For the first time over the past two months, the US dollar ended the week in a positive zone against a basket of major currencies, supported, on the one hand, by strong production data, and on the other, by the weakening of the single currency amid mixed data on production indicators.

After all, why did the dollar grow and if it has prospects to change the trend?

Indeed, Friday's economic statistics from America had a positive impact on the exchange rate of the US currency, as many believe, but the question arises: why was such dynamics not observed earlier, when the data came out positive? But, on the contrary, the dollar was declining? We believe that the main reason is not in the good values of economic statistics, but in how the Fed can begin to react if the economic recovery accelerates. It can be noted that the minutes of the July meeting of the Federal Reserve presented last week showed that the regulator will not take any action to influence the yield curve of government bonds. This indicates, in fact, that if Treasury yields continue to grow, then the regulator will not do anything to reduce them, which means that they will support the national currency rate by their dynamics. And in this case, all forecasts, including ours, will remain irrelevant. An increase in profitability will lead to an increase in the dollar rate in the currency market in the near future, and then we will observe a reversal of global trends in the currency markets.

How long can a dollar rise?

The scenario described above may or may not take place. Almost now, the dollar is in a kind of junction point, when it can really try to continue local strengthening or still return to square one, resuming the decline. The weak recovery of the US economy, which forces many investors to view the dollar as a safe haven currency, and the above-mentioned situation with the behavior of government bond yields speaks in favor of the possible growth of the dollar. In addition, the expectation of a very tense political struggle for the presidency, the impending uncertainty of the election results may stimulate purchases of the US currency.

A weak economic recovery, as well as massive stimulus programs aimed at supporting it, is playing against it.

Conclusions

We believe that the result of the influence of multi-directional factors will be the general sideways dynamics of the ICE dollar index which can end either on the wave of accelerating the economic recovery process or after the presidential elections.

Forecast of the day:

The EUR/USD pair is trading in a range again, actually forming a continuation of the "rising flag" trend. If it holds above the support line or the level of 1.1755, it will grow to 1.1955. At the same time, a decline below the level of 1.1755 will cause the price to decline to 1.1700.

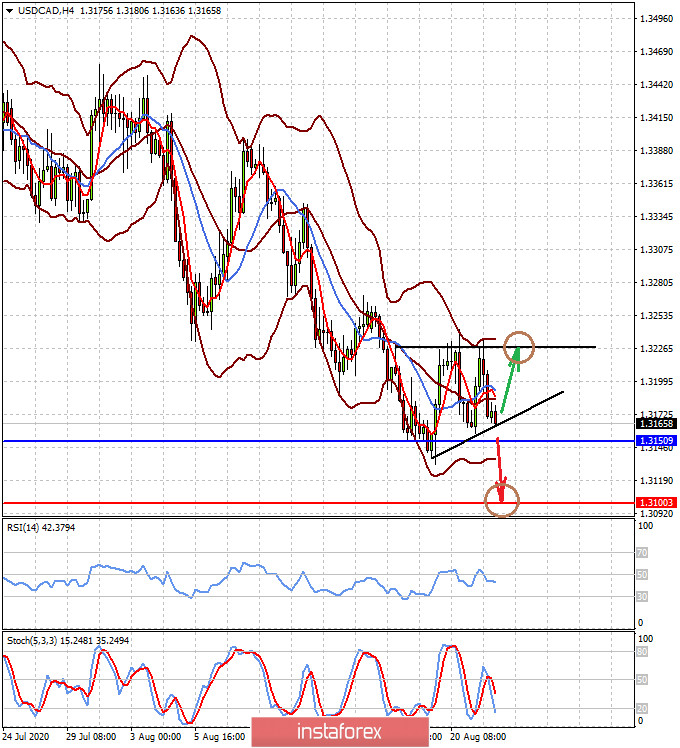

The USD/CAD pair is also consolidating. If it declines below the level of 1.3150, it will continue to decline to 1.3100. At the same time, its upward reversal will cause the price to rise to 1.3225 and then form a pattern of continuation of the "rising pennant" trend with a further shot down.