The composite index of the largest companies in the region Stoxx Europe 600 on Tuesday fell by 0.97% and amounted to 479.79 points.

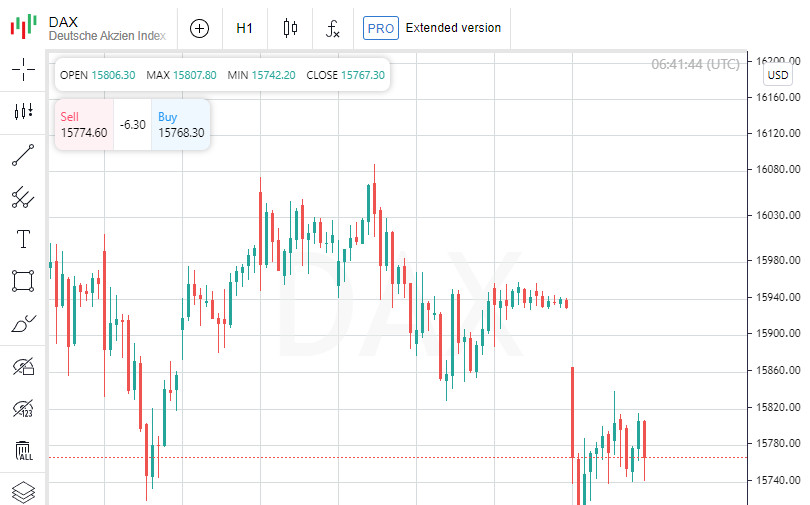

The German DAX index lost 1.01%, the French CAC 40 - 0.94%, the British FTSE 100 - 0.62%. Spain's IBEX 35 and Italy's FTSE MIB shed 0.65% and 0.74%, respectively.

The focus of traders remains the monetary policy of the US Federal Reserve System (FRS) and the beginning of the reporting season.

A growing number of Fed officials and Wall Street economists see the possibility of more than three hikes in the base interest rate by the US Central Bank this year against the backdrop of a significant increase in inflation. Over the past week, however, it has become clear that there is growing support for the idea that the Fed will raise rates more aggressively after the March rate hike than previously expected.

Shares of Hugo Boss rose 1.1%. The German apparel and accessories maker delivered higher-than-expected revenue and earnings before interest and taxes (EBIT) in 2021, thanks to record-breaking fourth-quarter revenue.

Anexo Group PLC rose 3.4%. The legal services company has given a strong revenue forecast for 2021.

Siemens AG tumbled 2.3% on news that Europe's largest industrial conglomerate is selling traffic control equipment business Yunex Traffic to Italy's Atlantia SpA for €950m.

The energy sector rose following the rise in oil prices to the highest level since 2014. Capitalization of BP Plc increased by 0.5%, Royal Dutch Shell - by 1.6%, TotalEnergies - by 1.5%.

The drop leader in the Stoxx Europe 600 was Polish online retailer THG PLC, which shed 9.6%. Shares of Norwegian renewable energy company NEL ASA (-7.2%) and Swiss dental implant manufacturer Straumann Holding AG (-6.4%) also dropped significantly.

The gains were led by shares in French video game developer Ubisoft Entertainment SA, which surged nearly 12%. On the positive side for the video game sector as a whole was the news that Microsoft Corp. buys one of the segment leaders, Activision Blizzard, for $68.7 billion.

Shares of Norway's Aker ASA also rose 6.9% and Sweden's Lundin rose 6.7%.