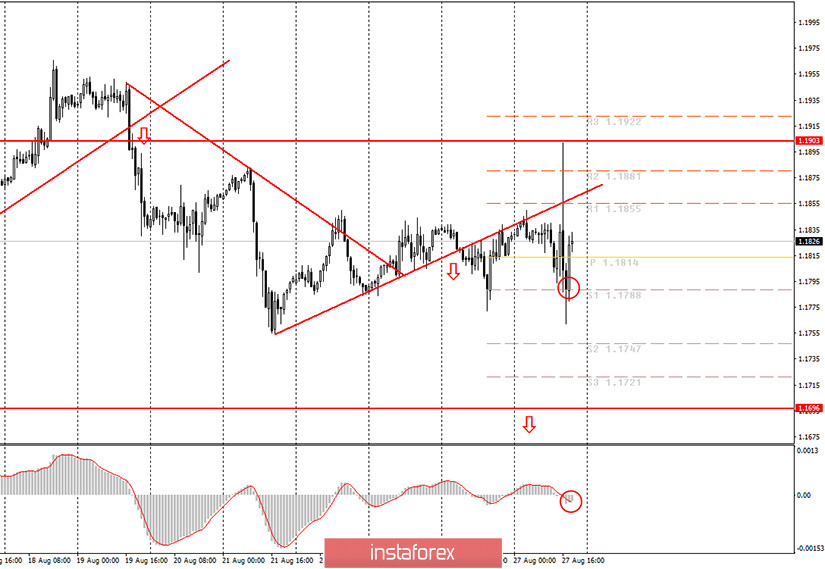

1-hour chart of EUR/USD

On Thursday, August 27 EUR / USD was still trading lower in line with our assumption made after the price had consolidated below the uptrend line. Remarkably, during Jerome Powell's speech, EUR/USD first spiked 100 pips up and then tumbled 100 pips down. At the same time, the MACD indicator did not turn upward, so beginners who opened short positions on the previous MACD signal and did not close them before Powell's speech could leave them open. As a result, by the end of the day, the first support level of 1.1788 was worked out, which could have brought 45 pips of profit to novice traders. A bit smaller profit could have been made if you exited the market before Powell began his speech. Now we need to wait for the markets to calm down. The message of the Fed Chairman's testimony will be considered below, but his ideas cannot be interpreted somehow straight-forward. Therefore, in any case, the movement of EUR/USD in the last few hours was not "a logical reaction of the market to what is happening."

There were many macroeconomic events on Thursday, but traders were focused on Jerome Powell's speech. A little earlier before this event, the second estimate of US GDP for the second quarter was released, which unexpectedly turned out to be much better than the first estimate. According to the new estimate, the US national output contracted in the second quarter by the record 31.7%. It's still a severe downturn, but better than it was before. The US dollar even gained a little on this news. And then the speech of the Fed's leader began. It became clear that the US central bank rejected the idea of "targeting inflation at 2%." In practice, this will mean that the Fed will allow inflation to rise above 2% and will not consider an immediate rate hike. Jerome Powell also said that the Fed is changing its attitude towards the situation with jobs and the adjusted policy will be aimed at people with low incomes who have been hardest hit by the "coronavirus crisis" and the epidemic. In general, the US dollar strengthened slightly after the speech of the Fed's Chairman, but very quickly it lost all its advantage, since everything Powell said does not have any immediate effect on the economy and markets.

On Friday, August 28, the economic calendar lacks any news and macroeconomic reports from the US. Of course, at any moment Donald Trump could make an unexpected statement, or another extraordinary event could happen in the US, which will be mirrored in the foreign exchange market. However, it is impossible to predict such events. As for the macroeconomic reports, we do not believe that the data on personal income and spending, as well as the consumer confidence index will be able to agitate the markets. Most likely, tomorrow EUR/USD will "move away" from important events on Thursday. When everything calms down, it will be possible to re-evaluate the situation and consider opening new positions.

On August 28, the following scenarios are possible:

1)It is not recommended for novice traders to consider buying the pair at this time, since the price has overcome the uptrend line. At the moment, there are no new patterns supporting the upward movement. Thus, to buy the pair, you need to wait for the formation of a short-term upward trend and the corresponding buy signals.

2)We still recommend considering selling when forming a new signal from the MACD indicator, although, in fact, this indicator has not turned upward yet (it can only do this on the current bar). In any case, now you need to wait for the market to calm down. So, we recommend that you re-evaluate the current situation tomorrow morning and only after that make decisions.

What's on the chart:

Support and Resistance Price Levels - Levels that are targets when buying or selling. Take Profit levels can be placed near them.

Red lines are channels or trend lines that display the current trend and show which direction it is preferable to trade now.

Up / down arrows - show when reaching or overcoming which obstacles should be traded up or down.

MACD indicator (10,20,3) - a histogram and a signal line, the crossing of which are signals to enter the market. Recommended for use in combination with trend lines (channels, trend lines).

Important speeches and reports in the economic calendar can greatly influence the movement of the currency pair. Therefore, during their release, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.