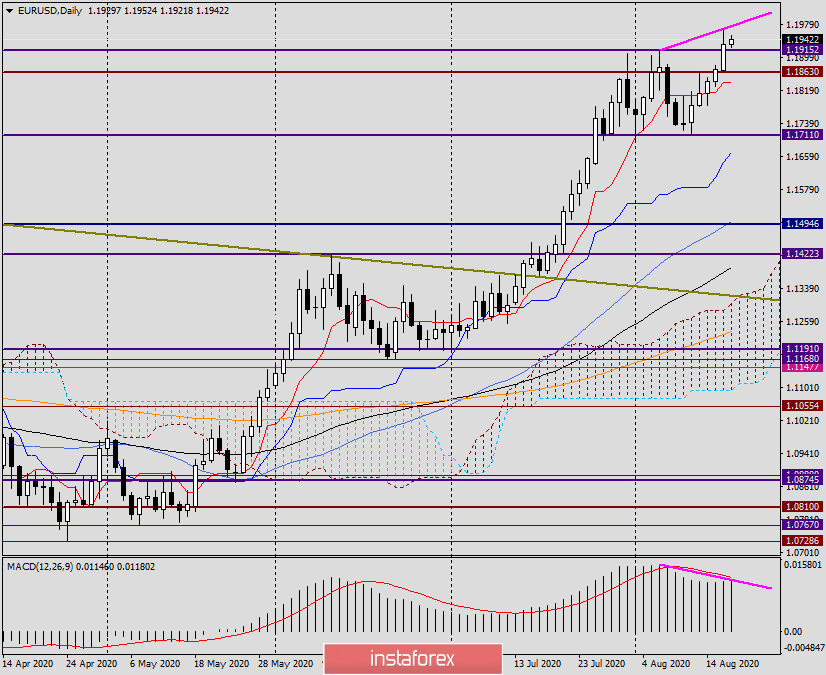

Daily

Well, what was supposed to happen happened. At yesterday's trading, the main currency pair of the Forex market confirmed its intentions to move in the north direction by breaking through the important and key resistance zone of 1.1900-1.1915 at that time. Tuesday's trading closed at 1.1930, and highs were shown at 1.1965. Thus, two of the previously outlined growth goals were achieved: 1.1945 and 1.1960. At the same time, the last level, according to long-term observations, I consider very technically strong.

Now a little bit about the situation related to the weakness of the US dollar. As we all remember, at the height of the COVID-19 pandemic, the US currency was in demand among investors as a safe asset and was in high demand. However, after the US Federal Reserve System (FRS) began to pour liquidity into financial markets, risk appetite began to appear on global trading platforms, which became stronger every week. The lifting of restrictions in European countries, on the one hand, and the appalling situation with the daily number of COVID-19 infections in the US, on the other, also served the dollar poorly. Now investors fear that the world's leading economy, which is undoubtedly the American one, will recover at a slower pace than the Eurozone economy. Let me remind you that the European Union has approved a seven-year budget, as well as a program to support the economy in the form of a recovery fund, which amounts to 750 billion euros.

At the same time, in the United States of America, the election race that has started does not allow us to adopt a program of additional economic stimulus. The reason is banal and simple. Democrats block all Republican initiatives, putting a stick in the wheels of all the good intentions of Donald Trump to restore the country's economy after the negative impact of the coronavirus epidemic on it. As you know, the excellent state of the American economy before COVID-19 was the main trump card of Trump, who considered it his merit, and seriously counted on his re-election due to very good indicators of the American economy. Now the situation has changed radically, and a forgetful Biden can take the presidential chair from the current head of the White House.

However, let's return to the analysis of the EUR/USD currency pair. I want to emphasize that today will be very important and almost decisive in the future direction of the quote. Let me remind you that the minutes of the last FOMC meeting will be published today at 19:00 (London time). After studying the protocol, market participants will draw conclusions about the economic and financial conditions in the United States, as well as see how the votes were distributed during the last decision on interest rates. If the protocols are won back by the market in favor of the US dollar, and the pair returns to the level of 1.1900, ending the trading session under this important mark, the breakdown of the resistance zone of 1.1900-1.1915 will have to be recognized as false, which will give grounds to expect a subsequent downward trend of the euro/dollar.

Another important point is the bearish divergence of the MACD indicator. Despite the fact that the divergence is considered only an additional signal, according to long-term observations, it is the daily and hourly divergences that the market works out most often. However, these observations are in conflict with others. As a rule, the market can interpret and react to any important events, including the Fed minutes, in different ways. Basically, there is a reaction in favor of the current trend, in this case, a bullish one.

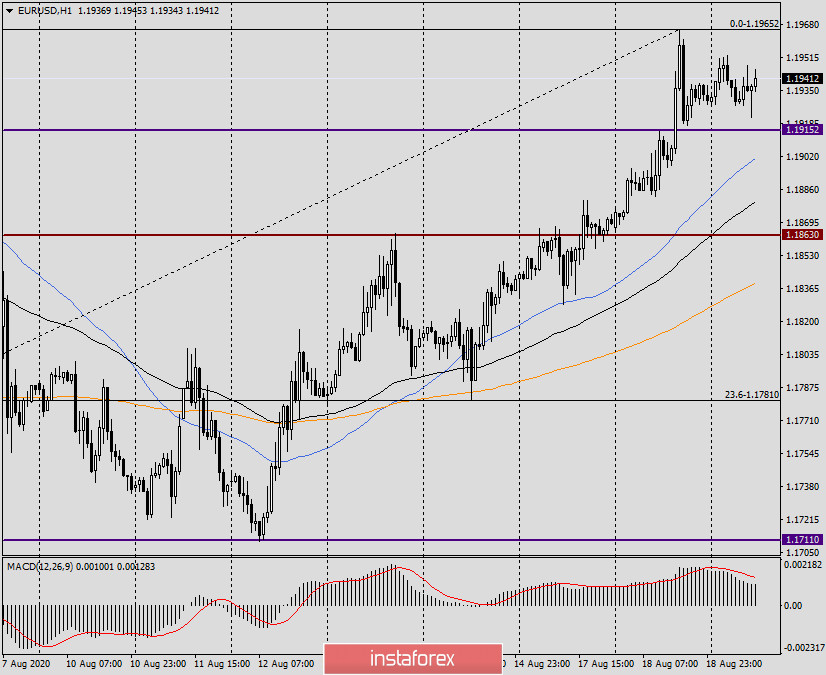

H1

Look at how technically the pair rolled back to the broken and very strong resistance level of 1.1915, thus providing an opportunity for those who want to open buy deals. If you remember, yesterday's review suggested this scenario. I recommended not to buy at the breakdown of 1.1915 (too risky), but to wait for the fact of the breakdown itself, and on the rollback to the broken level, consider buying EUR/USD. Yesterday's idea was correct, but today's recommendations are much more complicated. There is no doubt that the FOMC protocols, or rather, the reaction of market participants to them, will have a very strong impact on the results of today's trading.

As usual, I suggest planning lower purchases and higher sales. For example, opening deals at more favorable prices. For today, I recommend considering purchases after short-term declines to 1.1900, 1.1880 and 1.1868. It is better to plan sales after the appearance of bearish candle signals near 1.1960, 1.1980 and 1.1000. Once again, this is a very important day for the main currency pair. We are waiting for the publication of the minutes and the reaction of investors to them.