To open long positions on EUR/USD, you need:

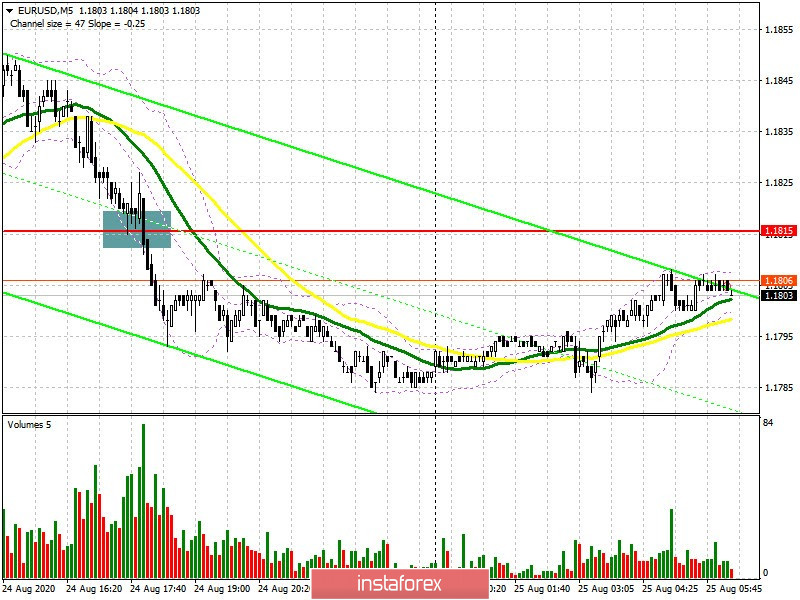

Sellers of the European currency quickly returned to the market yesterday afternoon and coped with their task of returning and consolidating the pair below the 1.1815 level. Let's look at the trades. If you look at the 5-minute chart, you will see that the bulls did not make any attempts to protect this level when they went down to 1.1815. As a result, the pair quickly moved down, and the bears continued to push the euro to daily lows. It was not possible to wait for a convenient entry point for short positions, so there were no deals. Important changes have taken place in the futures market, where both long and short positions were reduced last week. This means that some players preferred to consolidate their positions before the start of the autumn period.

The Commitment of Traders (COT) reports for August 18 marked a reduction in long non-commercial positions from the level of 266,078, to the level of 259,244, while short non-commercial positions also decreased from the level of 66,327, to 62,301. Given that the closing of long positions turned out to be much larger, as a result, the positive non-commercial net position sharply fell to 196,943, compared to 199,751 a week earlier. However, such changes did not seriously affect the balance of power in the market, and the demand for the euro will most likely return, after a slight correction of the US dollar.

As for the current situation in the pair, I do not recommend rushing to open long positions. It is best to wait for the release of fundamental data on Germany, and watch the euro's reaction at the 1.1787 level. Forming a false breakout there will be a signal to open long positions in anticipation of a recovery to yesterday's high of 1.1842, where you can watch the first profit taking. A high of 1.1884 will be the long-term goal, but it will only be possible to reach the target with excellent bullish momentum in the afternoon. If buyers are not active in the support area of 1.1787, it is best to postpone purchases until the last week's low has been updated in the 1.1755 area, or open long positions immediately for a rebound from the support of 1.1714 counting on a correction of 20-30 points within the day, since the market is still under the control of bears.

To open short positions on EUR/USD, you need:

Sellers of the euro will try to break below the support of 1.1787 and weak data on the growth rate of German GDP, together with the indicator of consumer confidence, can provide help in this. Settling below 1.1787 forms a good entry point into short positions in anticipation of continuing the downward correction to the area of the previous week's low of 1.1755, where I recommend taking profits. The long-term goal will be support for 1.1714. But don't write off the bulls' attempts to return to the market. It is best to open short positions on the euro's growth only after a false breakout forms at the 1.1842 level, but if bears are not active, the market can quickly switch to the side of buyers. In this case, I recommend selling EUR/USD immediately on the rebound from a high of 1.1884, counting on a correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the attempts of the bulls to return to the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Growth will be limited by the upper level of the indicator in the area of 1.1842. A breakout of the lower border of the indicator around 1.1770 will increase pressure on the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- The MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.