The Australian dollar conquers new heights: paired with the US dollar, the Aussie is testing the upper line of the Bollinger Bands indicator on the daily chart, thereby approaching the 73rd figure. Federal Reserve Chairman Jerome Powell's speech from yesterday was not in favor of the US currency, although the initial market reaction was contradictory. But in the end, the US dollar index went down, updating local lows. Dollar pairs reacted accordingly, except for the USD/JPY pair - the yen is depreciating due to the unexpected resignation of the Japanese prime minister and weak growth in the consumer price index in Tokyo. But the Australian currency was able to overcome the local resistance level of 0.7250, setting the next growth target for itself - the 0.7300 level.

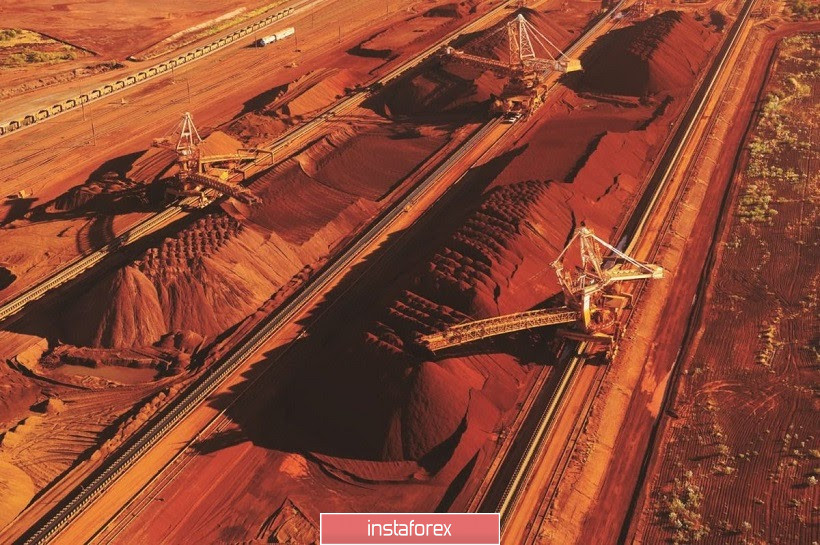

Take note that the current growth of AUD/USD is not only due to the greenback's fall, but also because of the growth of the commodity market. And although relations between China and Australia remain tense, the PRC continues to import iron ore, which is strategically important to the Australian economy, whose value reached multi-month highs in August. But more on that later, but for now let's start with the US dollar.

The market reacted ambiguously to Powell's speech: the dollar significantly fell in value during the speech, but then it sharply went up as a result of the speech. Then, a few hours later, the situation changed again - the dollar index began to gradually slide down. The downward dynamics strengthened during the Asian session on Friday, which made it possible for AUD/USD bulls to conquer new heights. This roller coaster ride is due to several factors.

First of all, this is a factor tentatively called "expectation/reality". A visual aid for those who study the psychology of the market and the behavioral models of traders. Indeed, the situation is classic: for several days before Powell's speech, the market was actively discussing options for the US central bank's possible revision of its strategy. As a result, experts have crystallized the general opinion that Powell's speech will be extremely dovish in nature, and this fact will undermine the position of the US dollar. Many currency strategists have assumed that the Fed will "tolerate" 3% inflation, while keeping interest rates at an all-time low. In addition, rumors circulated in the market that Powell would tie the issue of rate hikes to the unemployment rate. Some experts suggested that the central bank will completely rule out monetary tightening until unemployment falls below a certain level. There were other, no less dovish horror stories that put pressure on the dollar a few days before the start of the Economic Symposium.

As a result, the tension spring shrank to its highest values, and when, following Powell's speech, the worst forecast scenarios were not confirmed, this spring unclenched towards strengthening the US dollar. The Fed chief did not begin to indicate specific inflationary barriers, and even more so did not talk about the three percent level. He only noted that any excess inflation of the target level "will be moderate." As for targeting the unemployment rate, here he completely denied the rumors spread. Powell called it "unreasonable" to try to set numerical targets for the unemployment rate, since this indicator "changes regardless of monetary policy."

Of course, Powell's rhetoric turned out to be less harsh in relation to the preliminary forecasts of the analyst community. Thanks to this fact, the dollar strengthened in the first hours after its speech. But de facto, the Fed's new strategy significantly postpones the possible date of monetary tightening. And although we are not talking about a three percent inflation, the central bank still raised the bar, if surpassed, the Fed members will return to the issue of increasing the rate. In addition, the target two percent level still needs to be reached, and this path does not promise to be short, given the situation with the coronavirus in the United States, the pace of wage growth and the level of consumer activity of Americans.

The market came to these conclusions a little later on, after their initial emotions subsided. In my opinion, the current weakening of the US currency looks quite logical and reasonable. Moreover, the rate of the greenback's fall will only increase if inflation indicators show negative dynamics.

In turn, the Australian dollar received additional support from the commodity market. The fact is that iron ore rose in price to a six-year high in August due to a rapid recovery in demand in China (a key consumer of this metallurgical ingredient) and a decrease in ore production in Brazil in the first half of the year (this is due to the rainy season and quarantine measures) ...

All this suggests that the AUD/USD pair is ripe for testing the 0.7300 resistance level. But since the pair got close to this target, long deals already look risky. Traders can take profits in droves ahead of the weekend, so storming this price barrier may occur as early as next week. Therefore, if we designate medium-term prospects, then longs should be considered on Monday-Tuesday, when the market finally forms its opinion on the prospects for the US dollar in the light of the new Fed strategy.