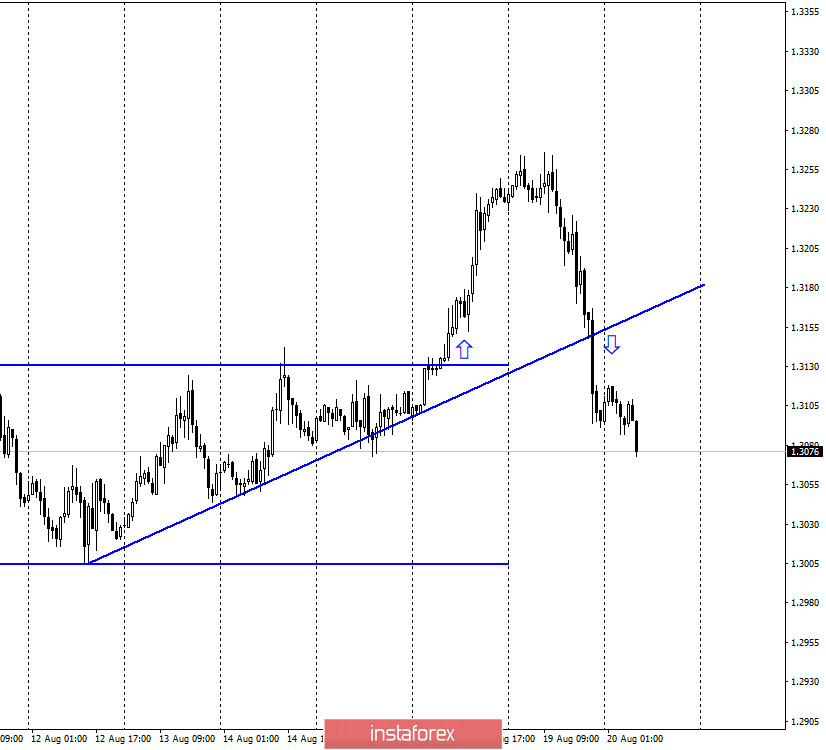

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and began a strong fall, also performing a close under the ascending trend line. Thus, the mood of traders has changed to "bearish", and now I expect the quotes to continue falling. While in the US, Republicans and Democrats are trying to agree on a new package of financial assistance to the economy, negotiations continue in Brussels between the groups of David Frost and Michel Barnier, who are trying to agree on an agreement that will operate between the parties after Brexit. This is the seventh round of negotiations, and it is not difficult to guess how the previous six ended. The parties want to reach an agreement before October 2, so that there is time to ratify the deal in the EU and British Parliaments. However, none of the parties still does not want to concede one of the key issues. It is reported that the delegations will discuss technical issues today, after which Frost and Barnier will meet again on Friday. Experts believe that the probability of progress this time is also extremely small. In any case, the negotiations will move from the "dead end" only when one of the parties makes a concession on one of the most important issues (fishing, competition, jurisdiction of the European Court of Justice, compliance with EU standards).

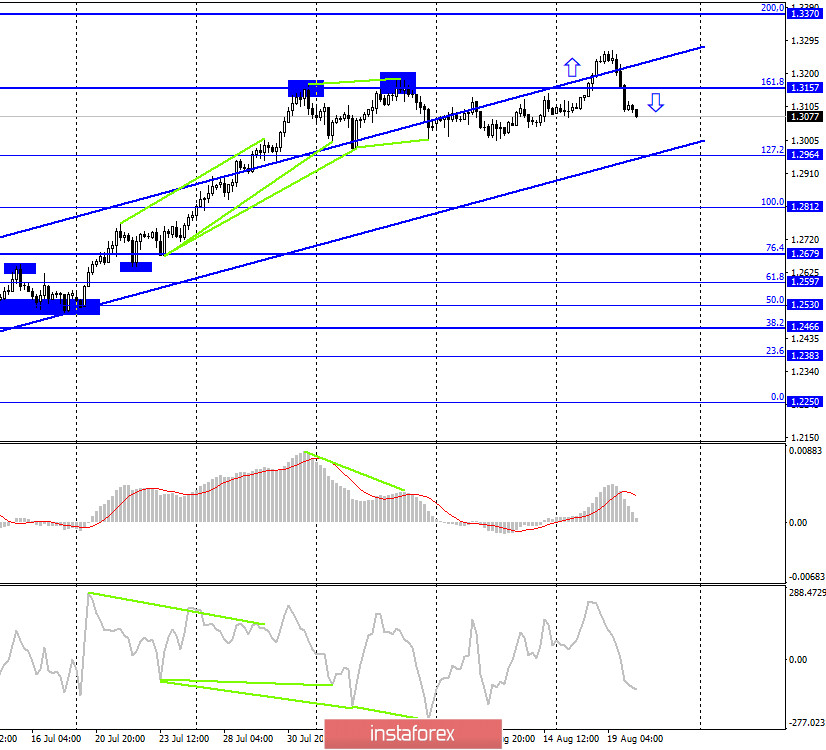

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US currency and anchored under the corrective level of 161.8% (1.1357), which now allows us to count on a further fall in the direction of the next Fibo level of 127.2% (1.2964). Fixing the pair's rate above the level of 161.8% will work in favor of the British dollar and resume growth in the direction of the corrective level of 200.0% (1.3370).

GBP/USD – Daily.

On the daily chart, the pair's quotes made a consolidation above the corrective level of 100.0% (1.3199), however, it turned out to be false, so the fall process can be resumed in the direction of the Fibo level of 76.4% (1.2776).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the lower downward trend line. A pullback from this line may allow the pair to perform a reversal in favor of the US dollar and resume the process of falling towards the approximately 1.1500 level. This is a long-term perspective.

Overview of fundamentals:

On Wednesday, the UK released a report on inflation, which unexpectedly turned out to be significantly better than traders' expectations. However, instead of the expected growth in this case, the pair almost collapsed. Thus, the report had no effect on the mood of traders. As well as the evening publication of the Fed minutes.

News calendar for the US and UK:

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On August 20, the information background will not be strong, as only one report is planned, which is not significant. Especially after yesterday, traders did not pay attention to much more important data.

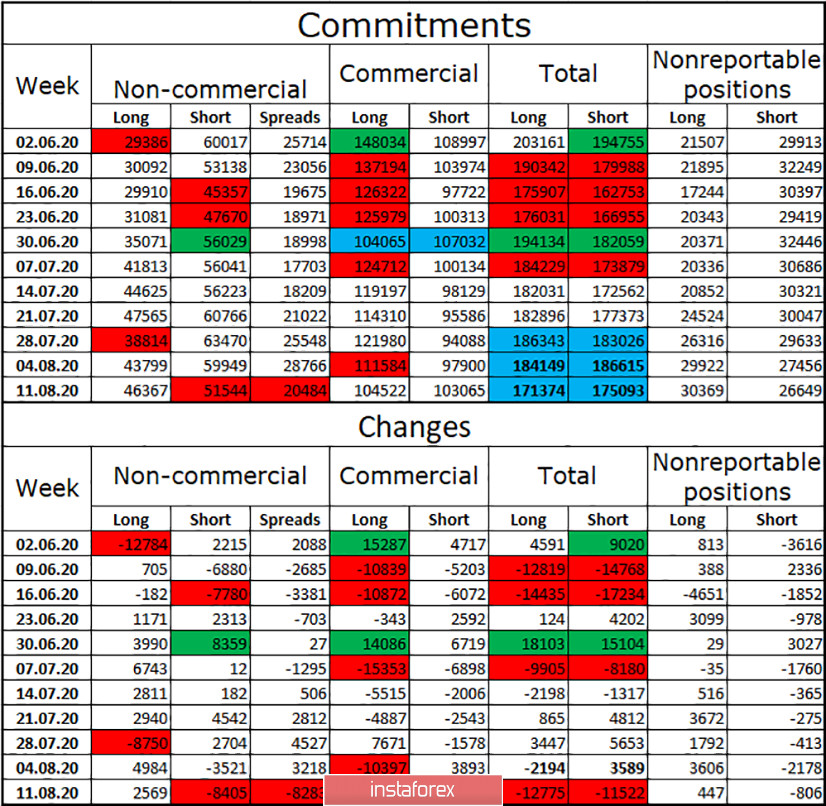

COT (Commitments of Traders) report:

The latest COT report on the British pound was absolutely predictable. Large speculators continued to increase long-contracts (+2.5 thousand) in the reporting week and got rid of short-contracts (-8.5 thousand). Thus, the "Non-commercial" group continued to believe in the Briton. The total number of buy positions opened by speculators has been growing for three weeks in a row, and the number of short contracts in their hands has been declining for three weeks in a row. At the same time, the total number of open long and short contracts for all groups of traders is already approximately the same - 171 thousand and 175 thousand. At the beginning of the new week, traders again actively bought the British dollar and only by the end of the week began to fall in quotes.

Forecast for GBP/USD and recommendations to traders:

Today, I recommend selling the British currency with a target of 1.2964, as the closing was performed at the level of 161.8% (1.3157). I recommend buying the pound again after the pair has fixed above the level of 161.8% with the goal of 1.3370.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.