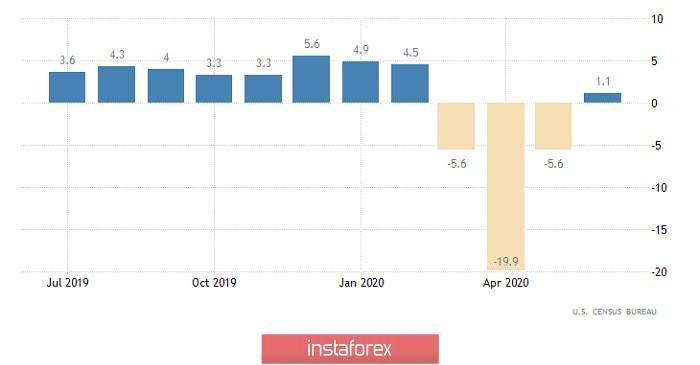

Repetitive Unemployment Insurance Claims (United States):

Apparently, investors are not yet very concerned about US data. More precisely, it is not really taken into account. Most likely, we are talking about investor concern regarding the results of the upcoming presidential elections, since a radical restructuring of the economic policy of the United States after them is possible. And such drastic steps are not particularly encouraging for investors. Moreover, they really do not yet understand what to expect. In this regard, European data are gaining much greater weight. However, it will not help much today, since only the second estimate of the euro area GDP for the second quarter will be published. And it should coincide with the first estimate, which showed an acceleration in the rate of economic decline from -3.1% to -15.0%. In many ways, the market has already taken into account such a significant acceleration in the decline. In addition, it must be admitted that the scale of the economic recession in Europe is much less than in the United States. So even if some kind of reaction to this data follows, it will be insignificant. And it won't last long.

GDP growth rates (Europe):

Most likely, US data, which have been significantly better than forecasts for several consecutive days, will not be able to change the general attitude towards strengthening the euro further. But the growth rate of retail sales should accelerate from 1.1% to 1.9%. There is an increase in employment, inflation, and consumer activity in the United States. This is just wonderful. But so far it hasn't helped the dollar. In all fairness, retail sales weigh less than inflation or the labor market. And since they failed to change the situation, then retail sales are unlikely to succeed.

Retail Sales (United States):

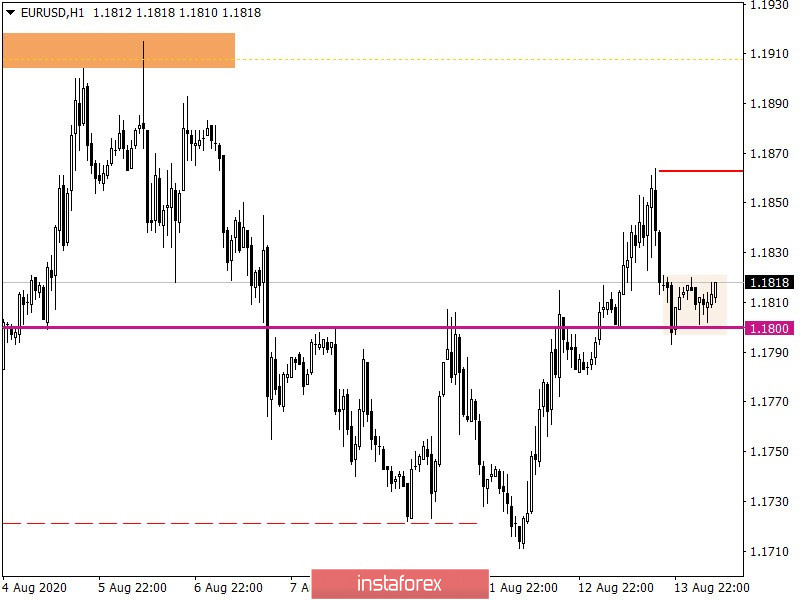

The euro/dollar pair continues to move along the trajectory of the side channel of 1.1700/1.1900, where this time the quote managed to jump to the 1.1865 area, but then there was a reverse surge, returning us to the area of the average level of 1.1800, which is where it all started.

Relative to market volatility, high indicators are recorded, even though we have been following the flat amplitude for almost a month. This factor indicates the prevailing speculative interest, where even without the information and news background, there may be a surge in activity.

We can assume that the stagnation in the 1.1795/1.1820 range has a short-term form, where you can expect a local surge in activity when the European session begins, which can be earned. The most optimal tactic is considered to be the method of breaking the established boundaries.

We will specify all of the above into trading signals:

- We consider long positions if the price settles higher than 1.1825, with the prospect of a move to 1.1165.

- Short positions are considered if the price settles below 1.1790, with the prospect of a move to 1.1770-1.1730.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments at minute and hour intervals signal a purchase by consolidating the price above the average level of 1.1800. The daily indicator still signals a purchase due to the general direction.