To open long positions on GBPUSD, you need:

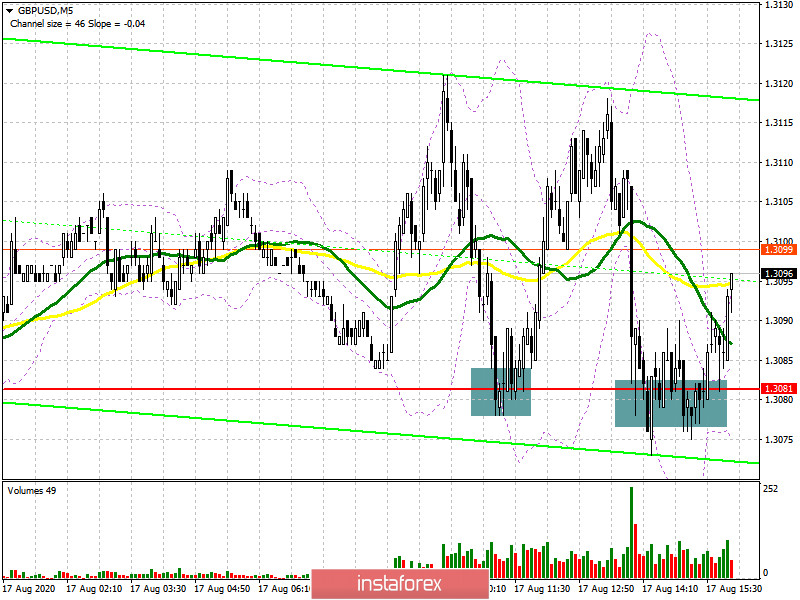

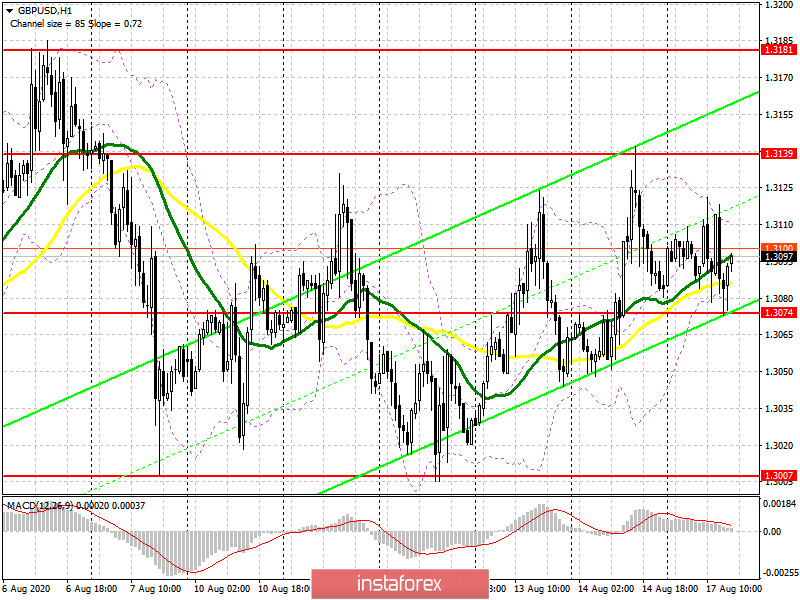

From a technical point of view, nothing has changed for buyers or sellers. The bulls tried to hold above the support of 1.3081, forming several false breakouts from it, which is clearly visible on the 5-minute chart. Also, several points were formed for entering long positions, which I highlighted on the chart. However, to achieve a complete victory and continue the upward trend has not yet come out. Trading is still conducted in the support area of 1.3074, which was formed from the level of 1.3080 and buyers of the pound need to try not to allow a breakdown of this range, just below which is the lower border of the current ascending channel. While trading is above 1.3074, we can expect the pair to continue its upward movement to the high of 1.3139. The longer-term goal remains the resistance of 1.3181, where I recommend fixing the profits. If there is no demand for the pound in the support area of 1.3074 and in the second half of the day, it is best to postpone new long positions until the lower border of the broader side channel is updated at 1.3007 in the expectation of a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

Sellers need to break below the support of 1.3074, as only a consolidation below this level will be a good signal for further opening of short positions in the expectation of reducing the pair to a minimum of 1.3007. A break in the support of 1.3074 will also lead to a break in the lower border of the current ascending channel, which buyers of the pound have been trying to form since the middle of Friday last week. The longer-term goal of bears remains at least 1.2916, where I recommend fixing the profits. In the scenario of recovery of the pair today in the second half of the day, it is best not to rush with sales, and wait for the test of a large resistance of 1.3139, but you can open short positions from there only if a false breakout is formed. I recommend selling the pair immediately for a rebound only after updating the resistance of 1.3181 in the expectation of a correction of 30-40 points.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates the lateral nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Breaking the lower border of the indicator around 1.3074 will lead to a larger movement of the pound down.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.