It would seem that when speculative net shorts for the dollar and net longs for the euro have reached local highs, technical indicators signal overbought, and macro statistics for the United States are pleasing to the eye, it is time to think about the correction of EUR/USD. Nevertheless, investors' confidence that the main currency pair will reach 1.25 in 2021 makes them use the slightest pullbacks to form long positions.

The second week of August started very well for the US dollar: thanks to the growth of Treasury bond yields in the run-up to auctions, the US currency seemed to be rising from its knees. Indeed, the collapse of stock indices in March and the subsequent large-scale monetary expansion of the Fed pressed the debt market rates to the very bottom. It is time for their growth on the background of positive data on the labor market, business activity and retail sales. Gold and the entire precious metals sector suffered the most. Moreover, judging by the dynamics of global purchasing managers' indices, the yield on US Treasury bonds is too low and simply must go north. If this happens, the dollar will have a strong argument to strengthen its position.

Dynamics of business activity and US bond yields

However, the topic of divergence in the economic growth of the United States and the Eurozone, as well as problems with the expansion of fiscal stimulus by the US Congress, faithfully serve euro fans. "Bulls" for EUR/USD have armed themselves with such drivers as the diversification of gold and foreign exchange reserves by central banks and the inflow of capital to the securities markets of the Old World. The US cannot solve the issue of increasing aid to the economy. Democrats are starting to bargain with the amount of $ 2 trillion, Donald Trump calls this figure ridiculous and unnecessary. As a result, recent employment gains may remain in the past, which will pull down the US dollar.

As for the talks between Washington and Beijing on August 15, during which a six-month assessment of the deal concluded in early 2020 to increase China's purchases of goods in the United States will be made, I personally do not expect a resumption of the trade war. Donald Trump doesn't need this in the run-up to the election. Joe Biden already blames him for the failure of the policy with China, and the new tariffs will be proof of the fiasco of the owner of the White House. At the same time, stock indices may collapse, which the current government does not want to allow.

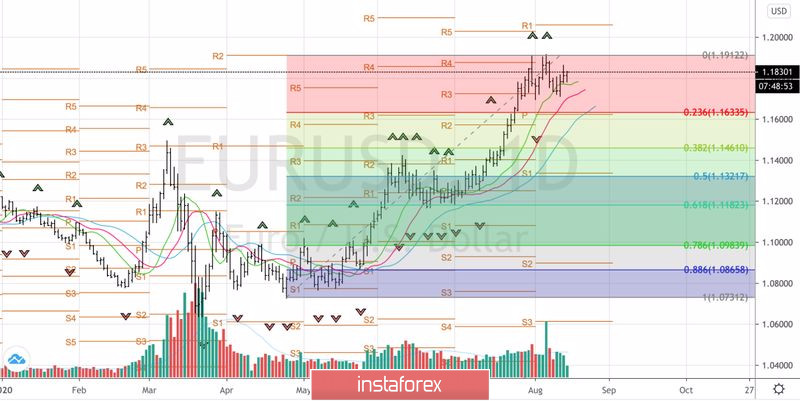

Thus, despite the fact that the economic calendar of the third week of August includes the publication of the minutes of the fed and ECB meetings, the main event of the five-day period is the release of data on German and European business activity. If the Eurozone continues to recover quickly, the EUR/USD bulls will have a great opportunity to increase their longs. The best way to do this is to break through the resistance at 1.188. In the opposite case, the pair risks falling into consolidation, and the growth in US Treasury bond yields will allow short-term selling of the euro in case of a successful support storm at 1.171.

EUR/USD, the daily chart