There has been a real battle in the currency market between the two main directions of the likely development of events over the past week. On the one hand, the tensions between China and the United States that have not disappeared anywhere, and the situation with the pandemic in the United States provide some support to the exchange rate of the US currency in relation to the main ones. This event forced the quotes of gold, which has not yet been able to hold above the $ 2,000 per ounce mark, to decline.

It seems that the dollar has not yet completely lost its influence as a safe-haven currency, but this feature will definitely weake, which is clearly indicated by its negative dynamics amid positive economic data from the United States. It can be said that there is a fairly transparent and unambiguous trend in the currency market - an increase in negative market mood caused by weak economic data and tensions between the United States and China, as well as the impact of coronavirus infection – this is a factor in full support of the dollar exchange rate as a safe haven currency. At the same time, the release of positive economic statistics in America weakened fears of economic recovery in the country and supported investors' interest in buying risky assets. In this case, the dollar is under pressure. And here are two factors, as they are called, fighting with each other, finding themselves on the global world scales.

The rate of one of them over the other currently leads to the strengthening of the dollar, then, on the contrary, to its weakening. That is why we are seeing in the market as a whole the sideways dynamics of the dollar index, but gradually tending to decline. We believe that this trend will not only continue in the short-term, but will also dominate until the end of this year.

We expect that as the US economy recovers, investors will increasingly consider the factor weakening the dollar, the most important of which are unprecedented stimulus measures from both the Treasury and the Federal Reserve, which strengthen the dollar supply in the financial system, making it massive, which actually "makes it cheaper" against other currencies, of course, primarily the main ones.

We believe that the general weakening of the dollar will continue this week. Any positive news on the US economy, for example, on the start of production of vaccines against coronaviru or good economic statistics, will stimulate an increase in demand for risky assets, while weakening the US currency.

We believe that the Swiss franc, Australian and Canadian dollars will have good prospects for growth against the dollar. The yen, however, is likely to continue to weaken against the dollar. Euro and sterling will also tend to grow, supported by the recovery of the British and European economies.

Forecast of the day:

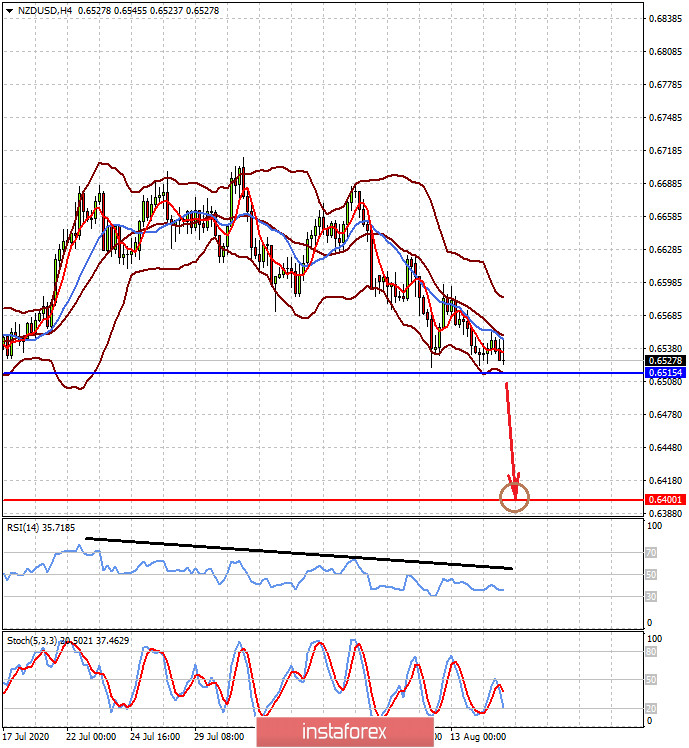

The NZD/USD pair is trading above the support level of 0.6515. The pair before publication of the minutes of the last meeting of the RBNZ, as well as tensions between the US and China, may decline to 0.6400 if it breaks through this level.

The USD/CAD pair remains in a short-term downward trend. In the wake of a limited recovery in oil prices within the general sideways trend, it may not continue to decline to 1.3150, if it breaks through the level of 1.3235.