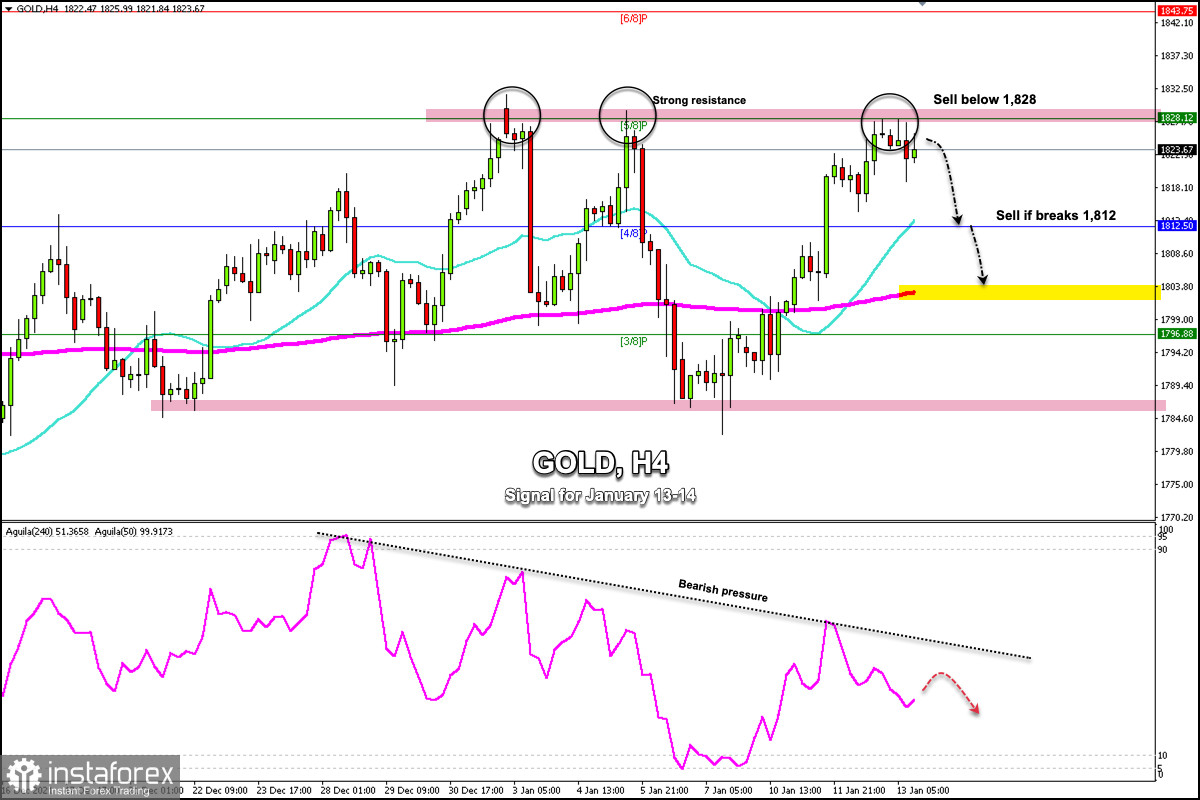

Gold has reached the resistance zone of 1,828. This level coincides with Murray's 5/8. On previous occasions, gold has failed to consolidate above this level and then began a technical correction.

The resistance of 1,828 is expected to be a strong top for gold. Thus, the price could make a technical correction towards the 21 SMA located around 1,812.

Gold has gained strength due to the weakness of the US dollar, which has been falling for three days in a row. However, the dollar index is reaching oversold levels and it is likely that there will be a technical rebound in the next few hours, which could push gold down, giving us a good opportunity to sell below 1,828

A firm breakout and consolidation in the 4-hour chart above 5/8 Murray will open the doors for a rally towards the zone of 6/8 Murray located at 1,843.

On the other hand, as long as gold is trading below the resistance zone of 1,828, we will have the opportunity to sell with targets at 1,812. If the SMA of 21 is broken, the metal can reach the psychological level of 1,800 around 200 EMA.

Since December, the eagle indicator has been generating a bearish signal. However, whenever gold recovers reaching 1,830 levels, it tends to fall rapidly. Therefore, this cycle is likely to continue repeating and we will have an opportunity to sell below the resistance of 1,828.

Support and Resistance Levels for January 13 - 14, 2022

Resistance (3) 1,836

Resistance (2) 1,831

Resistance (1) 1,824

----------------------------

Support (1) 1,817

Support (2) 1,812

Support (3) 1,803

***********************************************************

Scenario

Timeframe H4

Recommendation: sell below

Entry Point 1,828

Take Profit 1,812, 1,803 (200 EMA).

Stop Loss 1,835

Murray Levels 1.,828 (5/8) 1,812 (4/8) 1,796 (3/8)

***********************************************************