The CFTC report was similar to a report a week ago in many ways. The euro is still being bought, the cumulative long position on which has reached 29.313 billion, the Swiss franc, which from the point of view of speculative positioning looks preferable to the yen as a defensive asset, is still being bought. Meanwhile, the net long position in gold has declined by 5.371 billion, which may indicate the formation of the top, and on the overdue strengthening of the dollar.

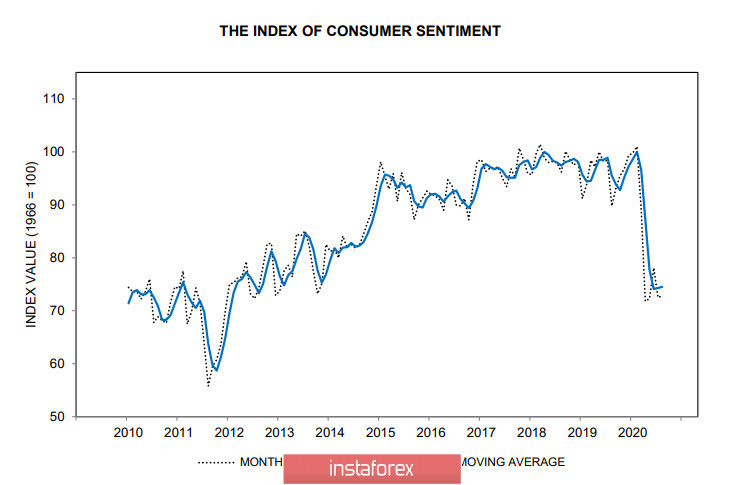

The latest macroeconomic reports from the United States look quite convincing. The number of applications for unemployment benefits was lower than forecast, and the growth in retail sales was higher. The consumer confidence index from the University of Michigan came out better than forecast, which gives hope for the formation of a local minimum and subsequent recovery.

The July industrial production report was significantly better than forecasted, which generally confirms the fairness of the estimates in the ISM survey, while the decline in commercial inventories also indicates growing demand.

In general, the US economy looks quite convincing ahead of the publication of the minutes of the Fed meeting on July 29. The market is currently focused on assessing the prospects for additional monetary stimulus, which may be introduced at the next FOMC meeting on September 16, and forecasts largely depend on the dynamics of the recovery in consumer demand. As recent reports show, demand is recovering rather quickly, which gives the Fed additional space ahead of the presidential elections.

The recovery in consumer demand reduces the probability of new stimulus, which, in turn, will affect the volume of provided dollar liquidity. The change in the liquidity flow will, in turn, have a decisive effect on the dollar rate, and at the moment, the signs of its imminent strengthening look more and more obvious.

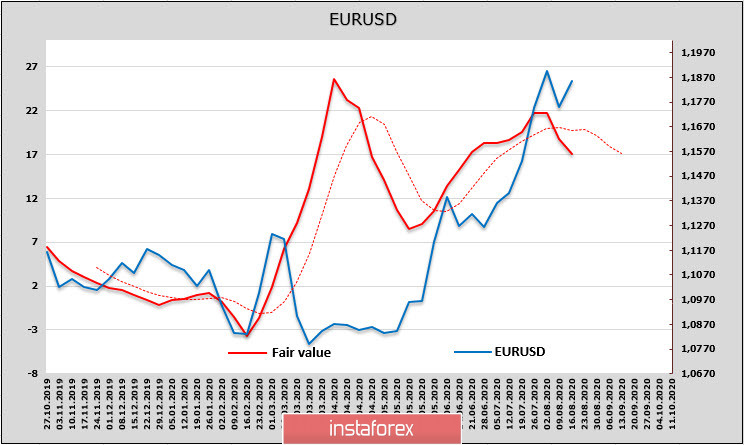

EUR/USD

The final data on GDP and employment for the 2nd quarter released on Friday were hopelessly outdated and did not affect the players' mood. Much more valuable from the perspective of the euro is the fact that currency positioning on the CME does not even think to show signs of the end of the bullish trend. At the same time, a number of other indicators, such as the comparative dynamics of stock indices and GKO yields, directly indicate the approach of a reversal, and the estimated fair price is turned down.

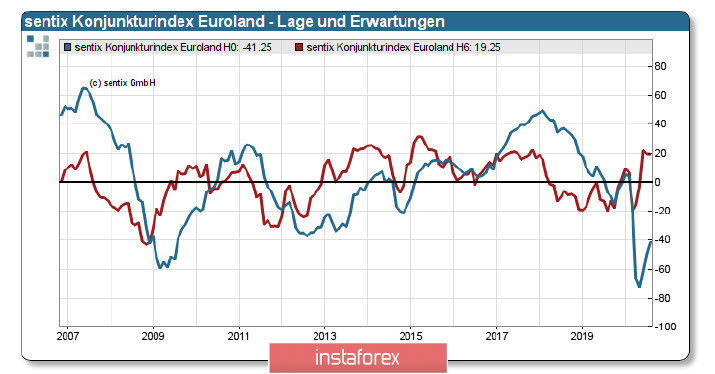

The growth of the euro is supported by confidence in the outstripping pace of the eurozone economic recovery, which will be supported by a new stimulus package, in any case, the research published last week looks very convincing for the euro bulls– the ZEW index rose in August from 59 / 6g to 64p., which was better than forecasts, a similar study by Sentix is also positive-growth from -18.2 p to -13.4 p.

EUR/USD failed to consolidate above 1.19, an attempt to grow is not excluded, but the formation of the top and a decline to the support of 1.1700/10 looks more likely. To continue growth, new grounds that are not yet taken into account by the market are needed, and their absence against the backdrop of the growing prospects for the dollar can play a crucial role.

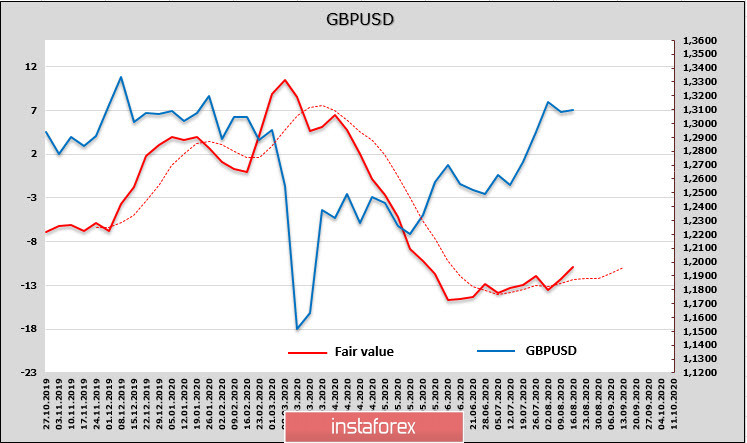

GBP/USD

The net short position in the pound declined again, this time by 973 million, and practically ceased to have a negative impact on the pound. The target price has an upward trend, but its gap from the spot price is too great and will hardly serve as a basis for a breakout of the resistance at 1.3180.

A new round of negotiations between the EU and the UK on Brexit will begin on August 18, and the first results will appear on August 21. As usual, a breakthrough is not expected, the positions of the parties are too far away, but some positive results, in particular, on fishing, it is still possible that the pound can get an incentive to grow.

A report on inflation in July will be published On Wednesday; in general, there is no reason for the pound to either grow rapidly or to decline. The overall expected dollar strengthening is likely to pull the pound down, key support at 1.2970/80, a breakout of which will strengthen the downside movement. While the pound is above this level, it is technically necessary to proceed from the assumption that the bullish momentum has not yet been fully worked out and attempts to grow are not excluded.