The EUR/USD currency pair has been following the amplitude of the side channel 1.1700 // 1.1810 // 1.1910, (6 + 5 + 4, lines) for the third week now and consistently working out the set boundaries. This time, the quote managed to consolidate above line 5 (area 1.1810), moving us to the upper part of the channel 1.1810/1.1910.

Based on the price fixing points with respect to the side channel, a number of possible market development scenarios can be obtained:

First, following the price towards line No. 4

In this case, we consider the price movement along the course of the upper part of the side channel 1.1810/1.1910, where line No. 5 plays the role of a support, which makes it possible to complete the cycle by touching the upper border of the channel. The entry point for a buy position is above the high of the previous day at 1.1864, which will give an opportunity to enter the market directly at the moment of the main movement.

Second, the price returns to the bottom of the channel.

In this case, the swing cycle between lines no. 5 and no. 6 resumes, where the quote consolidates below the level of 1.1750 first, and then goes towards 1.1720-1.1700

Third, breakdown of line No. 4 or No. 6

In this case, we are talking about the completion of the amplitude of the side channel 1.1700 // 1.1810 // 1.1910, where the main strategy is aimed at identifying price fixing points outside one or another border, which will make it possible to predict the further course of the market.

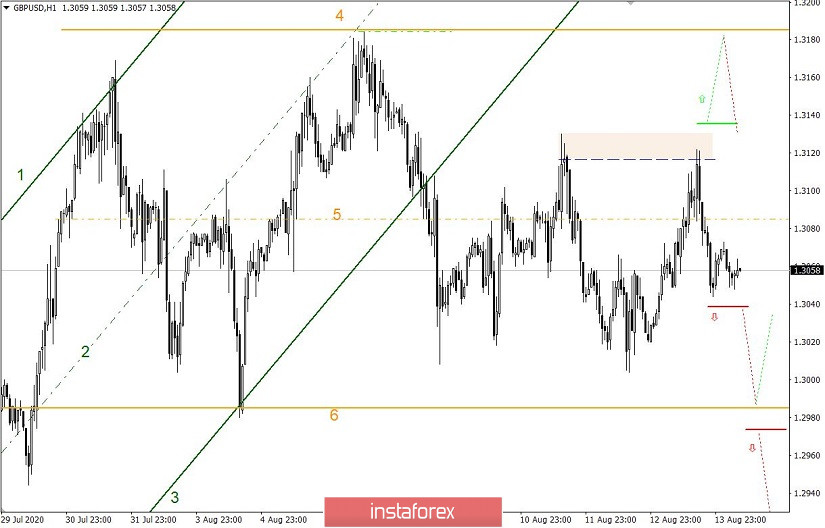

The GBP/USD currency pair has a similar cycle of sideways fluctuations within the boundaries of 1.2985 // 1.3085 // 1.3185 (# 6; 5; 4), where market participants managed to locally jump to the area of the current week's maximum (1.3115 / 1.3130) during the previous day. The area of the maximum played the role of resistance, returning the quote below the centerline of 1.3085 (# 5).

Based on the fact that the quote returned below line 5, we can consider the option of short positions (sell positions), resuming the swing cycle in the lower part of the sideways range.

Market development scenario:

First, price fluctuations at the bottom of the sideways range, lines No. 5 and No. 6

In this case, we consider the price movement along the course of the lower part of the sideways range, as it happened from the very beginning of the trading week. The point for entering sell positions is considered below the level of 1.3040, in the direction of 1.3010-1.3000.

Second, consolidating the price above the high of the current week

In this case, an upward move is considered, where the quote first needs to consolidate above the level of 1.3130, which may lead to a subsequent movement to line No. 4 (1.3185 area).

Third, breakdown of line No. 4 or No. 6

In this case, we are talking about the completion of the amplitude of the side channel 1.2985 // 1.3085 // 1.3185, where the main strategy is aimed at identifying price fixing points outside a particular border, which will make it possible to predict the further course of the market.