The dollar/yen pair actually ignored the release of data on Japanese economic growth in the second quarter today. And although the indicators updated multi-year anti-records, the yen remained at practically the same positions as before the publication. This "stress resistance" is explained, firstly, by the weakness of the US currency, and secondly, by the growth of anti-risk sentiment against the background of the accelerating pace of the spread of coronavirus around the world. As a result, the indicated currency pair stayed afloat, although the published figures were in the "red zone".

It is worth noting here that many of the world's leading countries have published their reports on GDP for the second quarter over the past few weeks. All of them reflected the consequences of the coronavirus crisis. The spring was the peak of the pandemic, when key countries were in a state of lockdown. Therefore, the "spring numbers" are of a corresponding nature: in the States, the country's economy contracted by 32%, Europe slowed down by 12%, and Britain by almost 30%.

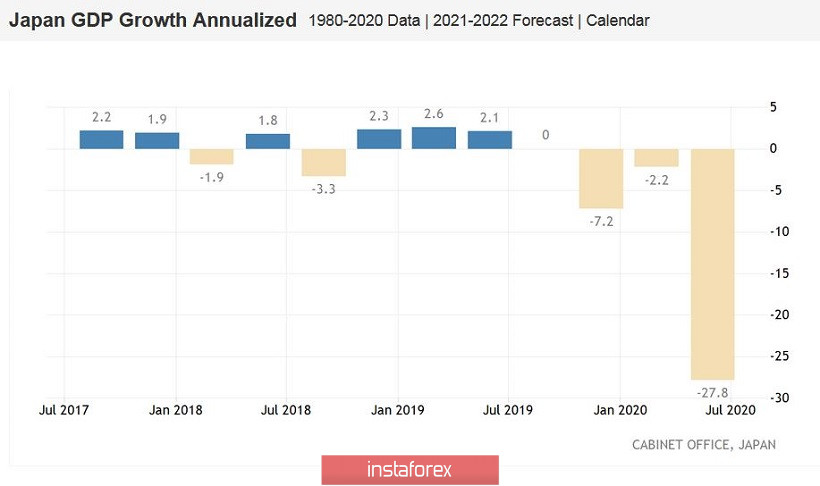

Japan is not exempted. On a quarterly basis, the Japanese economy slowed down by 7.8% (against the forecast of -7.5%). In annual terms, the volume of GDP declined by 27.8% (with the forecast of a decline to -26.9%). In turn, nominal GDP on a quarterly basis declined by 7.4% against the forecast of -6.5%, while the cost of goods for industrial purposes declined by -1.5%. For the first time since the summer of last year, capital expenditures have decreased (by 1.5% at once) - at the highest rate since 2018. The personal consumption indicator fell to -8.2%, declining for the third quarter in a row (for comparison, in the first quarter it came out at -0.8%). The rate of decline in this indicator is the highest over the past 30 years. The coronavirus also affected foreign trade - the volume of exports in the second quarter in Japan declined by 18.5%, this is the worst result in the last 11 years.

Thus, many components of today's release have updated multi-year anti-records, but the yen remained indifferent to this publication. First, the economic downturn in the second quarter was widely expected, especially against the background of similar dynamics in all countries of the world (to one degree or another). Secondly, the yen received support from the Minister of Economy of Japan, Yasutoshi Nishimura, who rather restrainedly commented on the published figures. He stated that the Japanese economy "is in dire straits, but the rate of GDP contraction is lower than in Europe and the United States." He also expressed hope that the recovery of the largest economies of the world will contribute to the recovery of Japanese exports. In addition, according to Nishimura, the level of consumption of goods and services is already beginning to recover, as proven by more recent data.

In other words, the head of the Japanese Ministry of Economy has neutralized the negative effect of today's release. This allowed traders of the USD/JPY pair to focus on the external fundamental background. Here, the role of the first violin is played by the coronavirus, which continues to spread the globe rapidly: over the past day, almost 300 thousand new cases of COVID-19 have been recorded in the world. This is a record daily increase since the start of the pandemic. At the same time, according to the data of the WHO experts, a significant number of infections are simply not recorded by statistics - there are countries in which tests are not even done.

Against the background of such anti-records on the market, interest in protective instruments increased, and not only to the yen, but also to both gold and franc which showed positive dynamics at the start of trading.

It is also necessary to take into account the dynamics of the dollar index. For the first time since May 2018, this indicator fell to the area of 92 points, reflecting the weakness of the US currency throughout the market. Lack of political coherence in the US Congress, a new round of political confrontation between Democrats and Trump (around the work of the Postal Service), as well as another escalation of the Cold War between Washington and Beijing – all these fundamental factors undermined the position of the dollar, which fell in price at the beginning of the trading week. the whole market.

From a technical point of view, the situation is as follows. The dollar/yen pair on the four-hour chart is located between the middle and lower lines of the Bollinger Bands indicator. If the price consolidates below the level of 106.40, the Ichimoku indicator will form a "Dead Cross" signal, in which the Tenkan-sen and Kijun-sen lines will be above the price, and the Kumo cloud will be below it. This configuration will indicate the priority of short positions - up to the lower border of the above cloud, that is, to the level of 105.90. However, it is advisable to consider selling only after the bears break through the level of 106.40.