Crypto Industry News:

Tesla CEO Elon Musk announced that Tesla is accepting Dogecoin as payment for the company's goods. Products eligible for the DOGE program in the Tesla Store can be purchased by sending crypto to a Tesla Dogecoin wallet.

The company also explained that it does not accept any other cryptocurrencies. Tesla informed customers that "digital assets other than Dogecoin sent to Tesla will not be returned to the buyer."

In addition, items purchased through DOGE "cannot be returned, exchanged or canceled." Tesla considers all purchases made through DOGE final, and cannot be redeemed for cash.

A month ago, Tesla confirmed that it would start accepting DOGE for the purchase of goods. The announcement resulted in a 25% increase in the price of memecoin. On Friday, just a few hours after the implementation of the DOGE payment, the price of the asset increased by 18.63%.

Meanwhile, Tesla may not be the only company to start implementing crypto payments this year. A Visa survey shows that small and medium-sized businesses will also embrace crypto payments in 2022.

Technical Market Outlook

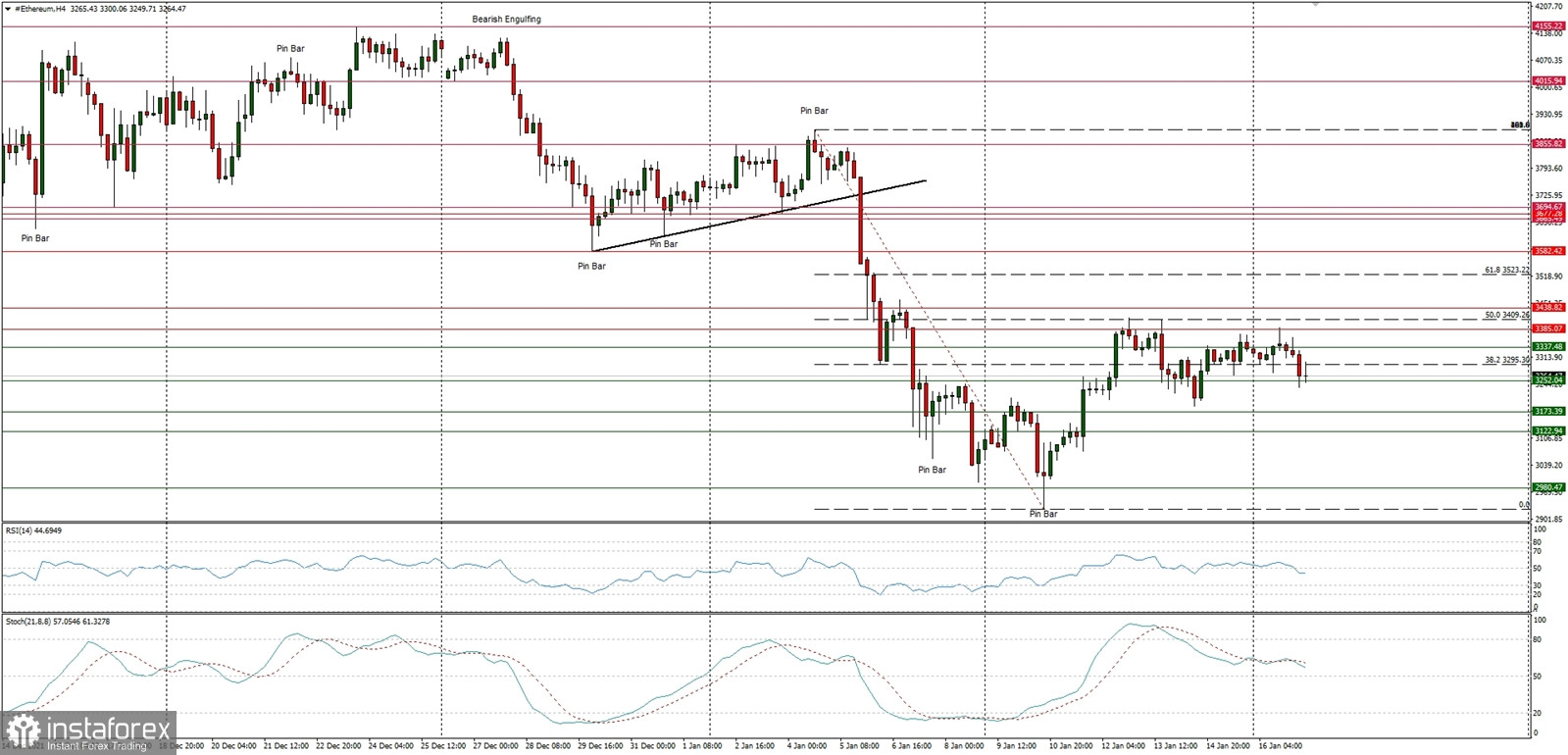

The ETH/USD pair volatility decreased during the weekend and the market is consolidating around the level of $3,295, which is a 38% Fibonacci retracement level of the last wave down. The momentum is hovering around the level of fifty and the same situation is with the stochastic oscillator. The market participants await the event that will trigger the up move again. The nearest technical support is seen at the level of $3,173 and the key short-term technical resistance is seen at $3,385.

Weekly Pivot Points:

WR3 - $4,051

WR2 - $3,728

WR1 - $3,566

Weekly Pivot - $3,237

WS1 - $3,077

WS2 - $2,765

WS3 - $2,585

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.