Crypto Industry News:

Indian Prime Minister Narendra Modi spoke about cryptocurrencies during a virtual conference in Davos, organized by the World Economic Forum. He again called on governments around the world to cooperate on regulating cryptocurrencies. He noted that "the type of technology it entails, decisions made by any single country will be insufficient to meet the challenges."

"The challenges we face are also growing. To counter this, there is a need for concerted and synchronized action by every country, every global agency. These supply chain disruptions, inflation and climate change are examples of this. Cryptocurrencies are another example."

This is not the first time that the Prime Minister of India has called on countries to cooperate on regulating cryptocurrencies. Last December, he said at a summit hosted by US President Joe Biden that cryptocurrencies should be used to strengthen democracy.

The Government of India has been working on a regulatory framework for digital assets for a long time. The law entitled "Cryptocurrencies and Regulation of the Official Digital Currency" was listed as up for consideration at the winter parliamentary session, but has yet to be voted. The government is currently rewriting the law. Modi is rumored to make the final decision on Indian cryptocurrency laws in 2022.

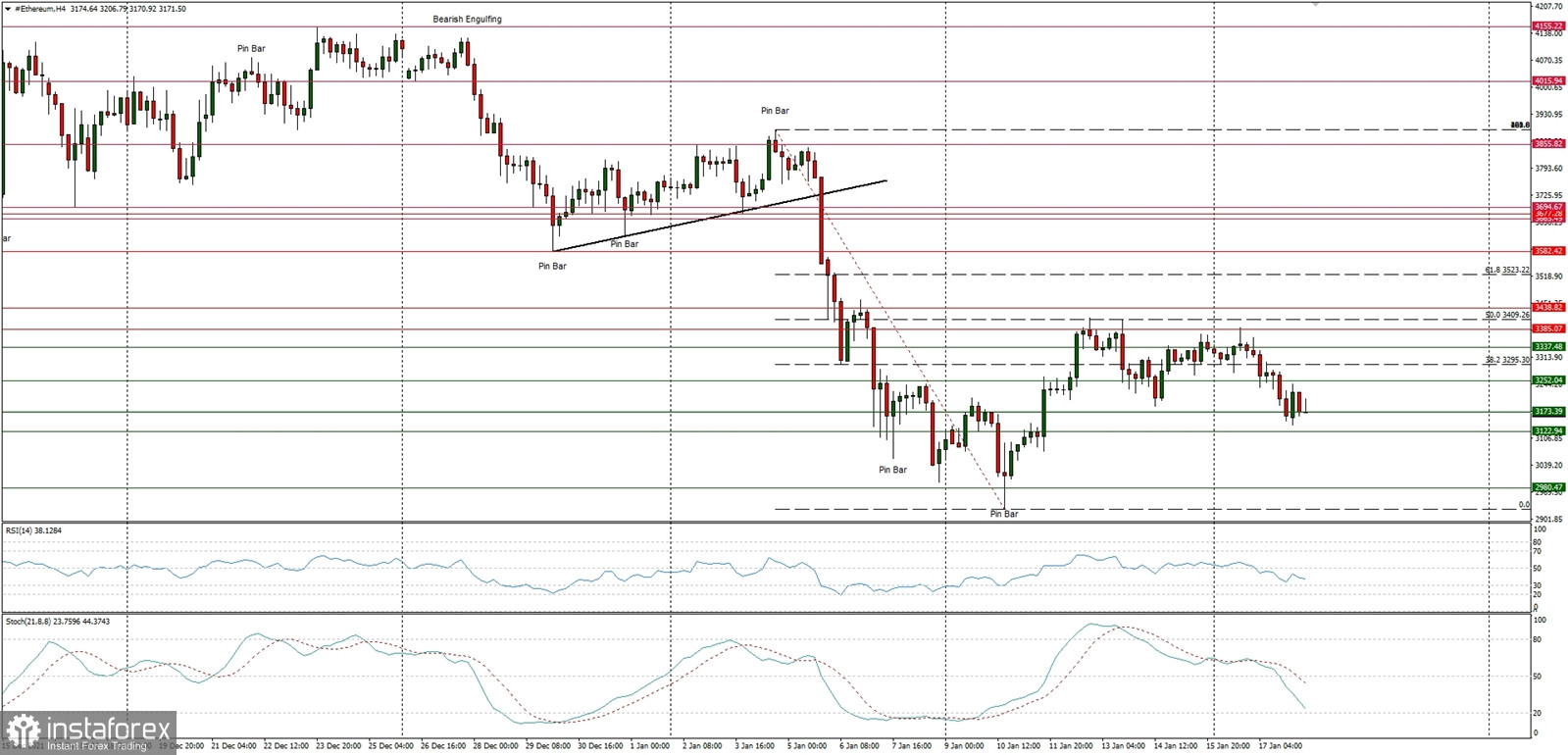

Technical Market Outlook

The ETH/USD bounce had been capped at the level of $3,295, which is a 38% Fibonacci retracement level of the last wave down and since then the market keeps going lower in a search for a bottom. The momentum is below the level of fifty and the same situation is with the stochastic oscillator - the market is approaching the oversold conditions. The market participants await the event that will trigger the up move again. The nearest technical support is seen at the level of $3,122 and the key short-term technical resistance is seen at $3,385.

Weekly Pivot Points:

WR3 - $4,051

WR2 - $3,728

WR1 - $3,566

Weekly Pivot - $3,237

WS1 - $3,077

WS2 - $2,765

WS3 - $2,585

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.