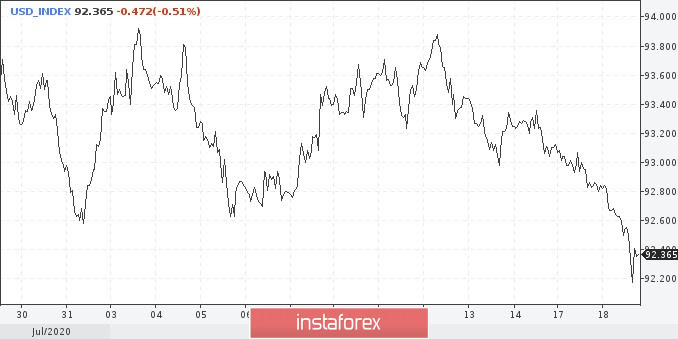

The dollar has been growing for many years, but the coronavirus pandemic has confused all the cards, leaving its imprint on the American economy. Today, under the pressure of low yield of treasuries and gloomy macroeconomic data, the dollar fell to a 2-year low against a basket of competitors. The greenback was trading around 92.30 at the beginning of the US session.

What is happening in the US economy and politics increasingly fuels the bearish beliefs of traders. At the end of last week, rates on the sale of the dollar increased to the largest value since May 2011, and, judging by the greenback's current dynamics, they continue to grow.

Sales of the US currency look excessive, after a strong and prolonged fall, the dollar needs to be corrected. This may happen, but the trend is still downward. Market players are convinced that the dollar's fall will not end there. The greenback will remain under pressure due to the tense domestic political situation and the upcoming US presidential elections. In addition, the country has a high incidence of coronavirus compared to other developed countries.

Market sentiment is also affected by the conflicting theme of new incentives, which is constantly overgrown with new and far from positive details. Representatives of the US Senate began to say that agreements will probably not be reached at the end. At this time, there were reports in the media about the plans of the Republicans to reduce the amount of stimulus.

Meanwhile, Acting Chairman of the Council of Economic Advisers, Tyler Goodspeed, made it clear today that US President Donald Trump is not going to back down on incentives and will continue to push for his bill. Recall that Republicans insist on $1 trillion, and Democrats - $3 trillion. After this news, the dollar index fell to new lows at 92.20 at the moment.

Investors continue to worry about the alleged deterioration in US-China relations. They expected an increase in tension ahead of the elections, but did not think that any concrete steps would follow. However, Trump contributed to the creation of a new rule that restricts Huawei Technologies' access to foreign-made chips. Innovation can have far-reaching consequences.

Trump issued a new statement on Tuesday. He promised to punish companies that move production abroad, such as to China, and create jobs in another country. These companies will be subject to duties, and those who return from China to their homeland will receive tax benefits. Thus, Trump encourages companies to produce goods and services at home. America has high unemployment, and the election is 11 weeks away.

It is worth noting that previously, the White House's policy in the trade war with China assumed pressure against Chinese companies like Huawei. Now, because of the pandemic, which Trump calls the Chinese plague, and probably from a certain despair, it was decided to go further and put pressure on American companies.

Strong data were released on Tuesday. Housing construction in the US rose in July for the third consecutive month. This sector seems to be becoming a strong side of the American economy, which is extremely small now. However, surpassing the forecast did not save the greenback from falling, but it should be noted that it slowed down.

The technical picture also does not promise anything good for the dollar. The first serious call for the greenback's fall sounded at the end of July, when the 94.70 level was broken. Now, when the bears continue to put pressure on the dollar, demonstrating their superiority, a new round of decline is expected.

Two points are important at the moment - this is the long-term upward trend line, which began in April 2011, and the round psychological value of 90.00. These two points will be critical. If they can resist, the dollar will have a chance to return to the March levels, that is, above 100. In the event of a breakout, the greenback will go deeper.

If anyone wins here, it is the euro. Due to the dollar's fall, traders maximized rates on the euro's growth. The 1.2000 mark is a matter of time, and the nearest one. Today, buyers of the main pair managed to bring the rate to 1.1960.

As for the pound, it probably won't be able to take full advantage of the dollar's fall. Brexit is back in sight, and unwary traders of the British pound may face a stressful situation.

The good performance of sterling, which shows today, as well as its resilience to gloomy economic data, was most likely based on the fact that investors pushed the Brexit story into the background. If there is no deal, the markets may begin to return the rate to previous levels.