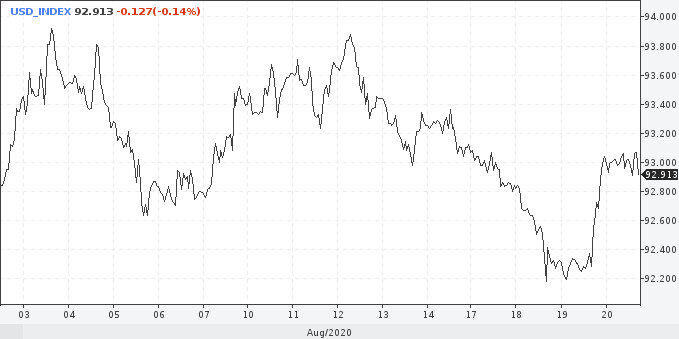

Let's sum the recent developments of the US dollar index. It was losing ground across the board in June which was followed by consolidation in July. In the same month, the index sank below 93. Now the USDX is consolidating at around 93. The Fed's minutes released yesterday propped up its consolidation at the level above 93. Let's try to figure out what is actually going on: a pause or a trend reversal.

Obviously, it was yesterday's publication of the Fed's minutes that influenced the dynamics of the US dollar. The thing is that it began to strengthen at the beginning of the American session. Some market participants think that bearish sentiment in the American stock market and an increase in yields on US Treasuries account for the greenback's growth. An auction of new 20-year government bonds with a placement volume of $ 25 billion could have also played a role here. Hm ... It makes sense.

So, on Wednesday, the oversold greenback posted the biggest daily gain since March. This afternoon, the dollar index was trading mostly sideways with brief spikes. It opened the evening session at just above 93 points with prospects for further growth. Both the long-term and medium-term outlook for the US dollar is bullish. The recovery of the greenback is also supported by the negative dynamics of stock indices and the energy market. In this context, it would be a good idea to consider long deals on the US currency.

Nevertheless, investors doubt that dollar bulls will be forceful enough to rule the market for long. No extra fiscal measures have been introduced yet. When it comes to the new package of financial aid, market participants are pondering over the stimulus size. They reckon the package is likely to be 1 trillion dollars. If the predictions come true, a new wave of dollar selling will hit the market.

Labor statistics are in the spotlight on Thursday. Last week the US Labor Department reported that the recovery of the labor market in the country was gaining momentum, the number of initial applications for unemployment benefits fell below 1 million to 963 thousand. This was a positive factor for the stock market and the dollar. Some traders were still worried about the sustainability of the labor and stock market recovery, and they were right. Today, the Labor Department announced an increase in initial applications for unemployment benefits by 135 thousand last week. Thus, the indicator again crossed the round figure of 1 million, which caught the markets off guard.

Uncertainty about the future movement of the stock market and the dollar remains due to the ongoing negative impact of the coronavirus on the economy. This, in turn, creates conditions for higher volatility in financial markets.

When it comes to the most popular currency pair, EUR/USD fell sharply on Wednesday amid an advance of the US dollar. On Friday, when PMIs are published for the manufacturing and services sectors, everything may change. According to forecasts, PMIs in European countries will come out with scores above 50. The higher they rise, the more it will strengthen the euro. On the whole, EUR/USD is likely to continue the overall uptrend.