Donald Trump's unexpected decision to step up in the field of fighting COVID-19 supported the positive mood in the markets on Monday, which was reflected in the weakening of the US currency against all major currencies and the recovery in demand for risky assets.

Why has Trump's decision to use blood plasma supported the markets?

The news from the American president has stirred up the financial markets, which caused a huge wave of optimism. This was further spread by media reports that there has been a significant drop in new cases of COVID-19 in the US. Hopkins University reported 34,567 new cases on Sunday, which was the lowest result of cases since June 22. In this regard, Trump said that he decided to allow vaccinating blood plasma from American patients who have recovered from COVID-19 to be used as a treatment for the disease.

The news triggered a rise in demand for risky assets in Asia, Europe and North America. In this situation, the US dollar naturally came under pressure. The positive mood of investors is based on the idea that D. Trump will have to support the process of recovery of residents in the country, revealing the economy of individual States that previously announced the resumption of elements of quarantine measures. Accordingly, a sharp recovery in economic activity followed by economic growth should be expected.

Will the dollar continue to actively decline?

We believe that it will balance against major currencies, anticipating J. Powell's speech at the economic symposium in Jackson Hole. Investors rightly believe that if he makes it clear that the regulator will not target inflation, but decides to take measures based on the economic situation in the country, then this may be a signal to the markets that the Fed weak monetary rate may not last as long as previously predicted. In this case, the dollar's global weakening will stop and it will begin to gradually recover its positions.

Conclusions

It can be concluded that before Powell's speech in Jackson Hole, the major currency pairs, where the US dollar is present, are likely to consolidate without specific direction.

Forecast of the day:

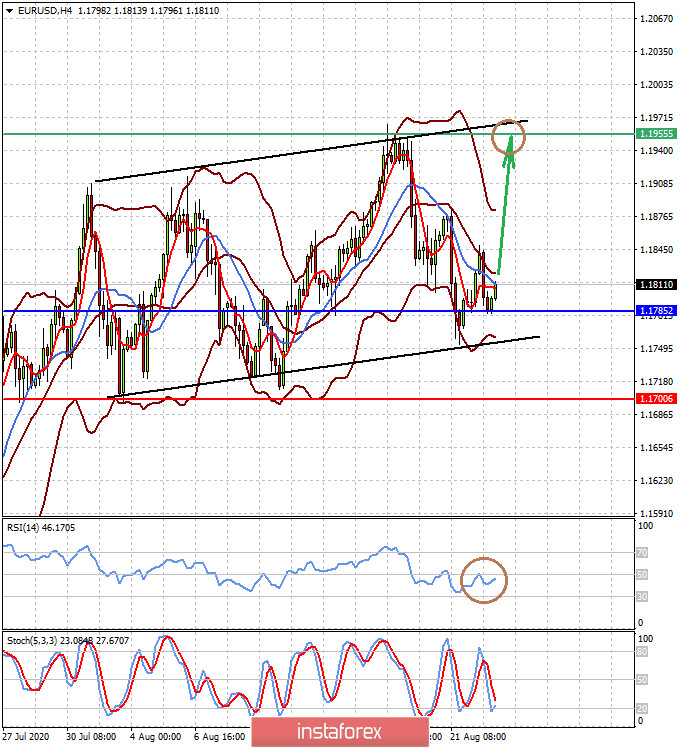

The EUR/USD pair is trading in a range again, actually forming a continuation of the "rising flag" trend. If it holds above the support line or the level of 1.1785, it will continue to rise to 1.1955.

The USD/JPY pair is consolidating below the level of 106.10. Positive mood in global markets is pushing the pair up amid rising risk-tolerance. We expect the pair to continue rising to 107.00, after it overcomes the level of 106.10.