To open long positions on EURUSD, you need:

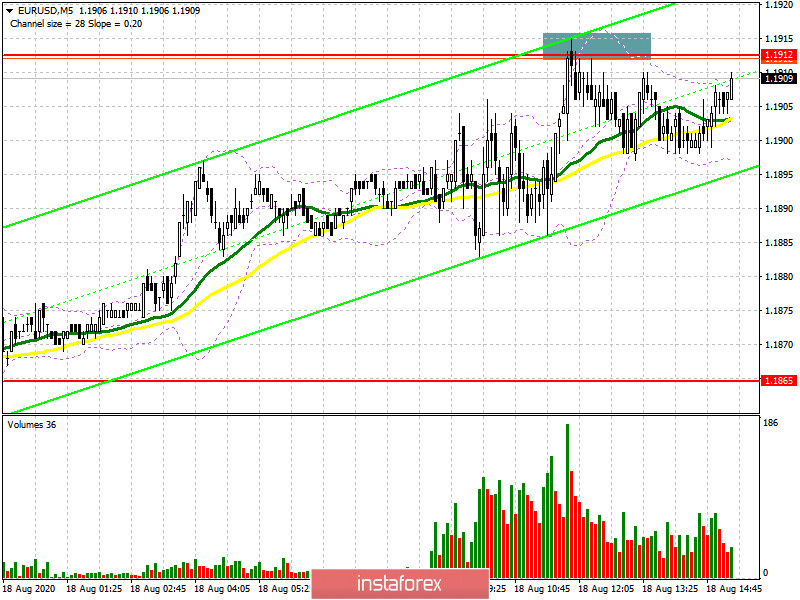

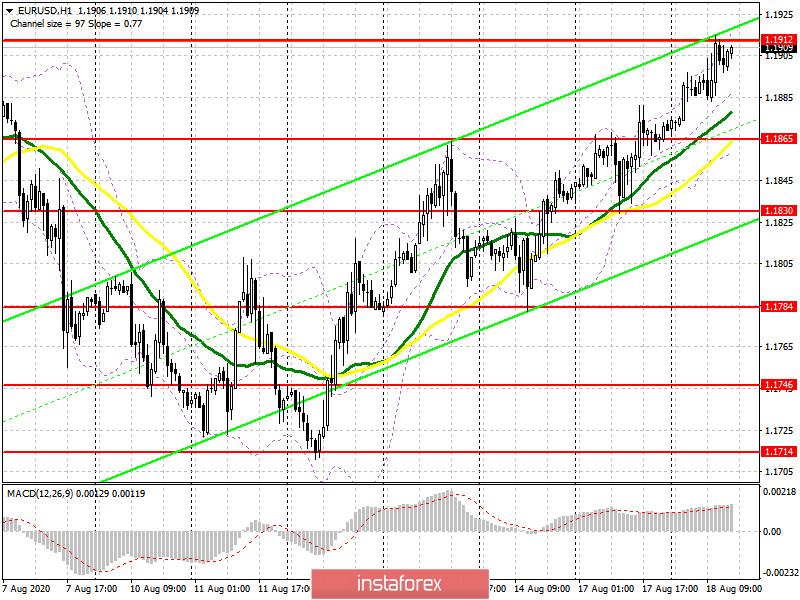

In the first half of the day, I paid attention to the probability of short positions from the level of 1.1912. However, as we can see, on the 5-minute chart, the test and the formation of a false breakout at this level did not lead to a serious sale of the euro and the bulls are gradually returning the pair to this level again. This indicates the continuation of the upward trend and the likely continuation of the pair's strengthening. The task for the second half of the day is to break through and consolidate above this range, which will lead to the demolition of a number of sellers' stop orders and a larger increase in EUR/USD to the maximum area of 1.1987 and 1.2020, where I recommend fixing the profits. The lack of important fundamental statistics also plays on the side of buyers of the European currency, and it is unlikely that data on the real estate market in the US will support the dollar. In the scenario of a decline in the euro, it is best to open long positions in the expectation of a rebound of 30-40 points from the minimum of 1.1865, where the moving averages are currently held, which is an additional support.

To open short positions on EURUSD, you need:

Even the formation of a false breakout at 1.1912 did not lead to a major sale of the euro in the first half of the day, so I recommend that you refrain from new short positions around this level. The bears' goal for the second half of the day will be to return the pair to the major support area of 1.1865, where the moving averages are also held, playing on the side of buyers. An equally important task will be to consolidate below this range, which will increase pressure on the euro and lead to an update of the minimum of 1.1830, where I recommend fixing the profits. However, even a test of this level will not create a real threat to the bull market, which we can now observe. This requires a return to the support of 1.1784. In the scenario of no activity on the part of bears in the area of 1.1912, and most likely it will be, it is best to postpone short positions until the highs of 1.1987 and 1.2020 are updated, from where you can sell EUR/USD immediately on the rebound in the expectation of a correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily moving averages, which indicates the continuation of the bull market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair declines in the second half of the day, support will be provided by the lower border of the indicator around 1.1850, from where you can open long positions immediately for a rebound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.