Something strange is happening with the pound. It initially ignores the good inflation data that came out earlier this week and then simply declines against the US dollar following the general trend in the market. The next day, without any reason, the pair returns to almost its monthly highs. But if we sort of figured out that situation, then today's reaction was once again surprising. Let me remind you that the inflation data at the present time cannot be considered as representative, or reliable, due to the distortions that were caused by the coronavirus pandemic in the spring of 2020. It will be possible to get a real picture only after the economy recovers from the consequences of the pandemic, but for now this is very far away. So, it turns out that the statistics waiting for us in the future will continue to be unpredictable, and in August we may see a sharp reduction in the indicator, although many economists will bet on continued growth.

A similar situation and opposite reaction to the very good data on retail sales and activity in the service sector will most likely occur today. Let me remind you that a report was released in the morning, which indicated that retail sales in the UK in July of this year increased significantly thanks to the resumption of operations of shops and restaurants, which are gradually returning to normal after the coronavirus pandemic, during which they were forced to suspend my job. According to the data, retail sales in the UK in July rose by 3.6% compared to June, while economists had expected growth of 1.4%. However, it's worth noting that clothing and fuel sales are far behind pre-pandemic levels.

A rather interesting report on the growth of borrowings from the UK public sector was also released today. However, the significant increase in this indicator against the background of the fight against the consequences of the coronavirus pandemic did not surprise anyone. The report indicated that the UK public sector net borrowing in July was 26.7 billion British pounds, and the borrowing rate increased. Economists expected the figure to be £ 29.9 billion.

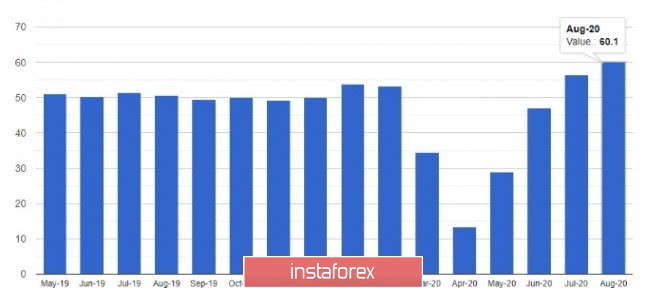

Now, let's move to the most important report. The British pound began to gradually lose its positions, sliding back to the lows of the week. The sharp rise in activity in the UK manufacturing and service sectors in August this year came amid a further relaxation of quarantine and social distancing measures. Such a sharp jump in indicators surely suggests that the UK economy will recover at a faster pace than expected, and that the situation with Brexit and the lack of progress in trade negotiations may be less damaging than was expected at the beginning of this year. But it remains a mystery why the pound reacted with a fall.

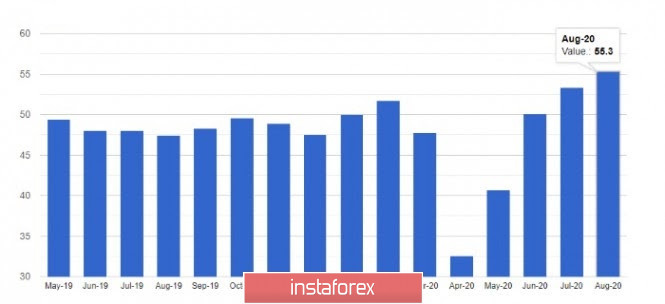

Thus, the preliminary PMI for the manufacturing sector in the UK in August was 55.3 points, while it was at 53.3 points in July. Economists had forecast a figure of 53.6 points. As for the service sector, it is even better. There, the preliminary PMI jumped right up to 60.1 points in August against 56.5 points in July and with the forecast of 57.0 points. The composite purchasing managers index, which takes into account both areas, rose to an 82-month high of 60.3 points in August from 57.0 points in July against the forecast of 56.4 points. Let me remind you that the indicator values above 50 signal an increase in activity.

From the point of view of technical analysis of GBP/USD pair, the sharp collapse of the pound is likely to continue after the data on the US, the release of which is scheduled for the second half of the day. The nearest targets of the bears are the support levels 1.3070 and 1.3040. In order for buyers to be able to return the market to their side, it is necessary to return the resistance at 1.3180, which will be extremely difficult given the fact how traders react by selling to good news. I think we will find out about what will happen then when the statistics start to deteriorate very soon, when the rebound from the bottom is over, and the indicators begin to shift to more real ones.