Technical analysis recommendations for EUR/USD and GBP/USD on August 19

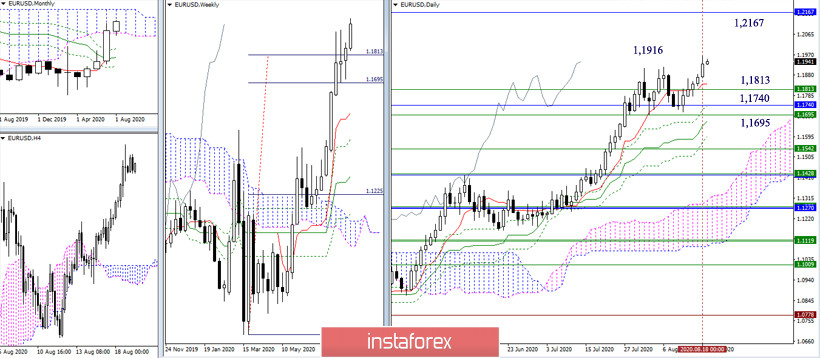

EUR / USD

The pair managed not only to update the previous high (1.1916), but also closed the working day above the level. Players on the rise managed to limit the downward correction and the emerging consolidation by supporting the worked out benchmarks: 1.1813 - 1.1740 - 1.1695 (weekly target + monthly Senkou Span A). These levels still retain the role of significant milestones that are responsible for the current balance of power and prospects. Maintaining the achieved and full recovery of the upward trend will allow upward traders to continue their growth to the upper border of the monthly cloud (1.2167). But failure to restore the upward trend and return to the area of the former correction can be a good reason for the start of a new and more effective downward correction.

In the smaller halves, the pair currently retains the advantage on the side of the bulls. Despite the current downward correction, all analyzed technical instruments support the bullish direction. The resistance of the classic Pivot levels (1.1975 - 1.2020 - 1.2074) serves as upward guidance within the day. TThe key support levels of the lower halves today diverged by a significant distance, giving the downward correction room for maneuver – 1.1921 (central pivot level) and 1.1848 (weekly long-term trend). Intermediate support is located at 1.1876 (S1). At the same time, it should be noted that a decrease to the weekly long-term correction (1.1848) today is not just undesirable, but also contraindicated for players to increase, since this will level out all yesterday's achievements and return the pair to the zone of the previous consolidation and correction of the upper halves.

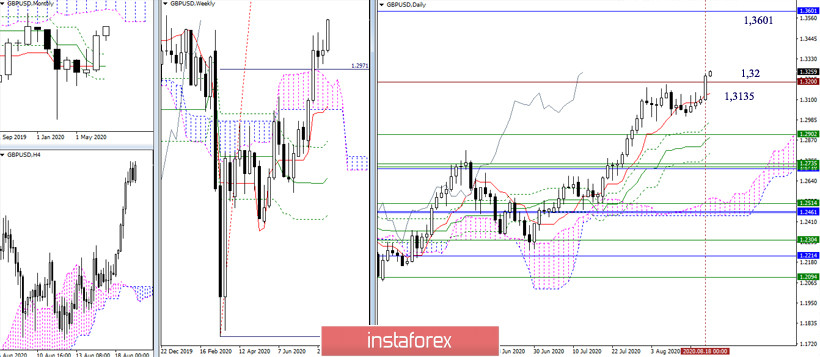

GBP / USD

Sometimes, it is possible to overcome a strong level only by making efforts commensurate with it. Players on the rise yesterday actively went on the assault and managed to close the working day above the historical resistance of 1.32. Now, their main task is to hold the situation and secure a foothold above. Otherwise, the return to the level and the response activity of bears can delay the continuation of the upward trend in this place for a long time.

In the lower halves, the bullish moods are now dominating, and players on the rise are supported by all the analyzed technical tools. The resistances of the classic Pivot levels are the increasing reference points – 1.3291 - 1.3346 - 1.3444. If a downward correction develops, the key support levels for the lower halves are waiting for the pair at 1.3193 (Central pivot level) and 1.3109 (weekly long-term trend). Anchoring lower will deprive players of the advantages of increasing not only on H1, but also on the daily time frame, they will lose support for the short-term trend (1.3135).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)