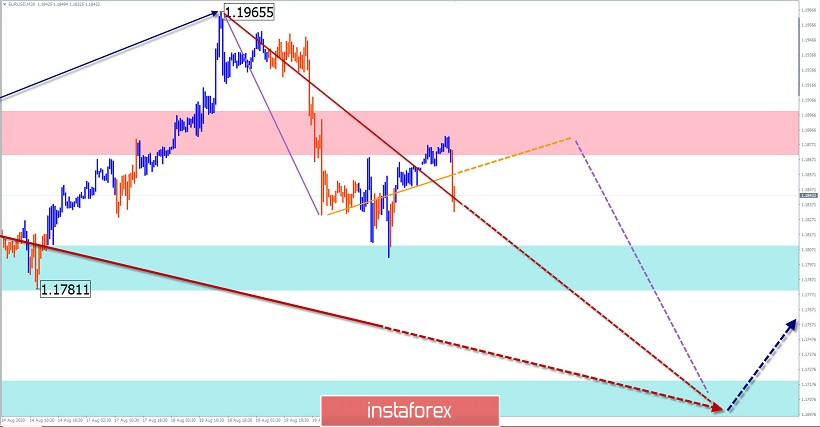

EUR/USD

Analysis:

The direction of the trend of the European currency since mid-March is set by the algorithm of the rising wave from March 20. The growth of the pair brought the price within the boundaries of a wide reversal zone of a large scale. In the last 3 weeks, the quotes form a stretched plane. The wave structure doesn't look complete.

Forecast:

In the coming day, it is expected to complete the rollback that began yesterday, turn around and return to the downward movement vector. Long-range support shows the expected end zone of the entire current correction.

Potential reversal zones

Resistance:

- 1.1870/1.1900

Support:

- 1.1810/1.1780

- 1.1720/1.1690

Recommendations:

The current decline is against the direction of the euro trend. Intraday supporters can make short-term sales. The optimal tactic is to refrain from trading during the correction, with the search for buy signals at the end of it.

USD/JPY

Analysis:

The direction of the short-term trend of the Japanese yen is set by the algorithm of the downward wave from June 5, which completes a larger bearish structure. In its structure, the final part (C) has been developing since August 12. In the last 2 days, the price formed an intermediate pullback.

Forecast:

In the coming day, we expect the end of the upward movement rate, a reversal and the beginning of a downward price move. The near-term support may delay the rate of decline. Most activity is likely at the end of the day.

Potential reversal zones

Resistance:

- 106.00/106.30

Support:

- 105.30/105.00

- 104.50/104.20

Recommendations:

Buying a pair today can be unprofitable. It is recommended to focus on searching for sales signals.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!