Crypto Industry News:

Pakistan's Supreme Court Sindh reportedly held a hearing regarding the legal status of cryptocurrencies in the country where several authorities, including the SBP, have filed a document with the court arguing that cryptocurrencies are illegal and cannot be used for trading.

According to a local news channel, the document lists at least 11 countries, including China and Saudi Arabia, that have decided to ban crypto. Pakistan's central bank has reportedly called on a court not only to ban digital assets, but also to impose penalties on cryptocurrency exchanges.

The SBP also referred to several investigations against stock exchanges by the Federal Investigative Agency (FIA), citing investor protection risks as well as money laundering and terrorist concerns. Despite the SBP's recommendation to ban cryptocurrencies completely, the Sindh Supreme Court has not yet ordered a ban on crypto transactions in Pakistan.

Instead, the court ordered the bank to appeal to the ministries of finance and law, which will ultimately decide on the legal status of cryptocurrencies in the country and determine whether the ban would be constitutional.

The news came years after the SBP issued an initial ban on trading digital currencies and tokens. At the time, the central bank argued that cryptocurrencies such as Bitcoin or initial coin offerings were not legal tender and were not "issued or guaranteed by the Pakistani government."

The recent moves by the Pakistani government reflect similar events unfolding in many countries, including India and Russia, where central banks are trying hard to ban cryptocurrencies, while other authorities are not necessarily willing to do so. In 2020, the Indian central bank had to lift a ban on banks' contacts with cryptocurrency-related companies, as ordered by the country's Supreme Court.

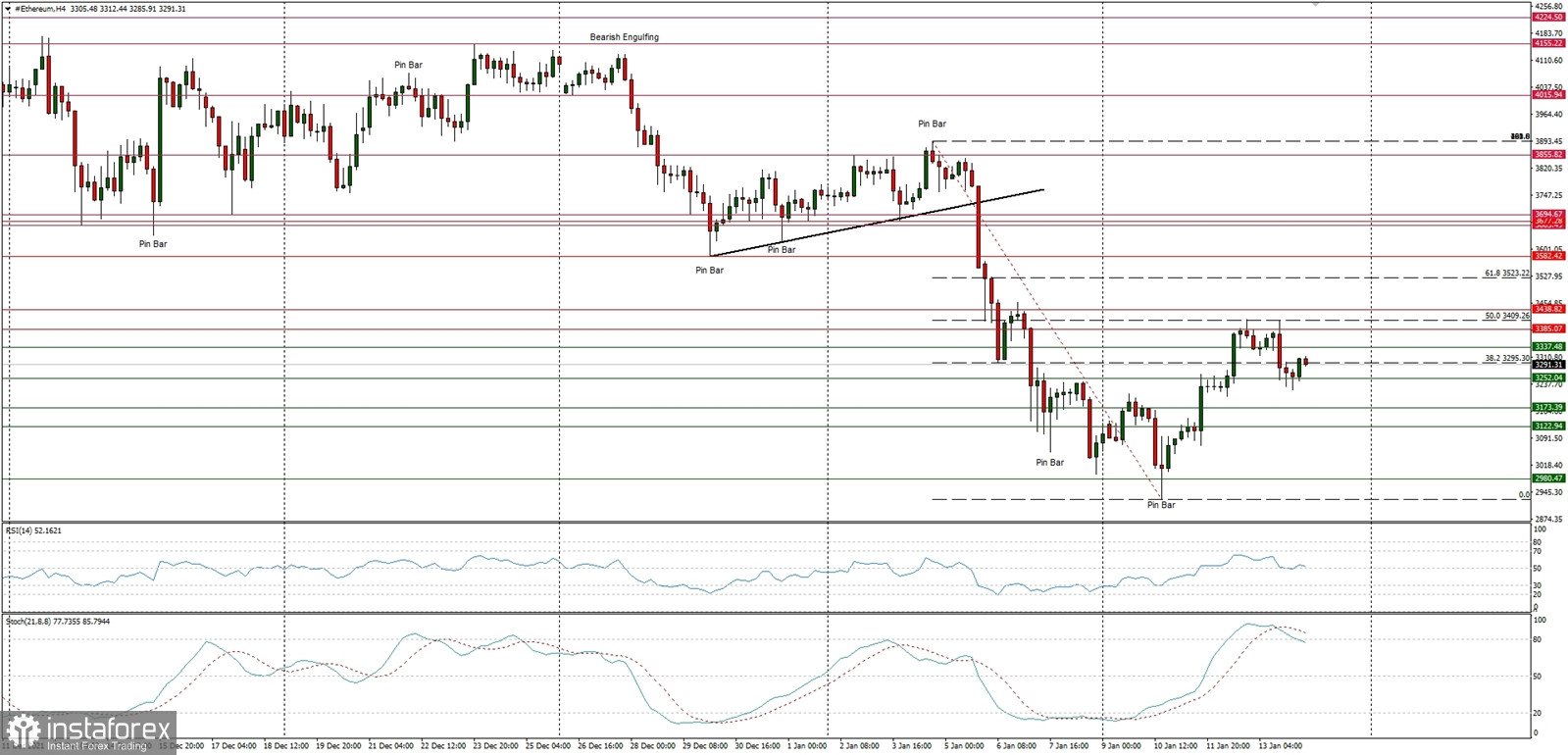

Technical Market Outlook

The ETH/USD pair has retraced 50% of the last wave down, but the bulls were capped at this level and the market reversed lower towards the technical support located at $3,353. The next target for bulls is seen at the level of 61% at $3,523. The game changer (the level that change the market control from bears to bulls) is located at $3,694. The complex and time consuming corrective cycle in form of ABCxABCxABC pattern might have been completed, nevertheless larger time frame trend remains up and only a clear and sustained breakout below the swing low at $2,644 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $4,512

WR2 - $4,187

WR1 - $3,620

Weekly Pivot - $3,304

WS1 - $2,721

WS2 - $2,382

WS3 - $1,782

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.