Outlook on August 26:

Analytical overview of currency pairs on the H1 scale:

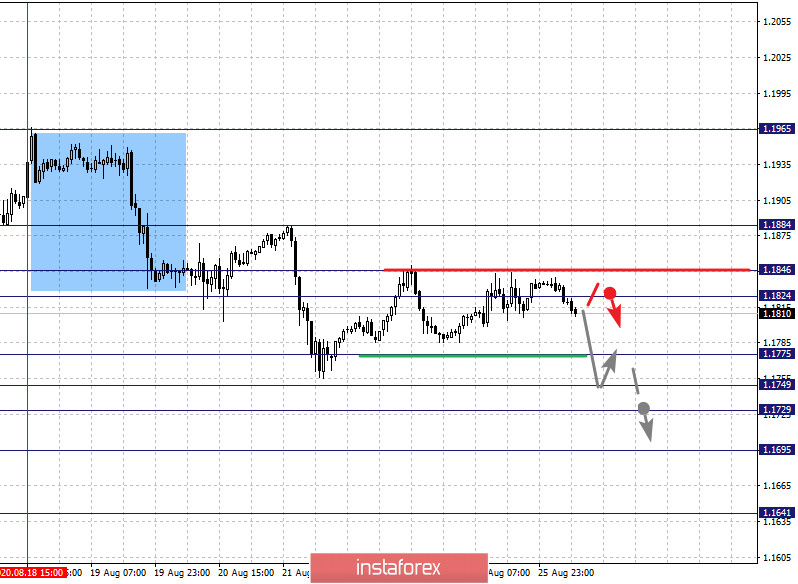

The key levels for the euro/dollar pair on the H1 chart are 1.1884, 1.1846, 1.1824, 1.1775, 1.1749, 1.1729, 1.1695 and 1.1641. The development of a downward cycle from August 18 is being followed here. A short-term downward movement is expected in the range of 1.1775 - 1.1749. Now, the price passing through the noise range 1.1749 - 1.1729 should be accompanied by a downward movement to the level 1.1695. Price consolidation is possible around this level. We consider the level of 1.1641 as a potential value for the bottom; upon reaching this level, an upward pullback should be expected.

A short-term upward movement is possible in the range of 1.1824 - 1.1846, if the last value breakdown, a deep correction will arise. The target is 1.1884, which is the support level for the downward structure from August 18.

The main trend is the formation of a descending structure from August 18

Trading recommendations:

Buy: 1.1824 Take profit: 1.1844

Buy: 1.1848 Take profit: 1.1884

Sell: 1.1775 Take profit: 1.1749

Sell: 1.1729 Take profit: 1.1695

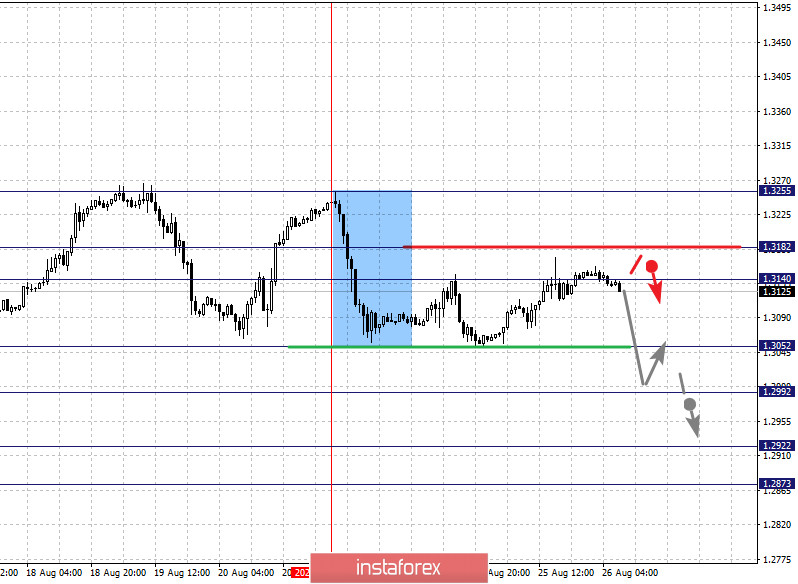

The key levels for the pound/dollar pair are 1.3255, 1.3182, 1.3140, 1.3052, 1.2992, 1.2922 and 1.2873. The local downward structure from August 21 is followed here. The continuation of the downward movement is expected after breaking through 1.3052. In this case, the target is 1.2992, and a consolidation near this level. If the level of 1.2992 breaks down, there will be a strong downward movement. The goal is 1.2922. We consider the level of 1.2873 as a potential value for the bottom. Upon reaching which, we expect consolidation and an upward pullback.

A short-term upward movement is possible in the range 1.3140 - 1.3182, breaking through the last value will lead to the formation of an upward potential. The target is 1.3255.

The main trend is the local downward structure of August 21, the stage of correction

Trading recommendations:

Buy: 1.3142 Take profit: 1.3180

Buy: 1.3184 Take profit: 1.3250

Sell: 1.3052 Take profit: 1.2994

Sell: 1.2990 Take profit: 1.2924

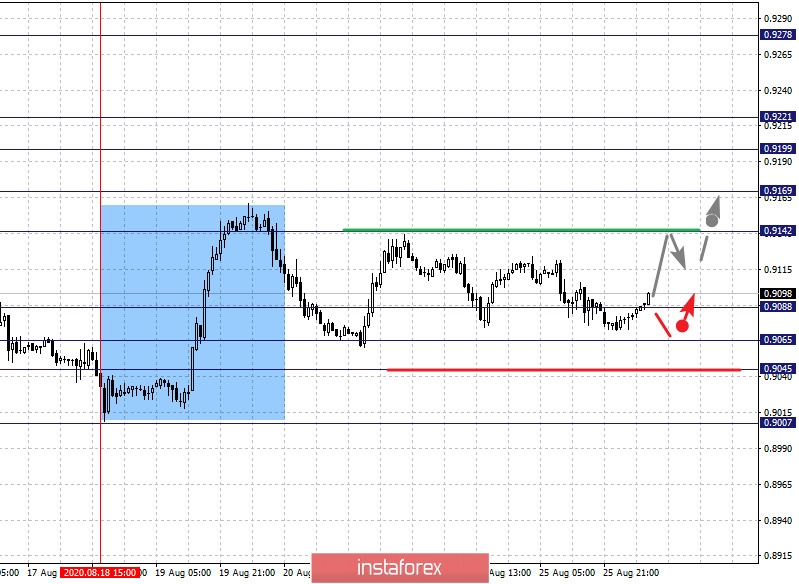

The key levels for the dollar/franc pair are 0.9278, 0.9221, 0.9199, 0.9169, 0.9142, 0.9088, 0.9065 and 0.9045. The formation of the upward structure from August 18 is being followed here. Moreover, a short-term upward movement is expected in the range 0.9142 - 0.9169, breaking through the last value will lead to the level of 0.9199. At the moment, short-term upward movement and consolidation are in the range of 0.9199 - 0.9221. We consider the level of 0.9278 as a potential value for the top; upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 0.9088 - 0.9065. The key support for the top is the level of 0.9045. The price passing through this level will encourage the development of a downward trend. In this case, the potential target is 0.9007.

The main trend is the formation of an upward structure from August 18

Trading recommendations:

Buy : 0.9142 Take profit: 0.9169

Buy : 0.9171 Take profit: 0.9199

Sell: 0.9088 Take profit: 0.9065

Sell: 0.9064 Take profit: 0.9046

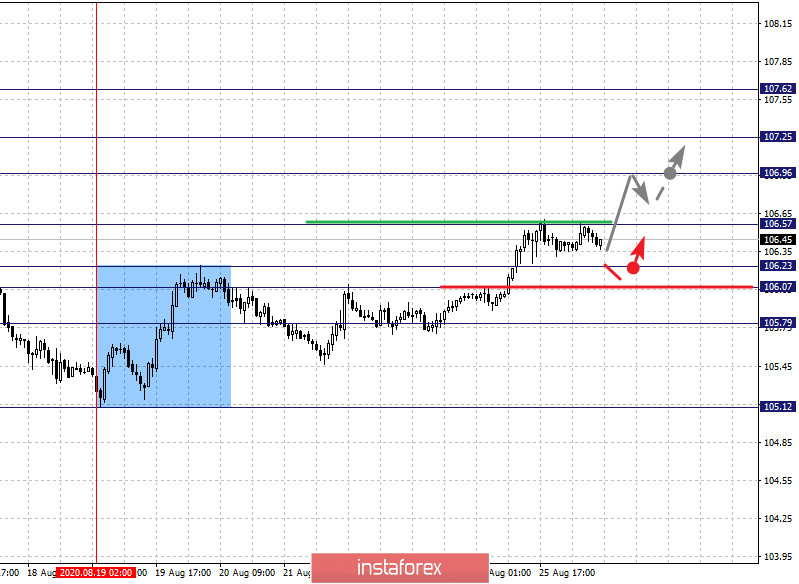

The key levels for the dollar/yen pair are 107.62, 107.25, 106.96, 106.57, 106.23, 106.07 and 105.79. We are following the development of the upward structure from August 19. The upward movement is expected to continue after the breakdown of 106.58. In this case, the target is 106.96. Meanwhile, there is a short-term upward movement, as well as consolidation in the range of 106.96 - 107.25. We consider the level of 107.62 as a potential value for the top; upon reaching this level, a consolidated movement and a downward pullback should be expected.

A short-term downward movement is possible in the range of 106.23 - 106.07. In case of breakdown of the last value, there will be a deep correction. The target is 105.80, which is the key support for the top.

The main trend is the upward structure from August 19

Trading recommendations:

Buy: 106.58 Take profit: 106.94

Buy : 106.96 Take profit: 107.23

Sell: 106.23 Take profit: 106.08

Sell: 106.05 Take profit: 105.80

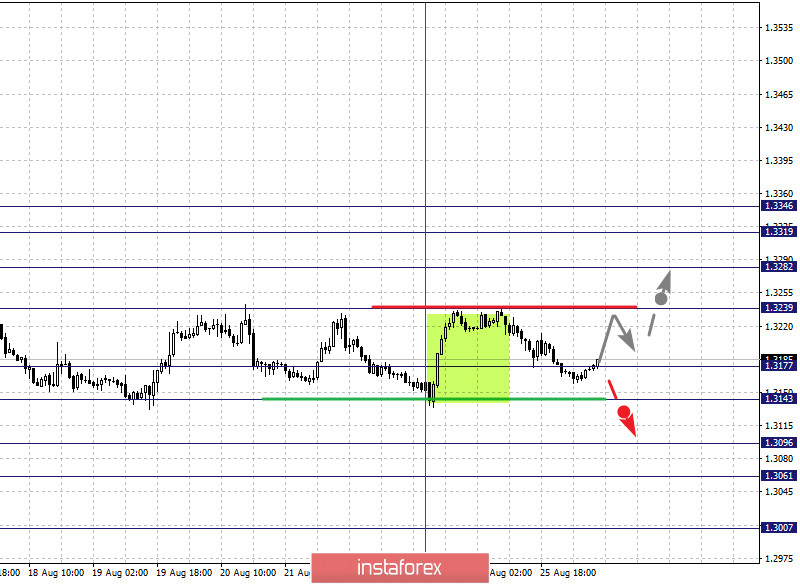

The key levels for the USD/CAD pair are 1.3346, 1.3319, 1.3282, 1.3239, 1.3177, 1.3143, 1.3096, 1.3061 and 1.3006. We entered an equilibrium state. A short-term upward movement is expected in the range 1.3239 - 1.3282, breaking through the last value will lead to a movement to the level of 1.3319. We consider the level of 1.3346 as a potential value for the top. Upon reaching which, a consolidation and a downward pullback will be expected.

A short-term downward movement is possible in the range of 1.3177 - 1.3143. The breakdown of the last value will allow us to expect a movement to the level of 1.3096. Meanwhile, price consolidation is in the range of 1.3096 - 1.3061. We consider the level of 1.3006 as a potential value for the bottom. Upon reaching this level, a consolidation and an upward pullback can be expected.

The main trend is the equilibrium state.

Trading recommendations:

Buy: 1.3240 Take profit: 1.3280

Buy : 1.3283 Take profit: 1.3319

Sell: 1.3177 Take profit: 1.3145

Sell: 1.3140 Take profit: 1.3096

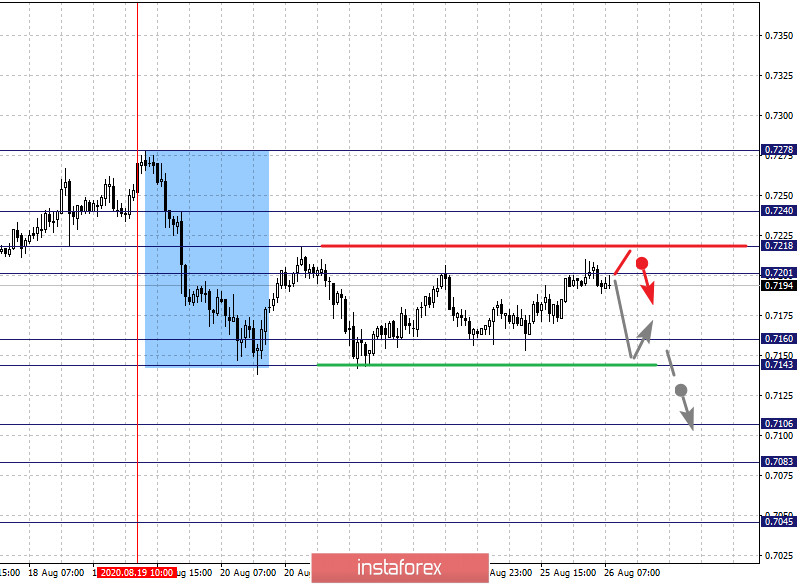

The key levels for the AUD/USD pair are 0.7240, 0.7218, 0.7201, 0.7160, 0.7143, 0.7106, 0.7083 and 0.7045. We monitor the formation of the potential for the downward cycle of August 19. A short-term downward movement is expected in the range of 0.7160 - 0.7143, the breakdown of the last value should be accompanied by a downward movement. The goal is 0.7106. On the other hand, there is a short-term downward movement, as well as consolidation in the range of 0.7106 - 0.7083. For the potential value for the bottom, we consider the level of 0.7045. Upon reaching which, we expect consolidation and an upward pullback.

A short-term upward movement is expected within the levels of 0.7201 - 0.7218. If the last value breaks down, a deep correction is likely. The goal is 0.7240, which acts as a key support for the downward structure from August 19. The price passing this level will lead to the formation of initial conditions for an upward cycle. In this case, the target is 0.7278.

The main trend is the formation of a downward structure from August 19

Trading recommendations:

Buy: 0.7219 Take profit: 0.7240

Buy: 0.7242 Take profit: 0.7278

Sell : 0.7142 Take profit : 0.7108

Sell: 0.7105 Take profit: 0.7084

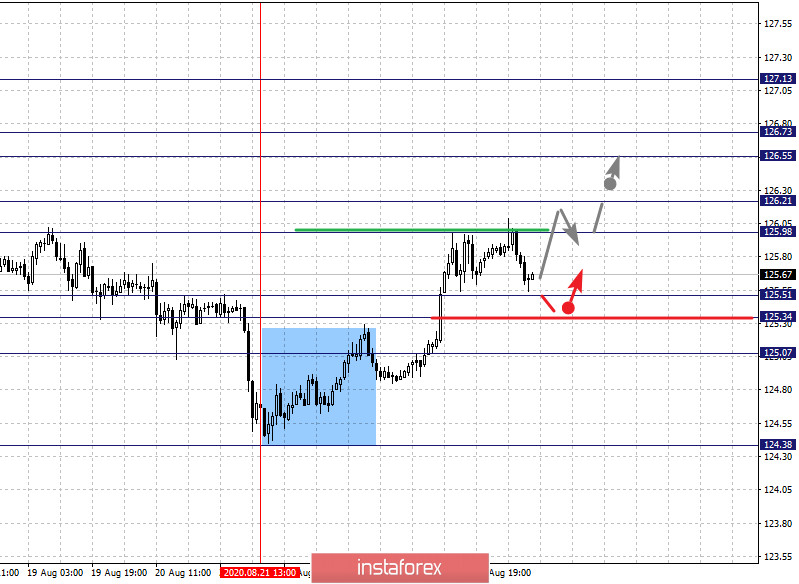

The key levels for the euro/yen pair are 127.13, 126.73, 126.55, 126.21, 125.98, 125.51, 125.34 and 125.07. We are following the upward structure from August 21 here. A short-term upward movement is expected in the range of 125.98 - 126.21. The breakdown of the last value will lead to a pronounced upward movement. The target is 126.55. Meanwhile, there is consolidation in the range of 126.55 - 126.73. We consider the level of 127.13 as a potential value for the top. Upon reaching which, we expect a downward pullback.

A short-term downward movement is expected within the level of 125.51 - 125.34, a breakdown of the last value will lead to a deep correction. The target is 125.07, which is the key support for an upward structure and its breakdown will encourage the development of a downward trend.

The main trend is the upward structure of August 21

Trading recommendations:

Buy: 125.98 Take profit: 126.20

Buy: 126.23 Take profit: 126.55

Sell: 125.51 Take profit: 125.35

Sell: 125.33 Take profit: 125.08

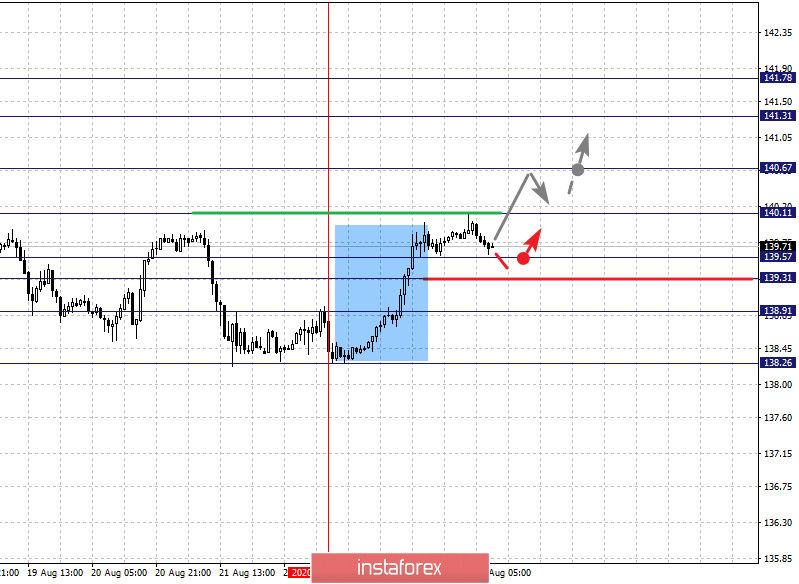

The key levels for the pound/yen pair are 141.78, 141.31, 140.67, 140.11, 139.57, 139.31, 138.91 and 138.26. We are following the formation of the upward structure from August 24. The upward movement is expected to continue after breaking down the level of 140.11. In this case, the target is 140.67 and there is consolidation near this level. The breakdown of the level of 140.68 will lead to a strong movement. Here, the target is 141.31. We consider the level 141.78 as a potential value for the top and upon reaching which, consolidation and a downward pullback are expected.

A short-term downward movement is possible in the range of 139.57 - 139.31, breaking through the last value will lead to a deep correction. The target is 138.91, which is the key support level for the top.

The main trend is the formation of potential for the upward movement of August 24

Trading recommendations:

Buy: 140.11 Take profit: 140.65

Buy: 140.70 Take profit: 141.30

Sell: 139.57 Take profit: 139.31

Sell: 139.27 Take profit: 138.91